Maria Elena Vizcaino, Michael O’Boyle and Amy Stillman, Bloomberg News

MEXICO CITY

EnergiesNet.co 07 21 2022

Petroleos Mexicanos’s suppliers are getting stuck with steep losses after the state-owned oil giant undertook an unsolicited debt swap in lieu of repaying its maturing obligations with cash.

The losses are piling up for companies that were forced to accept new bonds — rather than cash payment — as part of Pemex’s $2 billion commercial debt refinancing in early June. The oil producer issued bonds to address billions of dollars in accruing debts to its offshore service providers and suppliers, as it fails to generate enough cash to pay them amid a heavy tax burden and declining production. But the move has left those it owed — companies that service oil rigs or provide maintenance to offshore platforms, for example — racing to monetize this unwanted debt as quickly as possible, even at a discount.

About a month after the deal, Citigroup Global Markets Inc. helped these companies to offload about $288 million of the securities at 87 cents on the dollar, according to people familiar with the matter who asked not to be named because the information isn’t public, and data compiled by Bloomberg. The notes were valued at par at the moment of the swap and net losses for these companies amount about 4% when taking into account interest accrued in the period, one of the people said.

Pemex “needs additional sources of liquidity to face obligations with providers,” said Edgar Cruz, a strategist at BBVA in Mexico City. “In that sense the company could come back to market to continue this liability management — paying short-term obligations with long-term debt.”

Suppliers who didn’t sell their holdings on the secondary market still own about $200 million of the 2029 bonds, according to people familiar with the deal. These companies will be able to sell when their lockout periods end in either late July or toward the end of September, the people said.

Pemex’s ill-fated debt sale sparked discontent among dozens of suppliers and spooked bond investors, who were caught by surprise with the deal. Money managers weren’t expecting the firm to sell new bonds in a moment of low appetite for emerging-market credit, especially as questions swirled surrounding Pemex’s struggle to meet obligations despite high oil prices. Earlier last month, Citigroup sold $1.5 billion of the notes at 97.6 cents on the dollar, a discount that had already upset suppliers trying to get their money back.

Mexico’s state-run driller had the highest debt of any major oil company in the world at $108.1 billion by the end of March. But because President Andres Manuel Lopez Obrador has reiterated his support for the firm, the notes have ranked as an investor favorite as they pay higher coupons than their sovereign counterparts which typically have a similar risk profile.

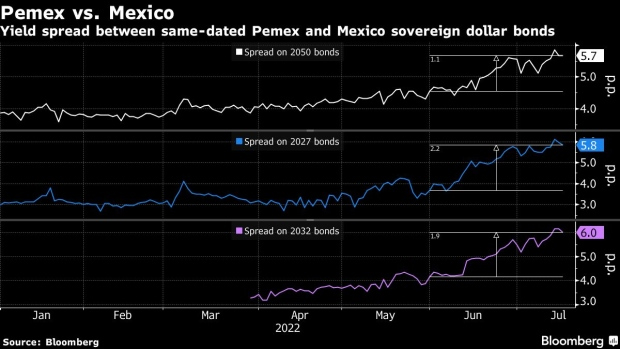

But the risk premium paid by Pemex over government bonds has increased since early June, as declines in the price of the company’s notes outpaced those of the sovereign notes. The yield spread between notes due 2032 climbed as much as 200 basis points to a record of 6.2 percentage points. A selloff in emerging-market bonds amid concerns over a global economic slowdown have also contributed to lower bond prices.

“Pemex has weak liquidity and is highly dependent on government support,” Moody’s Investors Service analyst Nymia Almeida wrote in a statement last week that accompanied a one-notch downgrade for the company. “In addition, Moody’s estimates that Pemex will have substantial negative free cash flow in the next 12 to 18 months, driven by insufficient operating cash generation to pay interest expenses, taxes and capital spending.”

bloomberg.com 07 19 2022