- Crude finishes at 15-month lows

William Watts, MarketWatch

NEW YORK

Energiesnews 03 21 2023

Oil futures gave up early gains Friday to end lower, booking the biggest weekly drop of 2023 as worries over the U.S. and European banking sector stoke recession fears.

Price action

- West Texas Intermediate crude for April delivery CL.1, +2.75% CL00, -0.36% CLJ23, +2.75% fell $1.61, or 2.4%, to close at $66.74 a barrel on the New York Mercantile Exchange, leaving the U.S. benchmark with a weekly loss of 13%. The U.S. benchmark suffered its biggest weekly loss since June, according to Dow Jones Market Data, posting its lowest close since Dec. 3, 2021.

- May Brent crude BRN00, -0.33% BRNK23, -0.33%, the global benchmark, dropped $1.73, o4 2.3%, to settle at $72.97 a barrel on ICE Futures Europe, its lowest close since Dec. 20, 2021. For the week, Brent dropped 11.9%, its worst performance since the week ended Aug. 15.

- Back on Nymex, April gasoline RBJ23, -0.59% fell 0.1% to $2.502 a gallon.

- April heating oil HOJ23, -0.03% rose 1.3% to end at $2.679 a gallon.

- April natural gas NGJ23, -1.02% jumped 7% to finish at $2.338 per million British thermal units.

Market drivers

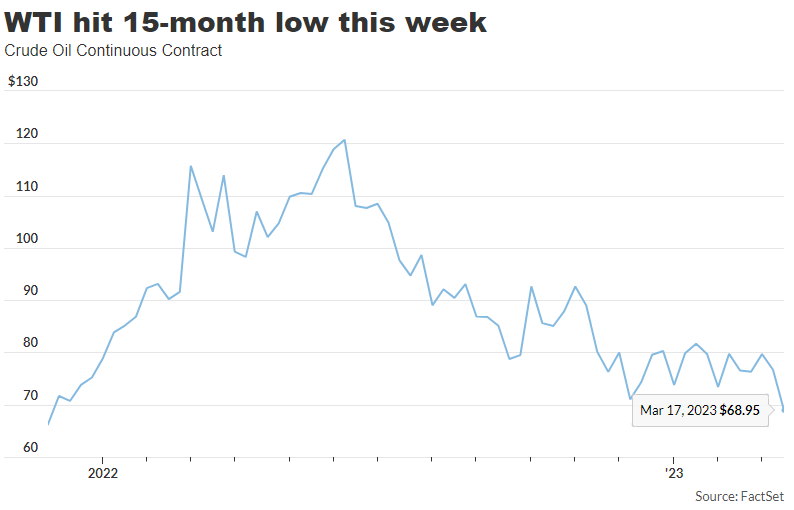

Both WTI and Brent ended the week at 15-month lows, bearing the brunt of a commodity selloff that analysts tied to recession fears that were amplified by the collapse of California’s Silicon Valley Bank and troubles at Swiss lender Credit Suisse.WTI hit 15-month low this weekCrude Oil Continuous

‘Oil prices have become particularly caught up in the downward pull amid the current market turmoil,” said Barbara Lambrecht, commodity analyst at Commerzbank, in a note.

Oil bounced modestly on Thursday after Credit Suisse said it had tapped a $54 billion lifeline from the Swiss National Bank and 11 U.S. banks agreed to deposit $30 billion with First Republic Bank FRC, +29.47%, the latest U.S. regional lender to find itself under scrutiny. Credit Suisse CS, +2.46% shares were seeing renewed pressure on Friday.

See: Here’s why a failure of Credit Suisse would matter to U.S. investors

“We regard the price slump to be excessive and speculatively driven for the most part,” Lambrecht wrote.

Russian Deputy Prime Minister Alexander Novak and Saudi Arabia’s energy minister, Prince Abdulaziz bin Salman, met Thursday. They likely discussed ways to stabilize oil prices, Lambrecht said, while the recovery of Chinese oil demand after the lifting of COVID restrictions remains an “important crutch.” Also, crude is now trading at a level that could prompt the U.S. government to consider refilling the Strategic Petroleum Reserve, which sits at a 40-year low, she said.

“In our opinion, this leaves sufficient (foreseeable) support for the oil price without OPEC+ having to convene an extraordinary meeting,” Lambrecht said. “Though much suggests that oil prices will begin rising again, however, sentiment on the market will probably be the main factor dictating the direction of oil prices in the short term.”

marketwatch.com 03 21 2023