Myra Saefong and Williams Watts, MarketWatch

SAN FRANCISCO/NEW YORK

EnergiesNety.com 09 11 2023

Oil futures finished modestly lower on Monday after marking fresh intraday highs for the year, as traders weigh prospects that output cuts by major producers will lead to tighter global supplies.

Price action

- The front-month October West Texas intermediate contract CL.1, -0.23% CLV23, -0.23% fell 22 cents, or nearly 0.3%, to settle at $87.29 per barrel after trading as high as $88.15 on the New York Mercantile Exchange. That was the highest intraday level for a front-month contract since November, FactSet data show.

- November Brent crude BRN00, 0.00% BRNX23, 0.00% shed a penny to settle at $90.64 a barrel on ICE Futures Europe, following a rise to as high as $91.45.

- Gasoline for October delivery RBV23, +2.72% settled at $2.72 per gallon, up nearly 2.5%.

- October heating oil RBV23, +2.72% tacked on 1.9% to $3.36 a gallon.

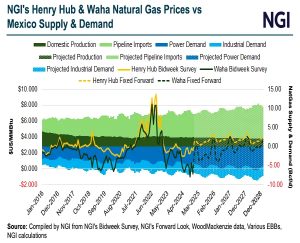

- October natural gas NGV23, +0.42% climbed by 0.1% to $2.61 per million British thermal units.

Market drivers

U.S. and global benchmark crude futures rose over 2% last week, and U.S. prices have jumped close to 10% over the last two weeks, as Saudi Arabia announced it would extend a production cut of 1 million barrels a day through the end of the year, while Russia said it would also extend supply cuts.

“The fundamental focus of the oil market has shifted from demand — more specifically concerns that a slowdown in global growth will hurt consumer spending on refined products — to the supply side as Russia and Saudi Arabia caught markets off guard with their output cut extension announcements,” analysts at Sevens Report Research wrote in Monday’s newsletter.

Factoring in the extended cuts, “many forecasts reflect deepening supply deficits in physical markets into the end of the year and that, paired with another wave of speculators getting scared out of the market by the latest OPEC+ surprise, has resulted in the latest leg higher to fresh 2023 highs in oil,” they said.

Looking ahead, the path of least resistance is higher for oil right now, with WTI “fast approaching our initial upside target of $89 [a] barrel,” the Sevens Report analysts said. “However, we remain in the camp that the onset of a recession will derail the rally.”

Monthly oil reports are due this week, on Tuesday from the Organization of Petroleum Exporting Countries, and on Wednesday from the International Energy Agency.

U.S. inflation data due Wednesday has the potential to up-end a number of asset classes.

marketwatch.com 09 11 2023