Maya Averbuch and Amy Stillman, Bloomberg News

MXICO CITY

EnergiesNet.com 03 20 2023

State oil company Petroleos Mexicanos is able to handle about $8 billion of debt payments coming due this year, though the government may help out if needed, Mexico’s finance minister said at a national banking conference Friday.

The Finance Ministry has lateral support for Pemex and is available to help just with amortization payments, Rogelio Ramirez de la O said in Merida in the Yucatan peninsula.

“These situations change from one week to the next, according to oil price indicators and situations the market is subject to,” Ramirez de la O said. “The support we provide to Pemex is very lateral support.”

Ramirez de la O’s comments echo previous remarks by President Andres Manuel Lopez Obrador and his administration that while support for Pemex is guaranteed, the intention is not to provide any more cash for its debt this year. The government has given Pemex about $45 billion in tax breaks, capitalizations and other aid since 2019.

Read More: Pemex Prepares to Go Green to Keep Bank Financing, Investors

The market is well placed to “respond to Pemex’s short-term credit demands,” Ramirez de la O said.

Pemex is struggling to pay down debts that have risen to the highest of any oil major at $108 billion as of the end of last year. It issued $2 billion in 10-year bonds in January that were among the most expensive new debt of 2022.

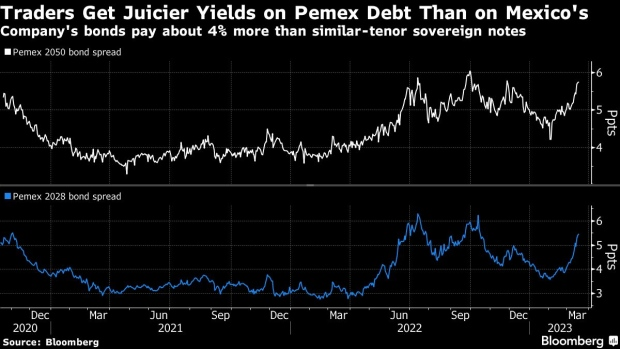

The extra yield investors get to hold Pemex bonds due in 2050 over Mexico’s sovereign notes is about 5.8 percentage points, according to pricing data collected by Bloomberg.

While the high cost can be explained by current global credit conditions, that the driller tapped international capital markets at all underscores its troubles.

–With assistance from Maria Elena Vizcaino.

bloomberg.coom 03 17 2023