A BP model envisions demand plummeting almost 80% by midcentury, but the steps to getting there appear increasingly outlandish.

By Javier Blas

Today’s Take: Oil’s Pipe Dream

For years, energy experts modeling the impact of 2050 net zero targets on oil demand had the advantage that the deadline, and the incremental steps to getting there, were a long way off. If time proved their scenarios wrong, they’d be long forgotten anyway.

But now, those first intermediate waymarks are around the corner, and they look increasingly farfetched.

Earlier this week, BP Plc published its annual Energy Outlook, presenting three scenarios — not forecasts — for how oil demand may evolve. The Net Zero path, broadly in line with the goals of the Paris Agreement, is difficult to reconcile with current trends.

In such a narrative, BP’s model shows global oil consumption collapsing to 21 million barrels a day by midcentury, down from about 98 million today.

Ignore 2050 and focus instead on the intervening milestones, starting with 2025. In just two years’ time, BP’s Net Zero scenario sees oil demand 4 million barrels a day lower than it is now. That would mean removing the equivalent of Germany’s entire consumption in 2024 and repeating that feat again the following year.

Every oil forecast I’ve seen shows demand rising in 2023, and the few 2024 projections already published — including one from the US government — see growth continuing.

Looking further ahead, BP’s Net Zero readout suggests demand would need to plunge a further 9 million barrels a day from 2026 to 2030, falling to 85 million a day by the end of the decade. That equates to eliminating the consumption of France each year and, on the final year, striking out Italy as well.

Then the really difficult period starts. The scenario sees the world using just 70 million barrels a day in 2035, requiring the annual removal of 3 million a day. That equals the demand of Japan, currently the world’s fourth-largest consumer.

Net zero models look increasingly at odds with short-term trends. It’s possible oil demand can sink by 2050, but is it going to plummet in a matter of months and keep falling precipitously every year for the next decade? No.

–Javier Blas, Bloomberg Opinion

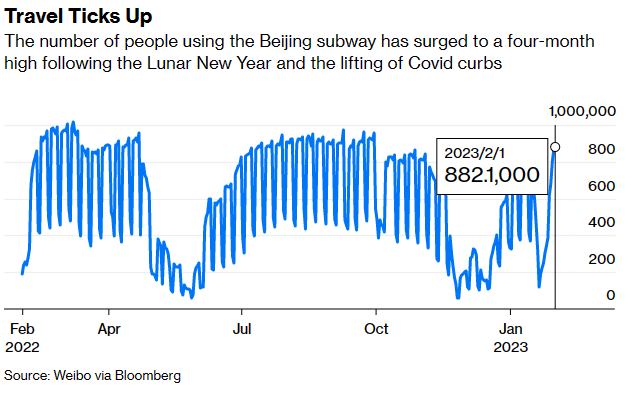

Chart of the Day

China’s city travel is returning. The number of people using public transportation in major urban centers has surged back to October levels. While subway journeys are still below 2021 levels — and some way off pre-Covid numbers — current trends indicate a rapid reopening of the economy in cities such as Beijing and Shanghai from the lows of late November and early December.

Today’s Top Stories

Shell Plc posted a fourth-quarter profit that was well ahead of expectations as its natural gas business thrived, lifting the oil major to a record performance in 2022.

Australian billionaire James Packer is considering an investment in Argentina’s energy or mining sectors, according to people familiar with the matter. He is flush with funds after last year’s sale of casino operator Crown Resorts Ltd. for almost A$9 billion ($6.4 billion).

Asian nations counting on offshore wind farms to meet climate goals are facing a shortage of ships to install them. Builders can’t churn out vessels fast enough, and the situation may worsen as turbine blades get longer and require bigger ships to handle them.

The US is beginning to detain imports of aluminum products suspected of being made through forced labor, particularly from China’s Xinjiang region, according to shipping giant AP Moller-Maersk A/S.

The need to feed growing populations while cutting agricultural emissions means farming must become more efficient, and the use of genetic technology in seeds is one route. Yet GMOs are a bugbear for many ESG funds, writes Bloomberg Opinion’s Chris Hughes.

Best of the Rest

- Europe’s energy crisis isn’t over, according to the Institute of International Finance. Gas prices are still far above the norm and recent declines partly reflect changes in demand, with energy-intensive manufacturing weaker than prewar levels, the IIF says.

- Slower growth in the US shale patch means OPEC will win market share in the next few years, the Nikkei reports, arguing that oil prices may stay higher for longer as a result.

- BP plans to dial back elements of its renewables push, according to the Wall Street Journal, which says the energy major is disappointed with returns from some of its green investments.

Javier Blas is a Bloomberg Opinion columnist covering energy and commodities. A former reporter for Bloomberg News and commodities editor at the Financial Times, he is coauthor of “The World for Sale: Money, Power and the Traders Who Barter the Earth’s Resources.” @JavierBlas

bloombergnews.com 02 02 2023