Jesper Stärn, Bloomberg News

STOCKHOLM

EnergiesNet.com 03 31 2022

The first few steps on Europe’s quest to cut its dependence on Russian energy have come with record electricity prices.

Monthly average rates in some of Europe’s biggest markets have never been higher than in March as low stocks of both natural gas and coal pushed up the cost of generating electricity from fossil-fuel plants. It’s a sign of what’s to come as the European Union plans to wean itself off decades of heavy reliance on its top supplier.

European consumers and industry are already suffering as everything from fuel to metals and food gets more expensive, sending inflation across the euro zone to the highest ever. Energy-intensive factories are reducing output, which could stifle growth if it continues for long enough.

“Prices at the start of March were so high that we started to see demand destruction within the European industry,” said Fabian Ronningen, an analyst with Norway’s Rystad Energy AS. “Such high monthly averages are unprecedented and will continue to have a big impact on both industries and private consumers.”

European Industry Faces Shrink or Shut Decisions on Energy Pain

Gas prices, which help decide power costs, extended gains on Wednesday after Germany activated an emergency plan to help the region’s biggest energy user manage supplies if flows from Russia are halted. In the coal market, traders are also limiting purchases from Russia, which has pushed up prices by more than a quarter since the start of the month as they scramble for alternatives.

Germany Enacts Emergency Gas Plan as Russia Wields Ruble Threat

“Everything is of course driven by worries about the development surrounding Russia,” and the swift need for Europe to find alternative supplies, said Christian Holtz, an energy markets consultant with Merlin & Metis AB in Stockholm.

Despite the push to move away from fossil fuels to curb global warming, Europe is still relying heavily on many legacy plants to heat its homes and keep the lights on. Output from coal plants rose 21% in March from a year earlier, according to data from Fraunhofer.

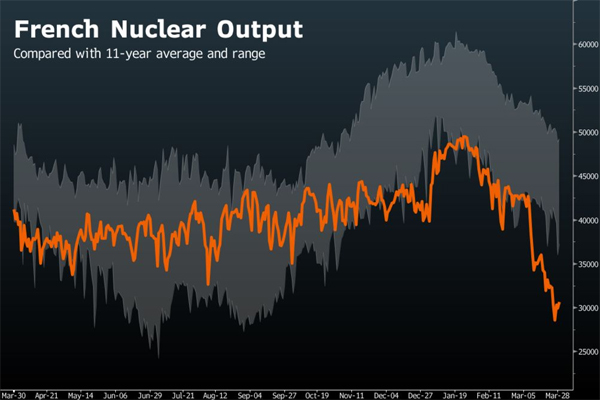

Generation from the main low-carbon alternatives — nuclear and wind — both plunged in March. German wind power output fell 20% from a year earlier, while French nuclear output dropped to the lowest level since at least 2011 on extended maintenance outages.

The problems for the French nuclear fleet are so bad that they turned Europe’s biggest exporter of power into a net importer during March. Of Electricite de France SA’s 56 reactors, only 30 are in use right now.

Italy had the highest average March price among the major markets in Europe, averaging 303.80 euros per megawatt hour, closely followed by the U.K. and France.

The cost of power could rise even further in the coming months as gas prices remain high and very volatile. In Germany, monthly electricity futures are trading above 200 euros per megawatt-hour until the end of the year, with June peaking above 270 euros on the European Energy Exchange AG.

“Low gas storage levels and concerns that there will not be enough new flows to refill them is still making power from gas plants exceptionally expensive,” Holtz said.

bloomberg.com 03 30 2022