Panama’s Pipeline Ambition: Securing the Canal’s Future Amid Climate and Geopolitical Challenges?

By Francesco Sassi

A new major Transoceanic pipeline could soon connect the Caribbean Sea with the Pacific Ocean in Panama. A transformative project in one of the most important waterways in the world, securing the independent future of the Canal and Panama from the U.S.

A pipeline announcement

The Administrator of the Panama Canal, Dr. Ricaurte Vásquez, surprised the audience of the Houston International Maritime Conference with a big announcement. Panama authorities are considering building a new Transoceanic pipeline to provide the Canal a long and bright future.

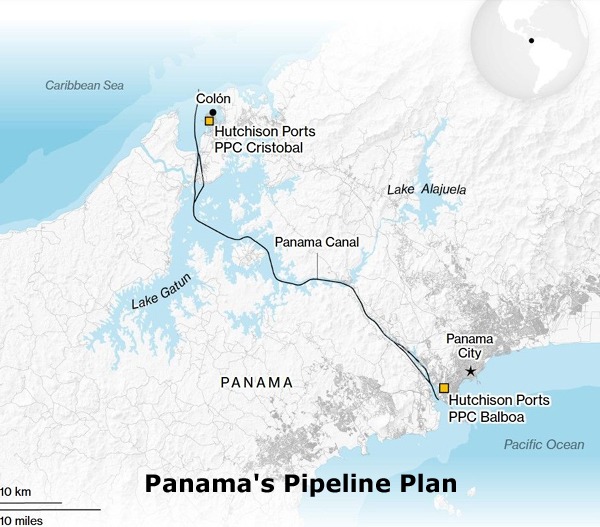

According to Vásquez, climate change poses a structural threat to the Canal. The transit of vessels – almost 10.000 in 2024 – which serves 180 maritime routes and 170 countries in the world, is affected by natural phenomena such as El Niño.

Graph 1: El Niño as a driver of Panama Canal rainfalls

Source: World Weather Attribution

In 2023, rainfalls in the Panama Canal area were a quarter below normal levels. This reduced available reservoirs of freshwater, slowing down cargo traffic throughout the next year. As a consequence, natural conditions forced authorities to slash the number of ships allowed to transit through the Canal from June 2023.

In the fiscal year 2024, the number of vessels transiting the Canal due to water-saving measures were 21% lower than the previous year, which prompted the Authority to implement adjustments to ensure sustainable water use, prioritise water use by the local population and environmental initiatives to ensure the canal’s sustainability in the future.

