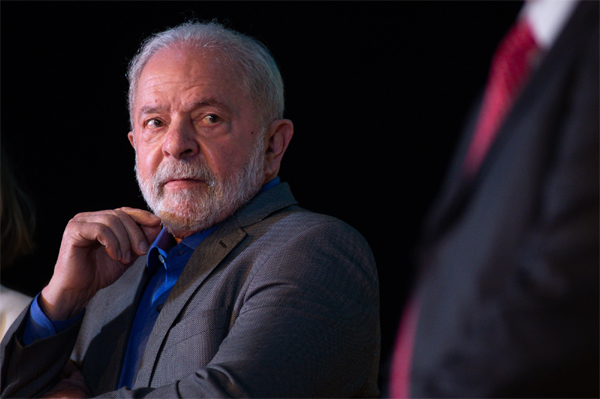

- Lula’s transition team calls for motor fuel stabilization fund

- Transition team recommends refinery and renewables spending

Mariana Durao, Bloomberg News

SAO PAULO

EnergiesNet.com 12 23 2022

Petrobras’s new management should carry out a two-month review of the oil giant’s business plan to bring it more into line with Brazilian President-elect Luiz Inacio Lula da Silva’s wider policy goals, according recommendations from Lula’s transition team.

The energy experts who worked on Lula’s transition concluded that Petrobras’s existing $78 billion five-year strategic plan is insufficient to build out priorities such as refining and biofuels, according to a person familiar with the team’s formal policy recommendations.

The group also calls for congress to approve a stabilization fund to ease price shocks during events such as Russia’s invasion of Ukraine, with the framework ready in about three months, the person said. The recommendations could still be changed before they are sent to the mines and energy ministry for formal consideration, the person said.

Mauricio Tolmasquim, the head of the transition team’s energy and mining group, declined to comment on what its formal recommendations will be.

The refinery investments are geared toward urgently reducing Brazil’s reliance on imported diesel and gasoline, and a national plan could include both Petrobras-run and private facilities. The group also suggests having the Mines and Energy Ministry, state development bank BNDES, and the Industry Ministry work on a refining expansion plan with Petrobras.

Lula has called for Petrobras to invest more to prepare for the energy transition and for Brazil to become self sufficient in refining, a dramatic shift from current policies that focus on maximizing profits from giant, deep-water oil fields and divesting from less profitable businesses.

Investors are expecting Petroleo Brasileiro SA, as it is formally known, to boost investments and erode what have been record dividend payments, and shares have fallen about 30% since he was elected on Oct. 30.

Lula’s transition team for energy included the two main contenders to become Petrobras’s next chief executive — Jean Paul Prates, a senator with Lula’s Workers’ Party, and Magda Chambriard, a former head of Brazil’s oil regulator, known as the ANP.

The recommendations will be sent to Brazil’s next mines and energy minister, who Lula hasn’t appointed yet, for a decision on adopting the measures.

bloomberg.com 12 22 2022