- Week 40 of 2023, Report on ideas to obtain a positive cash flow.

Market Report

Update of material financial information

October 1, 2023

1 Macroeconomic Environment:

Past Week:

These indicators were shown:

September ended, we concluded that volatility was king for the month. The indices registered losses as follows: Dow Jones -3.5 %, SP500, -4.9 % and NASDAQ,-5.8 %, respectively.

The 10-year Treasury bond closed below 4.6%, a resistance zone. The VIX, which measures volatility, ended the month below 18, also an important zone.

The Core Personal Consumption Expenditures Index rose 3.9% year over year in August, up from 4.3% in July, indicating a slight slowdown in inflation, less chance of interest rate hikes.

Technology stocks ended Friday’s session in positive territory.

If we think about future returns by looking at the modest yields of long term 10, 30 year bonds, one can conclude that the coming gains in the fast growing companies in the technology sector are more appreciated and raise the forecasts when doing fundamental analysis, hence they could rise in price.

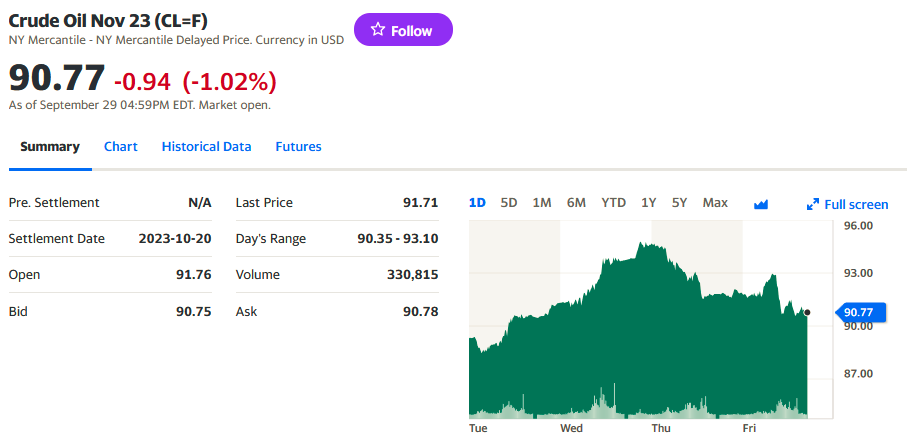

The WTI crude oil marker rose +1.62% during the week.

https://finance.yahoo.com/quote/CL%3DF?p=CL%3DF

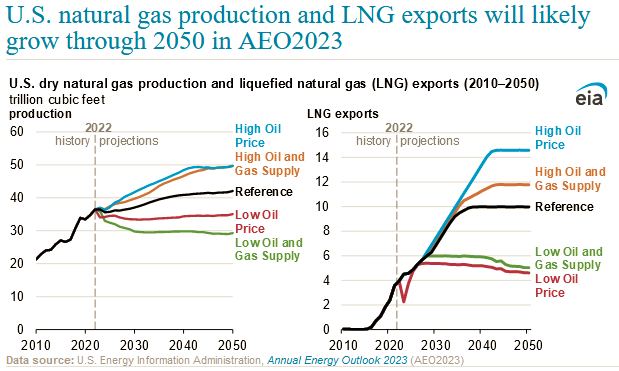

Meanwhile, the EIA reported that the Natural Gas inventory change rose from 64 bcf to 90 bcf.

Here is the chart with projections:

Next Week

October begins with the employment report on Friday the 6th. In addition, industrial manufacturing and oil market data will be released by the EIA.

2 Micro

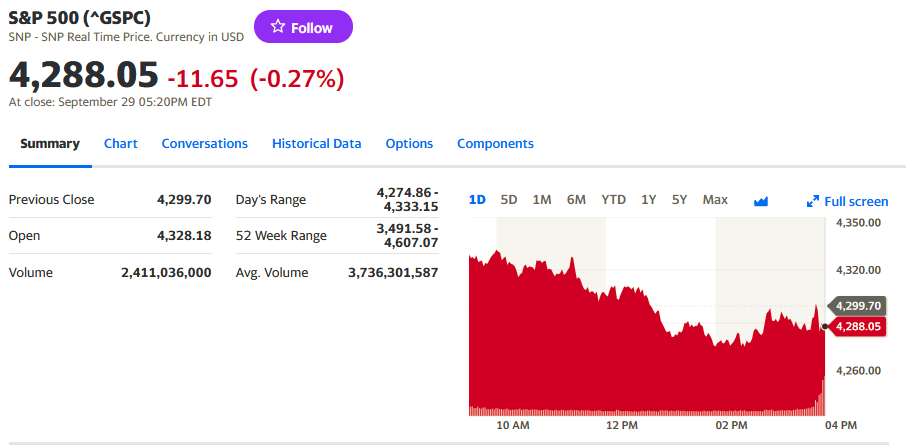

The stock market, SP500 gave up -0.5% in weekly total, it is worth noting that the weekly low was -1.6% last Wednesday, the usual day of higher volatility.

