Arathy Somasekhar and Marianna Parraga, Reuters

HOUSTON

EnergiesNet.com 11 16 2023

Venezuela’s state-run oil company PDVSA is offering to sell up to 1 million barrels of Corocoro crude through an intermediary, sources said on Wednesday, which could become the first sale of that grade in two years.

Since Washington temporarily eased oil sanctions on the country last month, PDVSA has been allocating spot cargoes of crude and fuel oil through little known firms that contract with trading companies, which ultimately deliver to refiners.

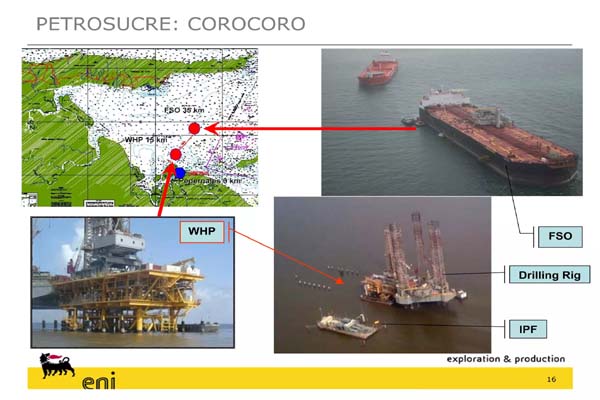

PDVSA and Italy’s Eni (ENI.MI), one of its joint venture partners, have been producing and storing about 2,000 barrels per day of Corocoro medium crude at a floating storage and offloading (FSO) facility.

The last export of Corocoro was in 2021, also from storage and to an Asian buyer, according to shipping and PDVSA data. Before U.S. oil sanctions were first imposed on Venezuela in 2019, the United States was the primary market for the crude.

PDVSA and Eni did not immediately reply to requests for comment.

This year, PDVSA and Eni have expanded trade as part of a U.S-authorized oil swap deal to pay off outstanding debt. They separately have engaged in talks to revive output at the shallow water offshore project where the Corocoro crude is produced, Golfo de Paria Oeste. A final agreement has not been signed.

Getting access to crude stored at the FSO is expected to bring some operational challenges due to its dilapidated condition and the possibility of some of the oil being off specification, especially due to water content.

The crude on offer would be discharged to barges and then transferred to a receiving vessel, the sources said.

Reporting by Marianna Parraga and Arathy Somasekhar in Houston; additional reporting by Francesca Landini in Milan

reuters.com 11 15 2023