Adjusted earnings surged to $6.4 billion, the highest in 8 years, and the company announced billions more in buybacks.

By Javier Blass

LONDON

EnergyNet.com 02 04 2022

After 104 years calling itself Royal Dutch Shell, the energy major faced investors on Thursday under its new brand of simply Shell Plc. But ironically, for the first time in a long time, shareholders actually received the royal treatment.

Adjusted earnings surged to $6.4 billion, the highest in eight years, and the company announced another $3 billion in share buybacks, on top of the $5.5 billion it had already promised. For a company under pressure from activist hedge fund tycoon Daniel Loeb to improve returns and perhaps split itself, the quarterly results are a relief to management — and the European-based shareholders supporting it.

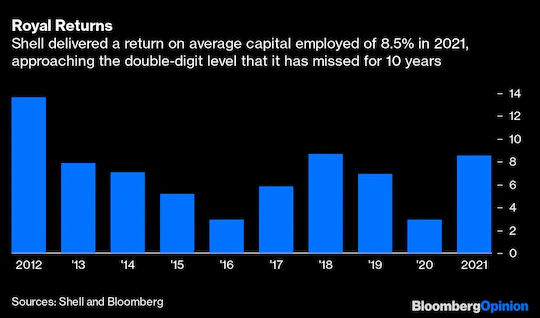

Beyond all the noise around the company’s most recent quarterly earnings, which included one of the best-ever gas trading results, Shell managed in 2021 to improve the metric that matters the most in its fight with Loeb’s Third Point Management hedge fund: return on average capital employed. On a four-quarter rolling average, RoACE jumped last year to 8.5%, up from a paltry 2.9% in 2020.

If oil and natural gas prices remain anywhere close to fourth-quarter levels, Shell RoACE should jump above 10% this year, meeting the target that Chief Executive Officer Ben van Beurden had long hoped for. Shell, the largest energy company in Europe, has not delivered a double-digit RoACE since 2012.

Double-digit RoACE will challenge one of the strongest selling points from Loeb’s line of attack — that Shell’s shareholders have faced two decades of poor profits and “decreasing returns on invested capital.”

Van Beurden, who’s been under question since he cut the company’s dividend in 2020 (for the first time since the second World War), allowed himself some humor about Third Point. Asked about Loeb’s investment in the company, he said: “Congratulations will be in order. I think Dan Loeb has been a smart investor: He stepped in our stock at the right moment and I’m sure he’s enjoying the returns.”

But Loeb will only enjoy those returns if van Beurden maintains control on spending. Shell has lowered capital and operational spending significantly over the last couple of years, bringing capex in particular to $20 billion. In the past, Shell had told investors it would keep spending in the $19 billion to $22 billion range, but on Thursday it hiked the guidance to $23 billion to $27 billion. That was a negative surprise.

True, Shell has some leeway to spend more, having reduced net debt by more than $26 billion in the last two years to just over $50 billion. But it should be careful, not only with Loeb but beyond: Shareholders won’t reward a return to the old ways. Van Beurden on Thursday said Shell would aim for the low end of the $23 to $27 billion range. No matter how much the price of oil and gas rises, he should keep that promise. Return on capital should be the priority over growth, and that includes green-energy growth.

Shell has showed real improvement throughout 2021, but it still needs to demonstrate that it can deliver a 10% return on capital employed in any oil and gas price environment. Keeping a lid on spending is the way to make sure that happens.

bloomberg.com 02 03 2022