- Week 40 in 2023, Report on ideas on how to make positive cash flow.

Market Report

Making Cash Flow Positive

Update of relevant financial information . We include Crypto Bitcoin.

1.- Macroeconomic Environment:

Last Week:

They showed these indicators:

Wednesday Cost of Living, Inflation, Consumption index rose slightly , especially due to Energy costs.

Last Thursday Retail Sales and Producer/Manufacturer Production Index very stable.

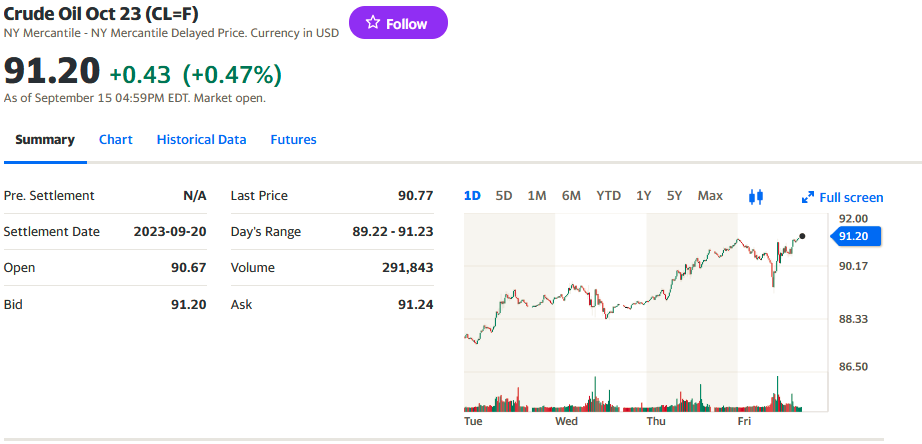

The WTI crude oil marker rose $3.53 or 4% for the week.

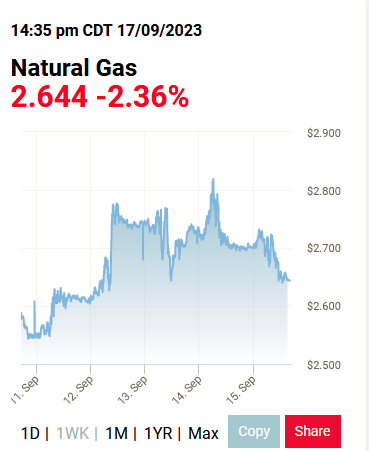

Meanwhile, the EIA reported the Natural Gas inventory change rose from 33 bcf to 57 bcf.

Next Week

Most relevant will be the release of the two-day meeting of the US money market committee , FOMC, at 2 pm on Wednesday , followed by Jerome Powell’s customary press conference.

Earlier, the EIA report on the state of the oil market will be released at 10 am.

2 Micro

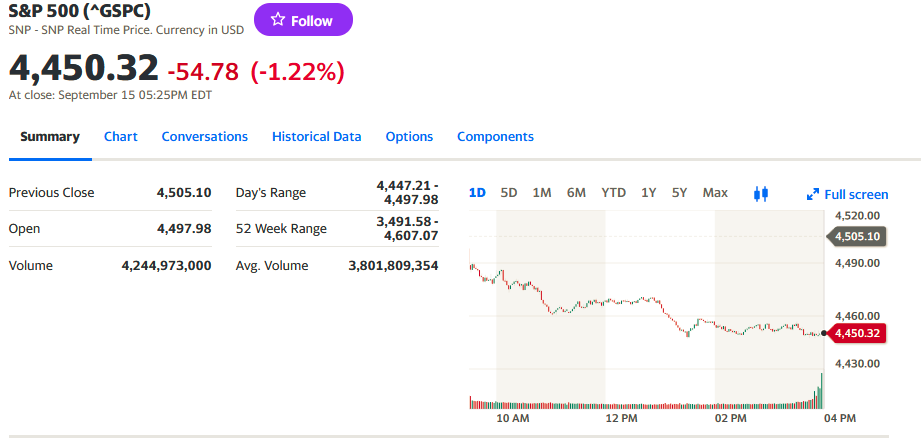

The stock market , SP500 gave up space by -0.64%.

