- Week 38 in 2023, Report on ideas on how to make positive cash flow.

Market Report

1.- Macroeconomic Environment:

Making Cash Flow Positive

In addition to our usual briefings on the economic environment, today we add special data on energy and how to invest in it. We also include a $1,000 investment challenge in which we participated and will show progress weekly.

Last Week:

They showed these indicators:

Available home sales came out higher than the market expected.

New home sales came in higher than expected.

The University of Michigan sentiment index came in at the same level as projected.

In Energy, the EIA announced lower natural gas inventories.

Fed Chairman Jeremy Powell’s Jackson Hole speech was balanced, with no major signals for the markets.

The vacations are over and liquidity is flowing into the markets. .

Next Week

GDP data on Wednesday

Employment situation on Friday

Consumer Confidence

Oil and Gas data on Wednesday and Thursday.

Atlanta Fed Governor’s speech on Friday.

2.- Micro

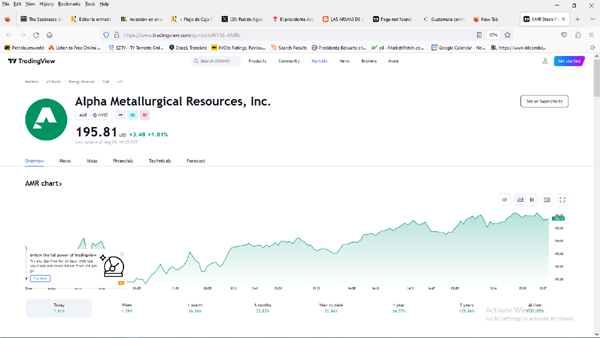

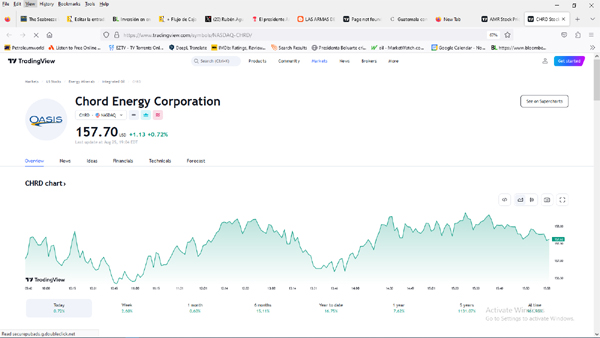

NVDA up 29%, and other consumer durable goods companies up 7.5% and mineral energy companies up 1%, while non-mineral energy companies rose 1.5%.

as examples:

There were no disappointments, strong market.

3.- Build a long-term portfolio

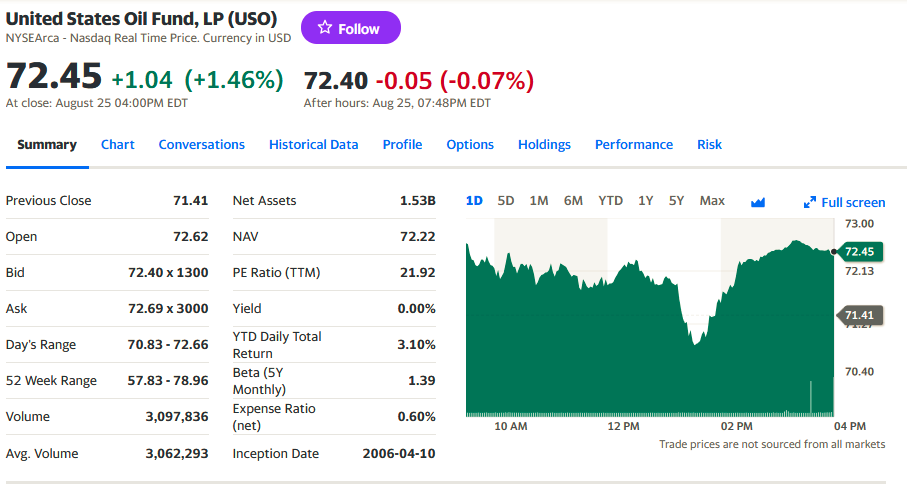

Let’s build a long term portfolio in energy companies.

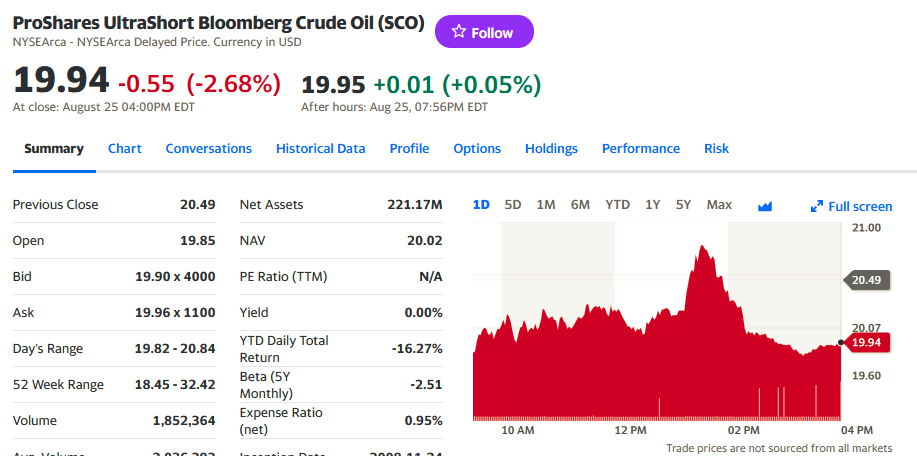

Here are some ETFs that would be useful:

Contains the following WTI futures contracts:

Top 6 Holdings (43.84% of Total Assets)

Name Symbol % Assets

Crude Oil Sept23 CLV3 9.38%

Crude Oil Oct23 CLX3 9.14%

Crude Oil May24 CLM4 7.04%

Crude Oil Nov23 CLZ3 7.03%

Crude Oil Dec23 CLF4 6.80%

Crude Oil Jan24 CLG4 4.46%

4.- Execution of an algorithm or method to generate cash flow on a long term portfolio or with money in the account.

Our favorite strategy.

We will update the inflows and outflows for the week.

5.- Analysis of previous week’s forecast results.

New liquidity started to enter, stable to solid market.

6.- Forecast for next week:

Let’s wait for the DATA .

Launched US $ 1,000 challenge to compare between:

USO energy investments.

Investments in technologies META, NVDA

Investments in financials BOFA, GS

Investments in Global ETFs SPY, QQQ

Investments in Gold GLD

Same in our Algo daily entries.

NOTE: We do not recommend investments, we only give our opinions.

For special courses or investment management contact us at: editor@petroleumworld.com

___________________________________________________

Raul Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and posted on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

EnergiesNet.com 27 08 2023