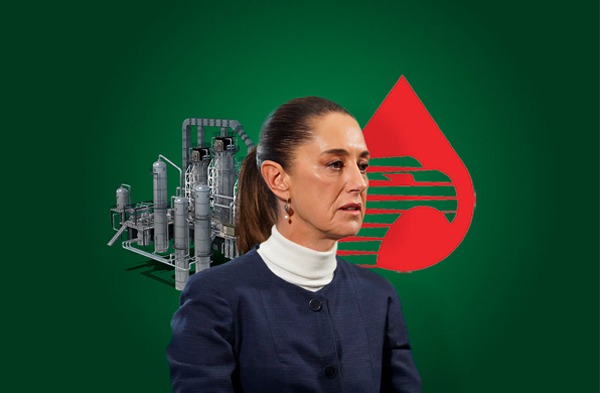

Oil production is now at ‘rock bottom’: IMCO analyst Ocampo. Massive debt burden overshadows company efforts at turnaround

Scott Squires, Bloomberg News

MEXICO CITY

EnergiesNet.com 02m 28 2025

Petroleos Mexicanos’ losses are worsening, compounding a crisis for President Claudia Sheinbaum as she seeks to rescue the state oil driller from sliding output, money-losing refineries and almost $100 billion in debt.

Article content

Pemex swung to a 190.47 billion-peso ($9.31 billion) loss during the final three months of 2024 from a meager 5 billion-peso profit a year earlier. It was the third straight period of negative results and topped off a whopping $30 billion in red ink for 2024, according to figures released Thursday.

The results suggest little has changed for Pemex after a new administration took the reigns in October to rescue the world’s most-indebted major oil producer. The company is struggling to boost output that has slumped to about half from its peak two decades ago. Crude and condensate production slipped by 10% in the final three quarters of 2024 to 1.67 million barrels a day compared with a year earlier.

“Crude production, not including condensates, is at the lowest levels since 1979, before Pemex exploited its massive oil deposits. It’s at rock bottom,” said Oscar Ocampo, an energy analyst at the nonprofit Mexican Institute for Competitiveness. “In refining, the operational losses they’re delivering are massive. The more they refine, the more money they lose.”

Meanwhile, the company is struggling pay down a debt load of nearly $100 billion as a weaker peso and aging equipment make it harder for the company to generate cash. Thursday’s results show Pemex also borrowed roughly $7 billion from financial institutions in the fourth quarter to help attend to about $20 billion in outstanding payments owed to oilfield-service providers, Finance Head Alberto Jimenez said during a conference call with analysts.

Sheinbaum is betting a new law approved by Mexico’s Senate Wednesday can turn Pemex around. The legislation aims to boost private-sector participation in energy by allowing profit sharing with Pemex in oil and natural gas ventures. The law, which also aims to streamline permitting, would guarantee state-controlled energy companies Pemex and Comision Federal de Electricidad retain dominance in the sector.

It remains to be seen if the change will be enough to rescue Pemex, which has been dogged by deadly accidents, explosions, and oil spills in recent years, as well as a fleet of refineries operating at a fraction of full capacity.

Dos Bocas, the company’s flagship refinery, processed zero oil in January as the company works to resolve an oil-contamination problem. Pemex executives said Thursday the problem was being resolved and Dos Bocas should return to operation in the coming days.

Mexico’s crude oil exports plummeted 34% in January from the month prior as US oil refiners along the Gulf Coast and in Europe began snubbing Pemex oil laced with too much water. At least three of Mexico’s domestic refineries have shuttered operations in recent weeks as the company seeks to fix the issue.

Despite the setbacks, investors have yet to totally abandon Pemex as government financial support is expected to remain steadfast, even as the company stares down its largest debt payments in the next years, according to Christine Reed, a portfolio manager at Ninety One in New York.

‘Too Big to Fail’

“We haven’t seen the improvements in the efficiency of the company that we would want to, but the support from the government is as strong as it ever was and that gives you a lot of comfort as an investor,” Reed said before the results were announced. “We would like to see the company become more productive, which is a challenge.”

Last year, under investor pressure Pemex management issued a sustainability plan targeting a 54% cut to greenhouse gas emissions by 2030, but it’s unclear how it will come up with the cash for green projects while it scrambles to pay debt, boost production and bring its refineries back online.

“We aren’t expecting any major changes from Pemex in the near term,” said Jared Lou, a portfolio manager at William Blair in New York. “We view the institution as too big to fail.”

—With assistance from Maria Elena Vizcaino.

bloomberg.com 02 27 2-25