Kiane Wilburg, Kaieteur News

Georgetown

EnergiesNet.com 06 10 2022

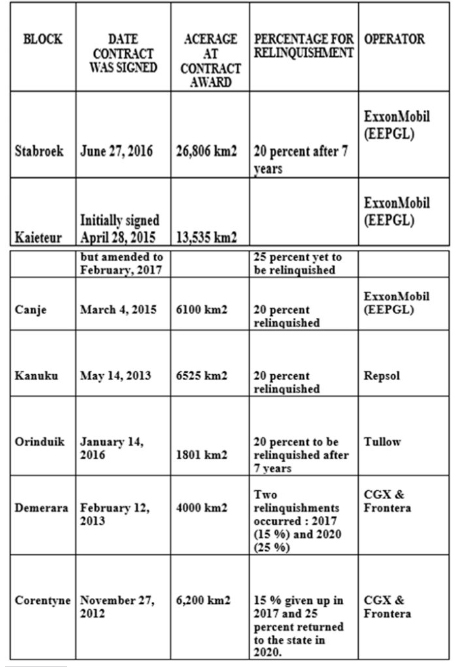

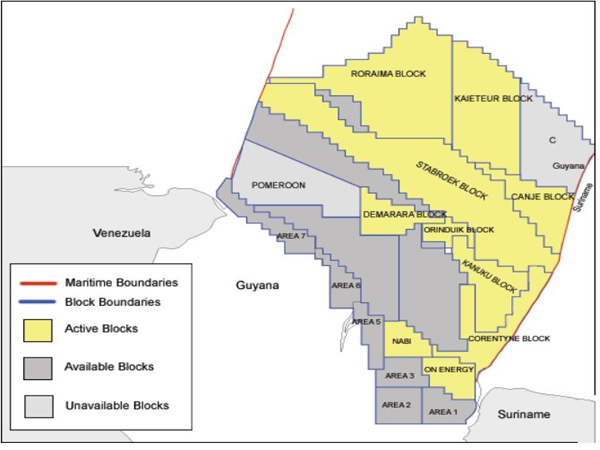

While the government has not disclosed which offshore blocks are set to be part of the nation’s first auction in the third quarter of 2022, Kaieteur News based on its review of the respective Production Sharing Agreements (PSA) has been able to ascertain that there will be five contenders. They include relinquished portions of the Kanuku, Corentyne, Demerara, Canje and the Kaieteur Blocks.

Importantly, no part of the Stabroek Block would be included in nation’s maiden bid round since the provisions of the 2016 contract only allow for 20 percent of the acreage to be relinquished after seven years. It therefore means that a portion of the oil rich block would only be surrendered to the State until 2023.

The Kanuku Block which covers 1,937 km2 in the Atlantic Ocean within the Exclusive Economic Zone of Guyana is operated by Repsol. The company gave up 20 percent of the block this year in which it holds a 37.5% stake and while Tullow holds 37.5% and TOQAP, a company jointly owned by Total E&P Guyana B.V. (60%) and Qatar Petroleum (40%), holds 25%.

The Corentyne and Demerara Blocks are operated by Canadian explorers, CGX Energy Inc and Frontera Energy Corporation. An independent Prospective Resource study of the two concessions by McDaniel & Associates Consultants Limited, noted that the concessions hold a combined median estimate of 4.84 billion oil-equivalent barrels. CGX has successfully relinquished parts of the Demerara and Corentyne blocks to the State.

Like Stabroek, the Kaieteur and Canje oil blocks are operated by ExxonMobil’s subsidiary Esso Exploration and Production Guyana Limited (EEPGL). In the case of Kaieteur, 25 percent had to be relinquished since February 2021. This is yet to occur. As for Canje, 20 percent was relinquished in 2019.

In the Canje block, EEPGL holds a 35 per cent interest. The remaining partners are: TotalEnergies E&P Guyana with a 35 per cent stake, JHI Associates with 17.5 per cent, and Mid-Atlantic Oil & Gas with 12.5 per cent.

In Kaieteur, Esso has 35 percent working interest, Hess Corporation holds 20 percent, Ratio Guyana Ltd has (25%), and Cataleya Energy Ltd. (20). In the meantime, industry analysts such as ABIS energy which has been involved in following Guyana’s oil story since 2018, have said via a report that the basin is highly likely to witness farm-ins and merger and acquisition (M&A) activities over the next five years.

The report said these will be driven on the one hand by operator cost reduction considerations and on the other by the inability of smaller independents like Eco Atlantic to raise the necessary financing to carry out or meet their contractual work obligations or requirements. The report concluded that given the largely deep and ultra-deepwater nature of Guyana’s most prospective exploration areas, any such M&A activities are likely to favour the major companies with the deep pockets necessary to carry out extensive exploration activities.