Mariana Durao, Bloomberg News

RIO

EnergiesNet.com 04 06 2022

Petrobras posted strong first quarter results thanks to growing oil production during the price rally, prompting a rebuke from President Jair Bolsonaro who wants it to freeze fuel prices ahead of an October election.

Latin America’s biggest oil producer also announced 48.5 billion reais ($9.7 billion) in additional dividends that mainly correspond to results from the first quarter. The results were bolstered by higher oil prices that also put the state-controlled company under political pressure to contain fuel inflation.

Bolsonaro called on Petrobras to freeze fuel prices on Thursday after the dividend was announced, adding that its profits are unacceptable during a crisis. Recently elected Chief Executive Officer Jose Mauro Coelho will be put to the test as the gap between Petrobras’s refinery gate prices and international levels widens.

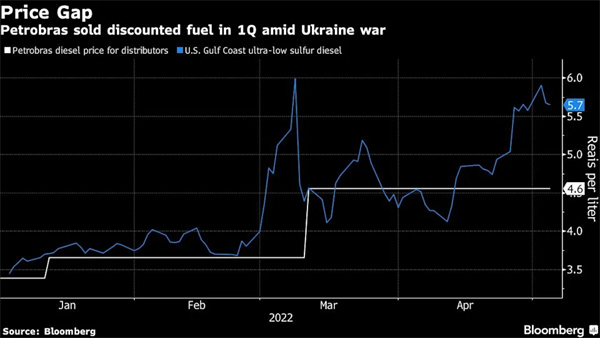

Brazil’s oil giant readjusted prices in March, but is selling fuel below international rates again, raising concern among investors who saw it turn from the world’s most indebted oil producer to a cash cow in the past five years.

Petroleo Brasileiro SA, as Rio de Janeiro-based producer is formally known, reported 44.56 billion reais of net income, up from the 31.5 billion reais in the previous quarter. Adjusted earnings before items, a measure of profitability, was 77.71 reais, beating the 74.4 billion-real average analyst estimate compiled by Bloomberg, according to an earnings report filed Thursday.

While Bolsonaro was urging for a price freeze, Petrobras released a statement saying that Brazilian society is the main beneficiary of its profits, and that its dividend policy is aligned with international peers.

After years subsidizing gasoline to contain inflation, in 2016 Petrobras adopted a policy of tracking international prices while shielding consumers from short-term volatility. The move has caused plenty of drama.

Since then, three of the company’s CEOs lost their jobs amid fuel-price disputes. The list includes Coelho’s predecessor Joaquim Silva e Luna, ousted by President Jair Bolsonaro after raising fuel in response to the war in Ukraine, even though Petrobras delayed the adjustment by more than two months.

“Petrobras’s main short-term risk is if there will be a change in the pricing policy,” said Fernando Valle, an equity analyst at Bloomberg Intelligence who covers Petrobras. He highlighted that the company was slow to pass through higher fuel costs to consumers in the first quarter.

High fuel prices are angering consumers and turning Petrobras into a political punching bag ahead of October presidential elections. The oil rally after the European Union proposed a ban on Russian crude, combined with a more hawkish U.S. Federal Reserve resulting in a stronger dollar, are putting pressure on Petrobras to adjust prices to comply with its policy of import parity.

Coelho pledged to keep market-based fuel prices when he took the helm, but it is unclear what will happen to this policy after October elections. Both Bolsonaro and his main adversary, former president Luiz Inacio Lula da Silva, have come out against fuel price increases, and congress is reviewing bills aimed at limiting volatility.

bloomberg.com 04 05 2022