- Platts says the market needs American oil and most traders agree, but the change isn’t without risk.

Alex Longley, Bloomberg

HOUSTON

EnergiesNet.com 03 31 2023

What is the oil price? Over the next few weeks, the answer to that question will change in a way that hasn’t been seen for decades.

A huge chunk of the market relies on one number — the Dated Brent price — published every day by S&P Global Commodity Insights, better known as Platts. By early May, that benchmark, which is ultimately linked to ICE Brent futures, will have crude from Texas added to it.

Brent was once a powerhouse of global oil production, but now it’s just a trickle. Some months, particularly during summer maintenance, the number of cargoes plummets, prompting BP Plc to caution one time that prices were suffering “regular dislocations.”

So Platts says the market needs US oil, and most traders agree.

European refiners increasingly use American crude as a mainstay of their diet, so in that sense the shift is logical. Since Russia’s invasion of Ukraine, US crude and refined-fuel exports have climbed as high as 12 million barrels a day. Five years ago, they were a little over half that amount.

The change isn’t without risk, though. US oil is generally cheaper than crude in Europe — that’s why so much makes its way across the Atlantic.

With Dated Brent used in everything from long-term gas contracts to the crude selling prices of African countries, any big moves after the addition of West Texas Intermediate will have multibillion-dollar ramifications.

Most traders and analysts expect some pressure on Dated Brent prices following the revamp, but just how much is a key unknown.

The first test will be later on Friday, when the expiry of the May Brent futures contract is settled, in part referencing derivatives for June — when delivery of US cargoes will be allowed.

But if the new Dated Brent tells us anything about the market, it’s that oil from the US is only getting more important.

—Alex Longley, Oil Trading Reporter

Chart of the day

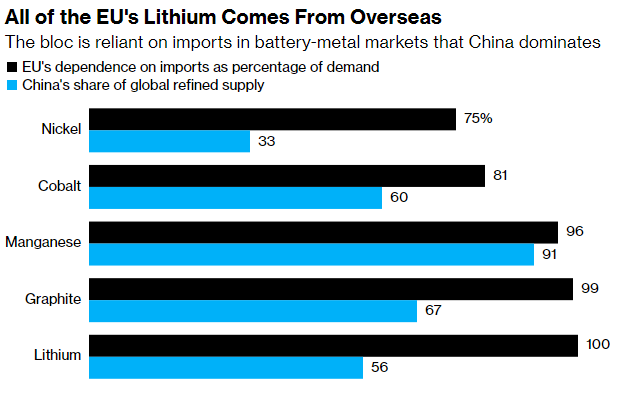

Note: Data shows China’s share of global mined natural graphite production, as data on refined production is unavailable

The pivotal role of lithium-ion batteries in the electric-vehicle revolution is driving lithium refinery projects across Europe. At the same time, the strategic importance of those developments has been underlined by a European Union initiative to cut its dependence on China for critical raw materials. Brussels is negotiating a deal with Washington in a bid to curb their reliance on China for key green metals, with the US keen to create a club of like-minded countries.

Today’s top stories

Oil headed for a weekly surge of about 8% as ongoing disruption to Iraqi exports tightened the market. Gulf Keystone Petroleum Ltd. became the latest producer in Iraqi Kurdistan to cut output as a legal spat between the region’s government and Baghdad dragged on.

Archer-Daniels-Midland Co. is weighing options to exit its main Russia operations, potentially adding to a list of Western agriculture traders pulling back from the world’s top wheat exporter.

Giant wind turbines are poised to get even bigger, according to Ming Yang Smart Energy Group Ltd., a manufacturer that already offers equipment fitted with vast 140-meter-long blades.

Rio Tinto Group agreed to sell a majority stake in Peru’s La Granja copper project to First Quantum Minerals Ltd. as the world’s No. 2 miner focuses on flagship developments in Mongolia and the US.

Argentina is rolling out a temporary, subsidized exchange rate for wine and other agricultural products in a bid to boost exports and foreign reserves as the worst drought in a century exacerbates a looming recession.

Best of the rest

- For decades, China was a leader at climate talks. But that changed at the COP27 summit, where it was criticized for failing to do enough. The US is now in a position to steal the climate leadership crown, an opinion piece in Foreign Policy shows.

- Almost 30% of electricity in the western US comes from hydro dams. But what happens when river water dries up? In this Columbia University podcast, host Bill Loveless talks to Tracey LeBeau of the Western Area Power Administration about the impact of drought and how power generation is set to change.

- A report from the Institute for Energy Economics and Financial Analysis examines the economic case for carbon capture in the power sector, concluding that the technology is costly, fraught with failures and subject to “rampant” optimism bias.

— With assistance by Michael Tighe and Mark Burton

bloomberg.com 03 31 2023