Mayra P. Saefong, William Watts, MarketWatch

SAN FRANCISCO/NEW YORK

EnergiesNet.com 07 14 2022

Oil future ended higher on Wednesday, marking a partial rebound from losses that pulled U.S. and global benchmark crude prices below $100 a barrel, even as U.S. crude supplies climbed for a second week in a row and traders continued to weigh risks to energy demand.

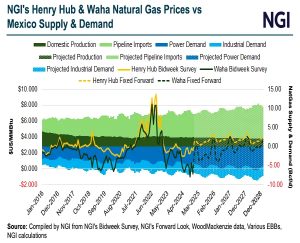

Natural-gas futures, meanwhile, rallied by more than 8% as weather forecasts raise the likelihood for a rise in demand for the commodity.

Price action

- West Texas Intermediate crude for August delivery CL.1, -2.70% CL00, -2.72% CLQ22, -2.70% rose 46 cents, or 0.5%, to settle at $96.30 a barrel on the New York Mercantile Exchange.

- September Brent crude BRN00, -2.23% BRNU22, -2.21%, the global benchmark, added 8 cents, or nearly 0.1%, at $99.57 a barrel on ICE Futures Europe. On Tuesday, WTI and Brent crude futures both settled at their lowest since April.

- Back on Nymex, August gasoline RBQ22, -2.82% fell nearly 1% to $3.2337 a gallon.

- August heating oil HOQ22, -2.59% rose almost 0.1% to $3.6659 a gallon.

- August natural gas NGQ22, -1.18% rose 8.5% to $6.689 per million British thermal units.

Market drivers

Data from the Energy Information Administration released Wednesday, as part of the agency’s weekly U.S. petroleum supply report, revealed a significant drop in gasoline demand in the wake of the Independence Day holiday weekend.

Total motor gasoline product supplied, a proxy for demand, fell 8% over the past four weeks to average 8.7 million barrels a day, the EIA said.

Still, it looks like the “incredible drop in demand was priced in with the recent price collapse” in oil, Phil Flynn, senior market analyst at The Price Futures Group, told MarketWatch.

Still, “let’s face it — the drop in demand is raising larger questions about the economy whether or not people can afford this record high inflation,” said Flynn. “We’ve seen liquidity drop dramatically in oil. Trading open interest is near a 15-year low and that’s creating some even crazier moves.”

Fears of recession and the potential for renewed COVID restrictions in China were blamed for a rout that saw WTI slump nearly 8% and Brent down more than 7% on Tuesday.

Analysts said the drop left crude oversold and due for a bounce.

“Brent is in oversold territory at the moment, and the fundamentals do not justify the scale of the selloff we have seen in recent weeks. The oil market is still tight, as reflected in the prompt Brent spread. The outlook is for this tightness to persist,” said Warren Patterson, head of commodities strategy at ING, in a note, ahead of the EIA supply data.

Meanwhile, the International Energy Agency said Wednesday the worst oil-supply crisis in decades is showing tentative signs of easing as flagging economic growth weighs on demand for crude while sanctions on Russia’s oil industry are having less impact on production than expected.

The Paris-based agency cut its demand forecast for 2022 by 240,000 barrels a day to 99.2 million barrels a day in its monthly report. Demand in 2023 will also be 280,000 barrels a day less than earlier forecasts at 101.3 million barrels a day, the report said.

However, IEA Executive Director Fatih Birol this week warned that the worst of the energy crisis may not be over and that Europe faces a “very, very difficult” winter as it deals with curtailed natural gas supplies from Russia.

Read: Skeptics say Biden’s Saudi visit unlikely to significantly bring down oil prices

Supply data

The EIA reported that U.S. crude inventories rose by 3.3 million barrels for the week ended July 8.

On average, analysts expected an increase of 1.4 million barrels, according to a poll conducted by S&P Global Commodity Insights. The American Petroleum Institute on Tuesday reported a 4.8 million-barrel increase, according to sources.

The supply gain came on the back of 6.9 million-barrel weekly decline in oil from the Strategic Petroleum Reserve, EIA data show.

Crude stocks at the Cushing, Okla., Nymex delivery hub rose 300,000 barrels for the week, but total domestic petroleum production fell 100,000 barrels to 12 million barrels per day.

“A dip in refining activity and a near 7 million-barrel SPR release helped encourage another crude inventory build,” said Matt Smith, lead oil analyst, Americas, at Kpler. “Commercial inventories are some 6 million barrels higher than at the start of the year, while SPR inventories are down over 108 million barrels to 485 million barrels.”

A large gasoline build and huge drop in implied demand are “causing a stir, but we saw super strong implied demand ahead of the holiday weekend as gas stations stocked up,” Smith said. “Today’s data is just the hangover from that front-loaded demand.”

The EIA report showed supply increases of 5.8 million barrels for gasoline and 2.7 million barrels for distillates. The analyst survey called for an inventory decline of 200,000 barrels for gasoline and an increase of 900,000 barrels for distillates.

marketwatch.com 07 13 2022