MARKET REPORT

Update of material financial information.

November 12, 2023

1 Macroeconomic Environment:

Last Week:

These indicators showed:

Consolidated Bull , bull market, appears to be breaking through resistance to the upside.

Crypto Fear and Greed Index

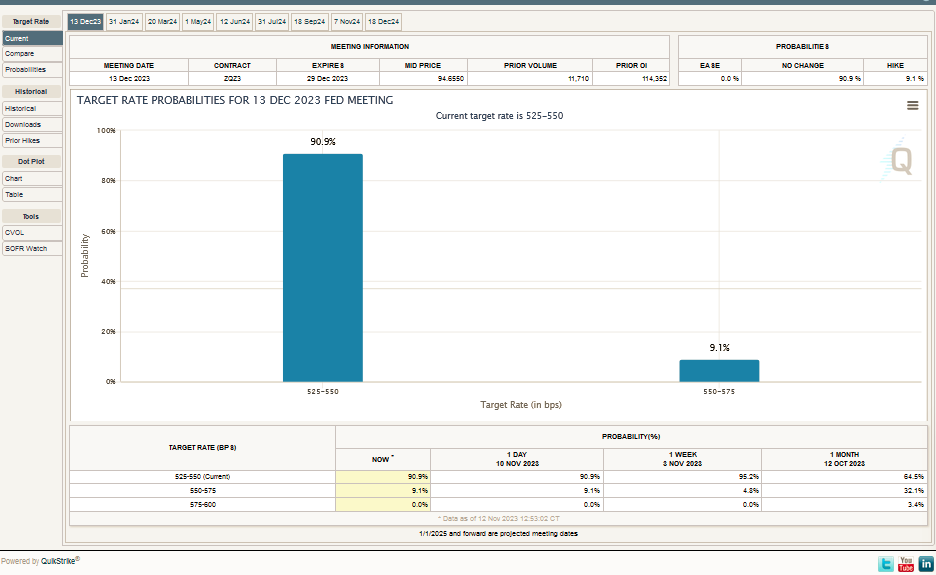

Fed governors and Chairman Powell himself made friendly comments toward expectations of interest rate hikes to further control inflation at the annual statistical research conference in Washington, DC.

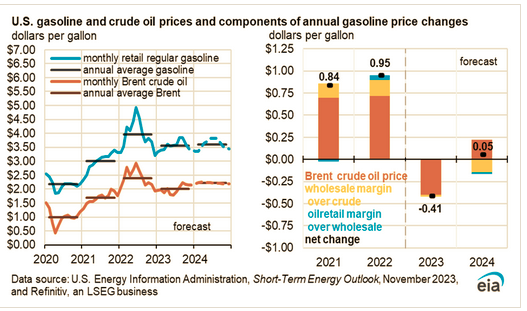

Also revealed was an interesting study on how domestic gas consumption has fallen amid an environment of high inflation and remote jobs

Next Week

- This week is full of economic news. The industrial production, PPI, CPI inflation and retail sales indices.

There will also be a flurry of events with Fed members speaking throughout the week. It promises to be one of the busiest weeks of the year.

- For the next monetary policy meeting on December 13, rate hike expectations are at 10 while rate hike expectations are at 90, reinforcing the market’s bullishness these days.

CME FedWatch Tool

2 Micro

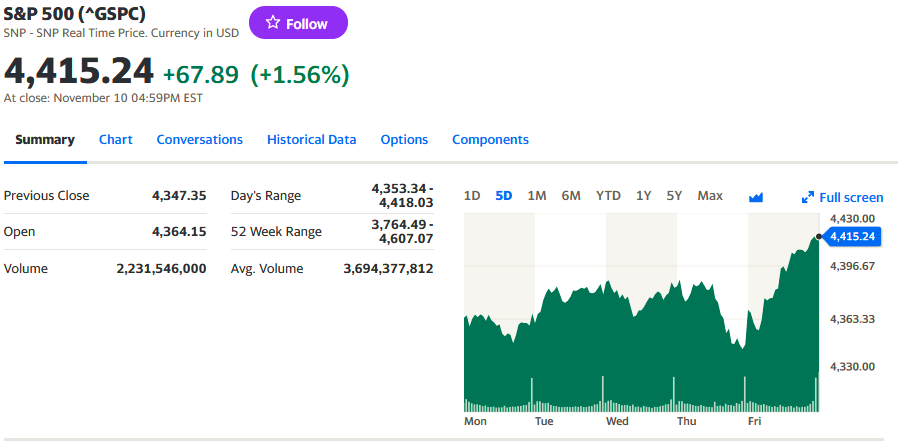

- The stock market , SP500 rose 50 points higher , adding 1.15% on the week, less than last week, but consolidating an eventual Santa Claus Rally.