The week’s focus will be on the Fed meeting which will be released on Wednesday afternoon.

3 Building a long-term portfolio

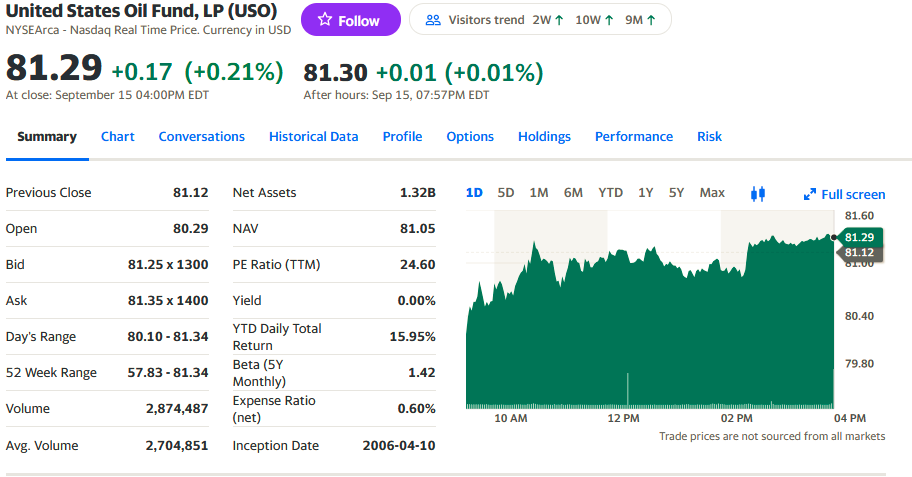

The two energy-focused Funds demonstrated the high volatility of energy at this time. as it should be, performance was crossover:

The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO, which works with short crude oil futures contracts, lost $-0.64 or 3.78% in one week.

Meanwhile, the United States Oil Fund USO, which, in addition to crude oil futures, holds futures on natural gas, diesel and gasoline, rose +$2.28 or +2.28% for the week.

https://finance.yahoo.com/quote/USO?p=USO&.tsrc=fin-srch

4 Execution of an algorithm or method to generate cash flow on a long-term portfolio or with money in the account.

Our favorite strategy.

The Magnificent 7, AAPL, TSLA, MSFT, GOOGL, NVDA, AMZN and META, had slight downward movements. META, NVDA, AMZN and APPL moved down, due to a moderate rise in the CPI. In APPL we expect to see reactions on its new products such as the IPhone. Some Wall Street analysts released price forecast at $240 for a year ahead, up from 175 where it is today.

https://www.tradingview.com/chart/AAPL/4kCbSPLD-APPLE-Local-Bullish-Bias-Buy

5 Analysis of results from last week’s forecast

Accurate prediction of buying opportunities in:

Crypto:

https://finance.yahoo.com/quote/BTC-USD?p=BTC-USD

Bonds :

https://finance.yahoo.com/quote/%5ETNX?p=%5ETNX

fear has yet to overcome euphoria.

6 Forecast for the week ahead:

Eyes on Tuesday and Wednesday’s FOMC meeting.

Weekly performance of the US $1,000 challenge to compare between:

USO energy investments +2.28%.

Investments in technologies META, NVDA META -1% NVDA -1% NVDA -1% Investments in financials

Investments in financials BOFA, GS BAC +0.62% GS +4.26% Investments in global ETFs

Investments in Global ETFs SPY, QQQ SPY -0.64% QQQ +1% Gold Investments GLD GLD EVD

Gold Investments GLD GLD EVEN

BITCOIN stable for the week. BIT 0.01% BIT 0.01% BIT 0.01% BIT 0.01% BIT 0.01

For inquiries about our Algo daily entries, write to : editor@petroleumworld.com

NOTE: We do not recommend investments, we only give our opinions.

For special courses or investment management contact : editor@petroleumworld.

_______________________________________________

Raul Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and posted on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

EnergiesNet.com 09 17 2023