Mayra P. Saefong and William Watts, MarketWatch

SAN FRANCISCO/NEW YORK

EnergiesNet.com 11 30 2023

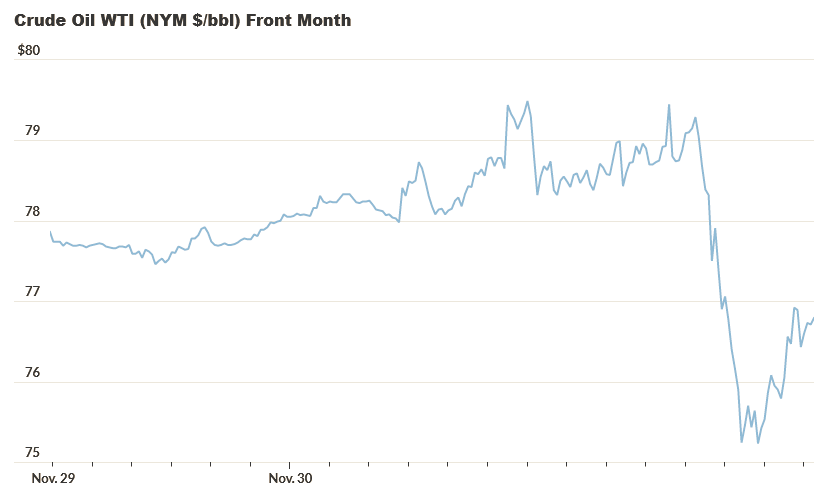

Oil futures settled with a loss on Thursday, erasing early gains after OPEC+ agreed on additional, voluntary production cuts that drew skepticism from traders.

Price action

- West Texas Intermediate crude for January delivery CL00, -0.57% CL.1, -0.53% CLF24, -0.58% fell $1.90, or 2.4%, to settle at $75.96 a barrel on the New York Mercantile Exchange. Prices based on the front month fell by nearly 6.3% for the month, according to Dow Jones Market data.

- January Brent crude BRNF24, -0.30%, the global benchmark, edged down by 27 cents, or 0.3%, to end at $82.83 a barrel on ICE Futures Europe, posting a monthly loss of 5.2%. The January contracts expired at the end of the session. February Brent BRN00, -0.58% BRNG24, -0.58%, which is now the front-month contract, dropped $2.02, or 2.4%, to $80.86 a barrel.

- December gasoline RBZ23, -3.89% declined 3.7% to $2.20 a gallon, losing 1% for the month.

- December heating oil HOZ23, -1.86% fell 2% at $2.83 a gallon, for monthly fall of 5.4%. The December contracts expired at the end of the session.

- Natural gas for January delivery NGF24, -0.75% settled at $2.80 per million British thermal units, down nearly 0.1%, after U.S. data revealed an surprise weekly rise in domestic supplies of the fuel. Prices dropped nearly 22% for the month.

Market drivers

After several days of wrangling, OPEC+ — made up of the Organization of the Petroleum Exporting Countries and its allies, including Russia — reached an agreement to reduce their monthly overall production by an additional 1 million barrels per day in early 2024 above existing cuts. The cuts, however, weren’t announced by OPEC+ as a group, with individual countries initially left to announce the voluntary reductions.

Later, OPEC released a statement putting total voluntary cuts at 2.2 million barrels per day. However, that total includes the widely expected extension of Saudi Arabia’s 1 million barrel-a-day cut, which was first implemented in July, as well as the extension of a 300,000 barrel-a-day reduction in crude supplies from Russia.

“While oil prices initially rallied on the extension and expansion of OPEC output cuts into 2024, investors remain concerned about OPEC compliance and global demand growth as we head deeper into the seasonally soft winter demand period,” said Rob Haworth, senior investment strategy director at U.S. Bank Asset Management Group. Outside of Saudi Arabia, “OPEC members historically struggle in compliance with planned cuts, leading to some market skepticism about the actual magnitude of cuts that will be implemented.”

Read: Why oil prices are dropping despite OPEC+ pledge to make additional production cuts early next year

In a note, Robbie Fraser, manager of global research and analytics at Schneider Electric, pointed out that reports said Saudi Arabia increasingly emphasized the role of smaller countries holding firm to promised cuts, signaling fading Saudi willingness to continue shouldering a disproportionate share of the burden as U.S. output hits all-time highs.

“In a familiar refrain from the shale boom era, Saudi and other OPEC+ members are continually faced with balancing actions that support prices near-term while also attempting to maintain longer-term market share,” he said.

A decision to delay the OPEC+ meeting, which was originally set to take place in person in Vienna on Nov. 26, had previously unsettled the market, stoking fears of a rift between producers that could jeopardize the ability to maintain cuts into 2024. The delay was attributed to objections by OPEC members Nigeria and Angola over proposed production targets.

On Thursday, OPEC+ also announced that Brazil would be joining the group as a member.

“Non-OPEC producing countries were largely expected to offset OPEC+ influence in the coming years,” said KPMG U.S. Energy Leader Angie Gildea, in emailed commentary. “Brazil joining, however, should likely help put OPEC+ back in the drivers seat in the future.”

Separately, the U.S. Energy Information Administration reported Thursday that U.S. natural-gas supplies in storage climbed by 10 billion cubic feet for the week ended Nov. 24.

Futures prices for natural gas turned lower, as analysts surveyed by S&P Global Commodity Insights, on average, forecast a weekly fall of 10 billion cubic feet.

marketwatch.com 11 30 2023