It did not reach 4,200 and seems to be strengthening above 4,300, stay tuned to that range.

https://finance.yahoo.com/quote/%5EGSPC?p=%5EGSPC

3 Build a long-term portfolio

The two energy-focused funds did not have the usual volatility due to the rise in crude oil inventories and Saudi Arabia’s reassurance that it would not cut production.

https://finance.yahoo.com/quote/SCO?p=SCO&.tsrc=fin-srch

The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO, which trades short crude oil futures contracts, gained just 0.2% in a week.

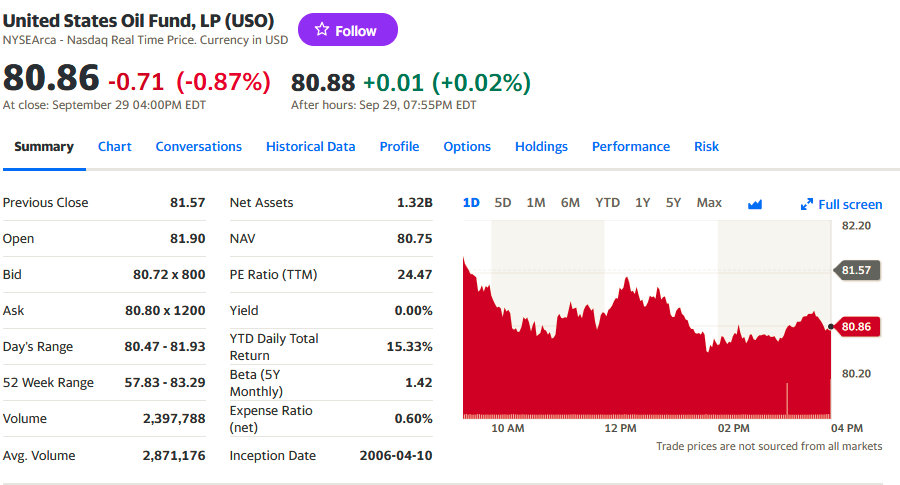

Meanwhile, the United States Oil Fund USO, which, in addition to crude oil futures, has futures on natural gas, diesel and gasoline, rose by only +0.40% during the week.

4 Execution of an algorithm or method to generate cash flow on a long-term portfolio or with money in the account.

Our favorite strategy.

The Magnificent 7, AAPL, TSLA, MSFT, GOOGL, NVDA, AMZN and META, we saw them with more upside than downside . CME’s FedWatch tool shows that the market is pricing in an 81% chance that rates will not change at the November meeting and 18% that they will. Fears fade.

Highlights APPLE on the downside and TSLA on the upside.

https://www.tradingview.com/symbols/NASDAQ-AAPL/

5 Results analysis of the previous week’s forecast.

We forecast upside entry opportunities in AMZN and TESLA.

AMZN down -2.10% but TSLA up +3.73%.

net effect : +1.63% Positive.

6 Forecast for the week ahead:

October begins , a month where investment algorithms turn on the quarterly earnings variable that usually considers historical DATA evidence that should favor high tech companies, less energy and utilities.

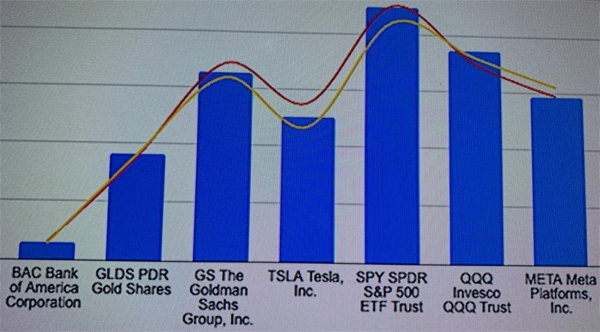

Weekly performance of the US $1,000 challenge to compare between:

USO energy investments +1.07%.

Investments in technologies META, NVDA META +1% NVDA +3.5% Investments in financials

Investments in financials BOFA, GS BAC -3.32% GS -3.83% GS -3.83% Investments in global ETFs

Investments in Global ETFs SPY, QQQ SPY -0.4% QQQ +0.28% QQQ +0.28% Gold Investments GLD GLD -0.28% Gold Investments GLD -0.28

Gold Investments GLD GLD -3.93% GLD -3.93% GLD -3.93% GLD -3.93% GLD -3.93

BITCOIN is up on the week. BIT +3.74% BIT +3.74%

Remarkable to see Gold down and Bitcoin up. See signals.

Portfolio since 4 weeks ago.

Chart of our portfolio since its inception 4 weeks ago.

Venezuelan market

Dollar price vs Bs

BCV : Bs 34.30

Unofficial : Bs 35.43

Caracas Stock Exchange Fixed Income:

OPERATIONS NOMINAL AMOUNT (BS.S) CASH AMOUNT (BS.)

7 10.161.000 10.560.000

TRADED SECURITIES CASH AMOUNT (BS.)

142 15.807.557 1.768.138,33

Up: 10

Down: 1

Equals: 14

For questions about our Algo daily entries, please write to : editor@petroleumworld.com

NOTE: We do not recommend investments, we only give our opinion

_______________________________

Editor’s note: This article is published as an opinion and is not recommended for investment.

All comments submitted and published on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

EnergiesNet.com 01 10 2023