Global choke points in danger

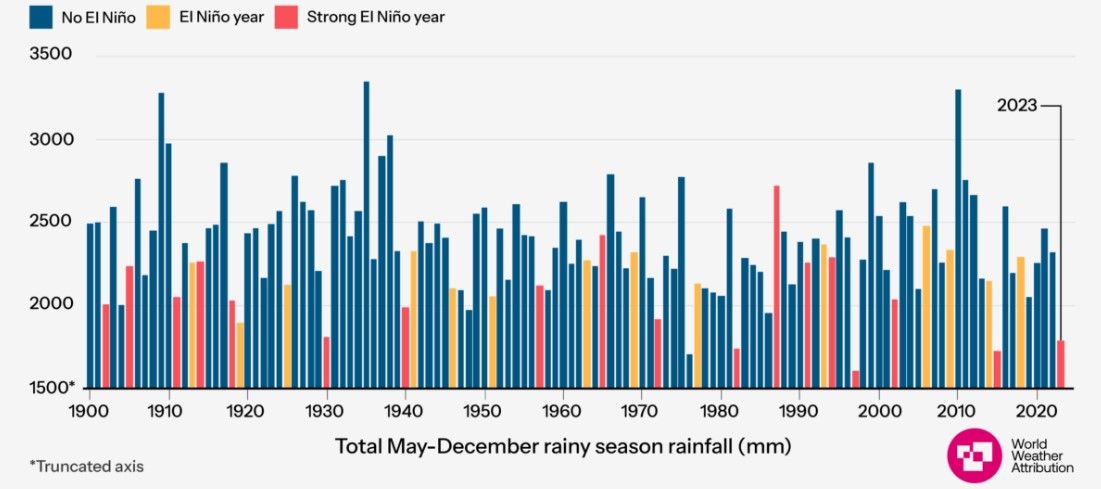

Because of the reasons mentioned above, and the expected increase in the number of episodes where the reduced availability of water will impact the use of the Panama Canal, Vásquez told the international audience gathered in Houston, Texas, that the Authority was considering “diversification options, including other forms of transportation, such as pipelines,” looking thus beyond maritime transportation and use the geographical (and geopolitical) landscape to the advantage of the strategic resilience of Panama as a vital choke point for global energy and trade (Map 1).

Map 1: Panama Canal and major ports

Source: Smithsonian Tropical Research Institute, Open Street Map, Bloomberg

The parallel disruption of maritime traffic through the Panama Canal and the Suez Canal, where the Houthis in Yemen launched dozens of attacks to transiting ships through the Gulf of Aden and the Red Sea threatened the already discontinued and feeble globalisation of energy trade.

According to a UN report, longer trade routes due to the disruption of trade flows through these canals raised global ton-miles by 4.2% in 2023 and by mid-2024 the rerouting increased the global demand for vessels by 3% and container ships by 12%.

Port congestion, higher fuel consumption, insurance premiums and piracy risks raised overall costs for stakeholders, but also greenhouse gas emissions, with small island states and least developed countries hit hardest. Raising freight rates impact not just energy consumption and trade, but also food prices, which disproportionately affects developing economies.

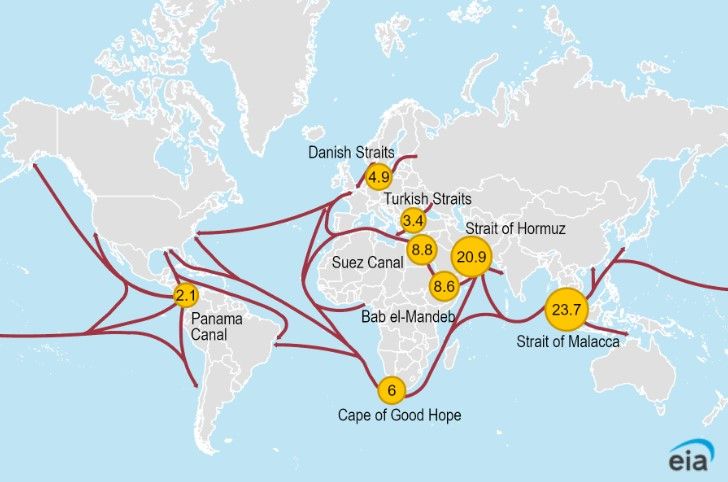

According to EIA data, the Panama Canal is a relatively important subject in global oil transit, with around 2.7% of the volume of crude oil and petroleum liquids transported through this choke point. In comparison, the Strait of Malacca and the Strait of Hormuz represent respectively the 30.8% and the 27% of the global oil and oil products transport (Map 2).

Map 2: Daily transit volumes of petroleum and other liquids through world maritime oil chokepoints (million barrels per day) (2023)

Source: EIA

Still, in normal times, the Panama Canal hosts 5% of global maritime trade and generates $2.5 billion for the Panamanian treasury, around 3% of the country’s GDP. Yet, when the 2023 drought hampered the continuation of transit, the profile of alternative trade interconnections was boosted. Projects such as Mexico’s Interoceanic Corridor (CIIT), or more speculative ones such as the buildup of a canal through Nicaragua or the futuristic Northwest Passage free of Arctic ice in the decades ahead returned on the table of global shipping companies and policymakers.

Pipeline politics in the age of global tariffs

As a matter of fact, geopolitics and not just climate change is the primary factor concerning the recent announcement by the Panama Canal Authority of a Transoceanic gas pipeline, which was reported with wonder by several agencies.

First of all, it is important to highlight that this pipeline project was in fact not new at all. Earlier in March, Vásquez introduced the idea of an LPG pipeline to be built between the Caribbean Sea and the Pacific Ocean during a presentation at the LPG International Seminar 2025 in Tokyo, Japan.

