Charles Newbery, Platts S&P Global

BUENOS AIRES

EnergiesNet.com 11 02 2023

Argentina has potential to increase natural gas exports to its neighboring countries to up to 75 million cu m/d from Vaca Muerta, once it expands takeaway capacity from the shale play and connects local pipelines with cross-border systems, Marcos Bulgheroni, CEO of BP-backed Pan American Energy, said Nov. 1.

It should take two years for these connections to be made, projects that include extending a new backbone pipeline from Vaca Muerta in northern Patagonia to the center of Argentina, he said at a business forum organized in Buenos Aires by Argentinian consultancy ABECEB.

That would take exports to start increasing from less than 10 million cu m/d this year, according to Energy Secretariat data.

“We have the resources, in particular of gas,” he said.

Bulgheroni said Vaca Muerta has enough gas resources, estimated at 300 Tcf, to supply all of what Argentina consumes — at 2 Tcf per year — and widen exports and “accompany” the rise in its consumption as part of the phase-out of oil in the energy transition to net-zero carbon emissions.

Brazil has the most potential

The most immediate markets for exporting at Brazil, Chile and Uruguay, which already have cross-border pipelines in place with Argentina.

Bulgheroni estimated that 75 million cu m/d of gas can be exported to these markets, with 20 million going to Chile, up to 40 million to Brazil and 15 million to Uruguay.

“We have started this process,” he said, listing off a series of projects to expand pipeline capacity in Argentina.

The first big project was the construction of a new backbone pipeline out of Vaca Muerta. The initial 11 million cu m/d of capacity came online in August and is expected to reach 20 million cu m/d by the end of the year before hitting the full capacity of 40 million cu m/d in 2025 with an extension of the pipeline to the center of Argentina, Bulgheroni said.

This Vaca Muerta pipeline, named after the late President Nestór Kirchner, will connect to an existing backbone pipeline that runs to the north of the country, where there are links with pipelines to Bolivia, Brazil, Chile and Uruguay. This pipeline to the north is being converted so that it is bidirectional, allowing supplies to be moved north, not just south as has been done for years to bring in gas from Bolivia.

Bulgheroni said these projects will allow Argentina to increase exports to these countries and start supplying Bolivia and Paraguay for the first time.

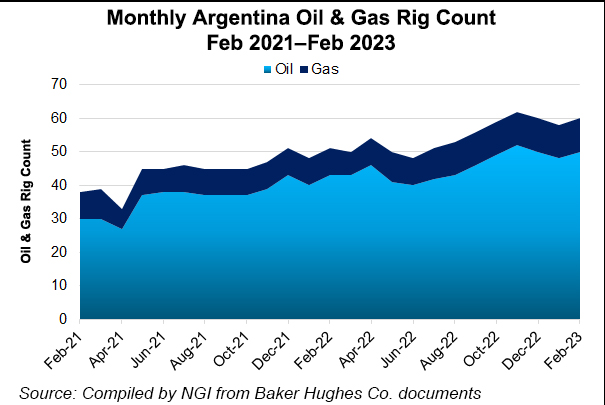

Rising output

These cross-border pipelines fell into disuse after Argentina’s gas production tumbled to as low as 114 million cu m/d in 2014 on maturing conventional reserves, beginning in 2004 when production was 143 million cu m/d. The start-up of production in Vaca Muerta between 2012 and 2013 is turning around this decline and building a surplus for export above the 140 million cu m/d of average demand. The country’s gas production reached 144.4 million cu m/d, the highest since July 2019, according to Energy Secretariat data. Of that, a record 67.8 million cu m/d came from Vaca Muerta, it said.

The government of Neuquén, home to most of the in-production fields in Vaca Muerta, has forecast that the province’s production could reach 150 million cu m/d by 2027 or 2028.

spglobal.com 11 01 2023