(Andrey Rudakov/Bloomberg)

Jack Denton, Barrons

LONDON

EnergiesNet.com 02 22 2022

Crude prices spiked Tuesday after President Vladimir Putin ordered Russian troops into Ukraine, raising the specter of war in Eastern Europe and a threatening to disrupt global oil supply.

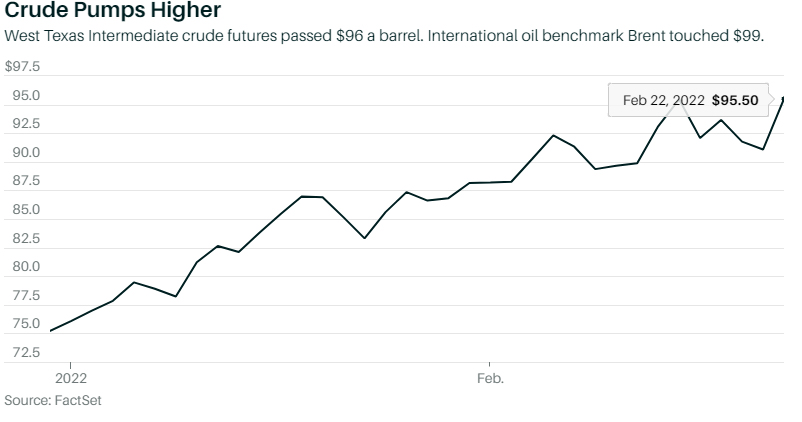

U.S. futures for West Texas Intermediate crude jumped almost 5%, touching $96 a barrel and settling near $95.50. International oil benchmark Brent rose 3.5% and was hovering around $99. Both benchmarks set seven-year highs.

Investors across asset classes have been on edge for weeks over the threat of an imminent invasion of Ukraine. Russian troops have been massing at the country’s borders amid Moscow’s objections to Ukraine’s possible membership in Nato, the Western defensive alliance.

The picture darkened on Monday as Putin recognized two breakaway regions in Eastern Ukraine—already controlled by separatists—and ordered troops into the area. In response, President Joe Biden signed an executive order restricting U.S. business with the breakaway regions, and wider sanctions are expected to follow globally. The invasion of Ukraine “has begun,” U.K. cabinet minister Sajjid Javid said Tuesday.

Crude has always been a key worry for investors as the Russia-Ukraine picture developed. In focus is how war would impact the supply of oil and other key commodities originating in Russia.

Russia is one of the world’s largest producers of oil, so sanctions or any restrictions on its supply of crude reaching wider markets has the potential to cause the price of the commodity to surge even further.

“Short of the U.S. and Europe throwing the Ukraine under the political bus and appeasing Putin in totality, it seems inevitable that Brent crude will test $100 a barrel sooner rather than later,” said Jeffrey Halley, an analyst at broker Oanda.

“A full-scale Russian invasion likely sees it spike to $130 (at least) dragging WTI with it. It is hard to see Brent moving back below $90 a barrel anytime soon now,” Halley added.Crude Pumps HigherWest Texas Intermediate crude futures passed $96 a barrel. International oil benchmark Brent touched $99.

Global crude supply is already tight and demand fundamentals are strong, with worldwide crude production from the OPEC+ group of national producers facing existing headwinds. Prices were trading at their highest levels since 2014 before Russia ratcheted up the pressure on Ukraine.

If elevated oil prices persist, or go higher—as could happen with wider war—it could lead to wider inflation and complicate the macroeconomic picture. Central banks including the Federal Reserve are looking to tighten monetary policy and raise interest rates multiple times this year as they face off against historically high inflation.

“A full-scale invasion of Ukraine by Russia will leave many central banks with itchy hiking trigger fingers in a quandary,” Halley said.

For now, some market participants are less worried about the prospects of wider economic disruption from the conflict.

Paul Donovan, the chief economist at UBS Global Wealth Management, said that “while an oil price spike may cause a temporary blip in inflation, economic disruption is more likely from oil prices that are higher for longer. The price level reached in a spike is less important.”

Jack Denton at jack.denton@dowjones.com

marketwatch.com 02 22 2022