Cartel raises its estimate for global oil demand growth in the third quarter of 2021

By Will Horner/WSJ

LONDON

EnergiesNet.com 02 10 2022

Stockpiles of oil in the largest consuming nations slumped in December, tightening an already stretched global energy market, as the supply of crude continues to lag behind robustly rising global demand, the Organization of the Petroleum Exporting Countries said Thursday.

Commercial oil inventories in the wealthier nations that make up the Organization for Economic Cooperation and Development dropped by 31.2 million barrels in December from the previous month to 2.72 billion barrels, OPEC said in its monthly report.

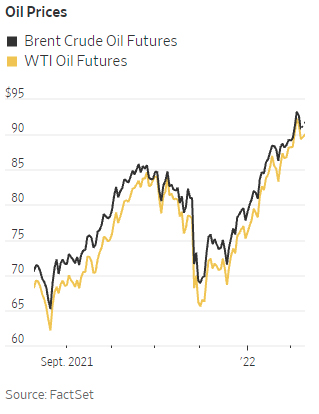

That leaves stocks 311 million barrels lower than in December 2020 and 210 million barrels below the five-year average, a drawdown that has resulted from flagging global output and has helped push oil prices to their highest level since late 2014.

Fears that the Omicron variant of Covid-19 would weigh on global economic growth have largely failed to materialize, keeping demand for oil buoyant.

OPEC said oil demand was moderately stronger last year than its earlier forecasts. The cartel raised its estimate for global oil demand growth in the third quarter of 2021 by 30,000 barrels a day and 20,000 barrels a day in the fourth quarter.

“As most world economies are expected to grow stronger, the near-term prospects for world oil demand are certainly on the bright side,” the group said.

Facing increasing pressure from major consuming nations such as the U.S. over rapidly rising oil prices, OPEC, along with a group of allied oil-producing nations, has pledged to gradually increase its output. However, the alliance, known as OPEC+, has struggled in recent months to keep pace with its own quotas. At a meeting last week, the alliance agreed to increase its output by 400,000 barrels a day in March.

In its report, OPEC, citing secondary sources, said its own output rose by 60,000 barrels a day in January from the previous month, some distance behind the roughly 250,000 barrels a day that the cartel is allowed to produce under the deal.

“Supply is struggling to revert to the level of demand, and when you think of the demand expected this year you can see how this is really underpinning a lot of the bullishness in the market,” said Joel Hancock, an oil analyst at Natixis.

The producer group also said supply growth among non-OPEC nations was slower than expected last year, at around 600,000 barrels a day—60,000 barrels a day less than earlier forecasts. For 2022, the cartel kept its forecasts for non-OPEC supply growth steady at 3 million barrels a day.

Oil prices rose Thursday, with Brent crude, the international oil benchmark, up 1.5% at $92.91 a barrel, and West Texas Intermediate, the U.S. benchmark, gaining 1.8% to $91.32 a barrel.

wsj.com 02 10 2022