Sheky Espejo, Platts

MEXICO CITY

EnergiesNet.com 05 27 2022

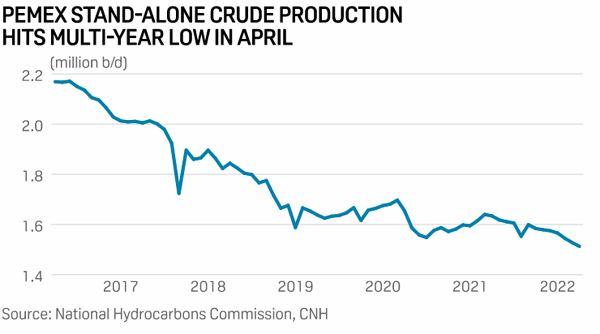

Crude production at Mexico’s state oil company Pemex has reached a new multi-decade low in April, according to official data published May 26.

With a portfolio of declining fields and limited exploration, Pemex has been unable to take advantage of high global prices in a tight market as major consuming nations avoid Russian crude after the invasion of Ukraine.

Pemex produced 1.5 million b/d of crude in April, according to National Hydrocarbons Commission data. A little over 50%, or 817,000 b/d, of total output came from seven fields, CNH said.

The figure had not been so low since the 1970s, before the company discovered Cantarell in 1979, at the time the largest oil field in the world. From 1960 to 1973, Pemex output was below 500,000 b/d, CNH data shows. After the discovery of Cantarell, Pemex quickly increased its production to more than 2 million b/d, which peaked in 2004 at roughly 3.4 million b/d. Production has been consistently declining since.

During the administration of President Andrés Manuel López Obrador, who began his term in December 2018, Pemex has been trying to raise production by pushing wells to early production. The government has consistently reduced its own goals as efforts fail, to 2 million b/d currently from 2.6 million b/d at the beginning of the administration.

However, Pemex’s investments in exploration have been limited, which resulted in a decrease in the country’s reserves. In 2021, Pemex did not add any reserves from exploration activities, CNH data shows. At current output levels, Pemex’s proven reserves are likely to last only nine more years, the data shows.

Private operators keep showing good results

But private operators increased their output in April to 93,943 b/d from 61,501 b/d in 2021, although output fell slightly from the 97,106 b/d produced in March, CNH data showed.

For the third month in a row, Russia’s Lukoil was the largest independent producer, with roughly 22,000 b/d. Lukoil entered the Mexican market in February when it acquired a portfolio of assets from Fieldwood Energy in a $435 million transaction.

Hokchi came in second, producing 20,000 b/d in April, data showed. Petrofac produced 16,479 b/d and Eni produced 14,000 b/d, data showed.

Natural gas production rises slightly

Natural gas production in the country increased marginally in April. Pemex increased its output slightly to 4.54 Bcf/d this year from 4.46 Bcf/d in 2021, although the company is still unable to comply with its commitments to reduce flaring. During its May 24 meeting, CNH anticipated the company may be fined for flaring gas at one of its gas fields. CNH said the investigation is ongoing.

Private operators also increased their gas output marginally in April, to 221.7 MMcf/d in 2022 from 207.3 MMcf/d last year, CNH data showed.

spglobal.com 05 26 2022