Nicole Yapur, Bloomberg News

CARACAS

EnergiesNet.cxom 09 17 2024

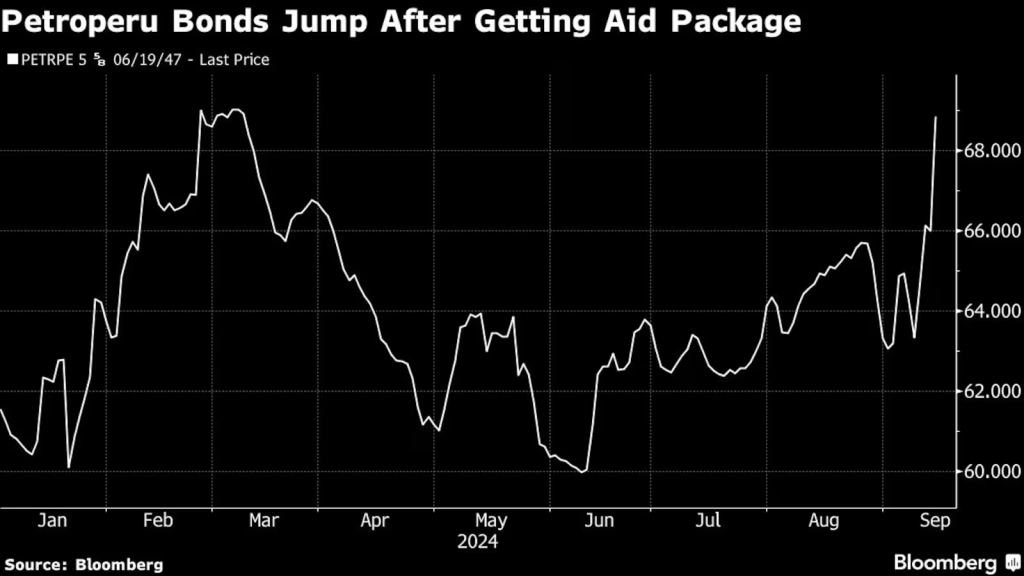

Dollar bonds of Petroleos del Peru, also known as Petroperu, soared on Monday after the government published a plan to temporarily take over debt payments from the cash-strapped company.

Notes maturing in 2047 jumped by almost 3 cents, the most since May 2020, to trade at almost 69 cents on the dollar, according to indicative pricing data compiled by Bloomberg.

The Finance Ministry will take responsibility for debt payments due in the second half of the year, the government announced on Saturday. The move follows months of uncertainty around when and how President Dina Boluarte’s administration would address the company’s liquidity and debt issues, stemming from the construction of the Talara refinery, which came in over budget and years late.

“This financial viability plan hinges upon Petroperu proving it can ramp up Talara into a profitable operation,” analysts at Banctrust & Co.’s research and strategy team wrote in a note. “Otherwise, this new government funding will only mean kicking the can down the road until a new rescue package is requested by the company.”

–With assistance from Marcelo Rochabrun.