The same pipeline would be designed for ethane and LPG, allowing tankers to avoid the Canal passage and to risk lining up, or even clogging up transit at times of low water levels. Moreover, the Panama Canal Authority aims at freeing capacity for LNG carriers to transit the same Canal, passing from the Atlantic to the Pacific basin and thus connecting mainly the U.S. market with Asian ones.

By no chance, the first announcement of the pipeline project, whose capacity should be up to a million barrels per day, and possibly increased to 2 million barrels per day in a decade, was made in Japan, a large importer of both LPG and LNG from the US.

In 2023, Japan was the fourth largest LPG importer in the world after China, India and South Korea. Around $5.7 billion worth of LPG was imported in the year, highly demanded by the industrial and residential sectors. Latest available data from 2021 confirm Japan being the main destination for LPG exports from the U.S. with almost 384,000 barrels per day of exports.

In 2024, Japan was the second largest LNG importer in the world after China. Using the latest available data from IGU, around 8.5% of the total LNG imports came from the U.S. in 2023, higher than the year before, but still much lower compared to competitors such as Australia, Malaysia and even Russia.

The Japanese PM Shigeru Ishiba visit to the White House confirmed the interest of Tokyo in sourcing more energy LNG from the U.S. as a way to address the trade imbalance and avoid an overdependence on the energy imports from the Middle East.

Ishiba’s visit failed to win assurances from the Trump administration of exemptions from sweeping tariffs which could seriously damage the Japanese economy, including the auto sector. Long-term energy agreements between Japan and the U.S. are also strategized by Ishiba as a way to avert the worst consequences of an alarming trade and tariffs conflict which could soon spark other protectionist measures, including on energy exports.

Panama’s pipeline politics and the Panama Canal Authority’s announcement are cunningly designed to assist both Japanese energy diplomacy towards the United States and the same quest by the Panama government to seek assurances from Washington about its own independence.

President Donald Trump has made clear during his joint address to the Congress that “to further enhance our national security,” the Administration will reclaim the Panama Canal as it was “built by Americans for Americans, not for others, but others could use it.”

Panama President Mulino’s pushback against Trump’s claims did not stop the White House offensive to secure access to the Panama Canal. The investment giant BlackRock pitched the idea of purchasing for $19 billion ports on both sides of the waterway, thus shifting them into Washington hands, after much scaremongering of Beijing laying hands on the American choke point.

A decision will be made by Panama and the Canal Authority within 12 months, authorities said. A critical timeframe in which the government and waterway institutions should balance state and business interests with the risks of losing sovereignty over the Canal.

In case the Trump Administration is not happy enough with the security of energy exports from the Caribbean Sea to Asia, involving the Japanese government through state-owned companies into realising the Transoceanic LPG pipeline could be an intelligent opportunity by the Panama government to be seized in order to speak clearly into Trump’s ears.

Yet, no policymaker in Tokyo will be able to directly influence rainfalls and climate change which, coupled with geopolitics in the age of global tariffs, could grievously jeopardise the future independence of the Panama Canal.

_______________________________________________

Francesco Sassi is an analyst and research fellow with many years of experience in energy geopolitics and markets. Dr. Sassi holds a Ph.D. (with honour) in Geopolitics – Political Science at the University of Pisa, Italy. He currently works as a consultant at RIE – Ricerche Industriali ed Energetiche. Also, Francesco works as an analyst at the energy security research unit of the Italian Parliament and the Italian Ministry of Foreign Affairs and International Cooperation and counsels various public and private institutions and energy stakeholders. Dr. Sassi’s insights and analysis appeared on various think tanks and media such as BBC, El País, CNN Arabic, S&P Global Platts, ISPI, Handelsblatt, The Times, Le Grand Continent, Euractiv, The Diplomat, Petroleum Economist and many others. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Exlipx on March 14, 2025. EnergiesNet.com do not reflect either for or against the opinion expressed in the comment as an endorsement of Petroleumworld or EnergiesNet.com

Pipeline Politics is Back in Panama

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

EnergiesNet.com 03 23 2025