- It broke resistance from 4,400 to 4,415.

3 Building a long-term portfolio

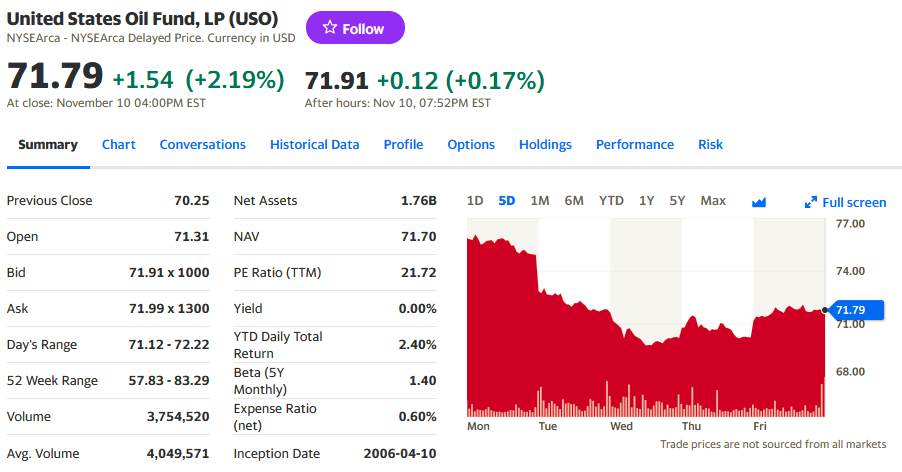

- The two funds concentrated in energy reflected the fall in crude oil prices and its derivatives with a lot of volatility, this week the energy markets moved like this:

- The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO, which works with short crude oil futures contracts, gained 9.10% in one week.

- Meanwhile, the United States Oil Fund USO, which contains not only crude oil futures, but also natural gas, diesel and gasoline futures, also showed volatility, falling by -5.29%.

- Positive arbitrage in the week for both Funds with a 3.81 % positive difference.

This news boosts the entire market, due to the importance of global energy costs.

However, it anticipates further gains to the markets in index readings over the next three months.

4 Execution of an algorithm or method to generate cash flow on a long-term portfolio or with money in the account.

Our favorite strategy.

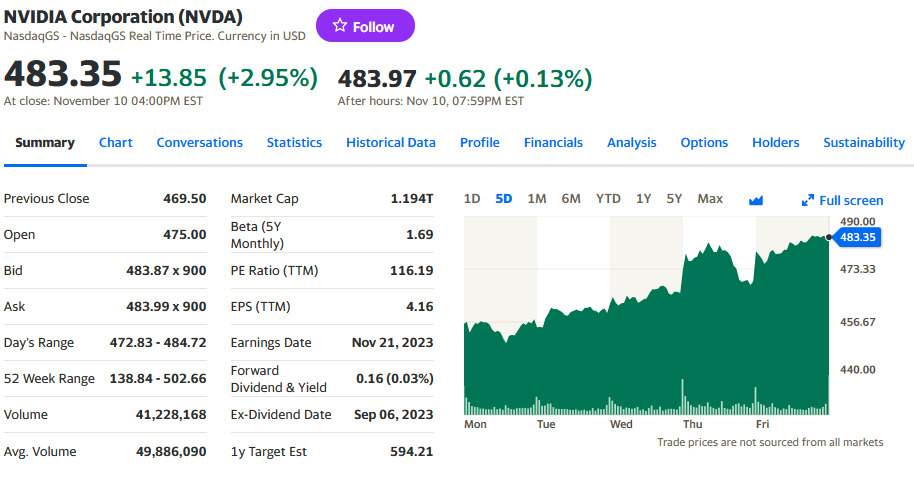

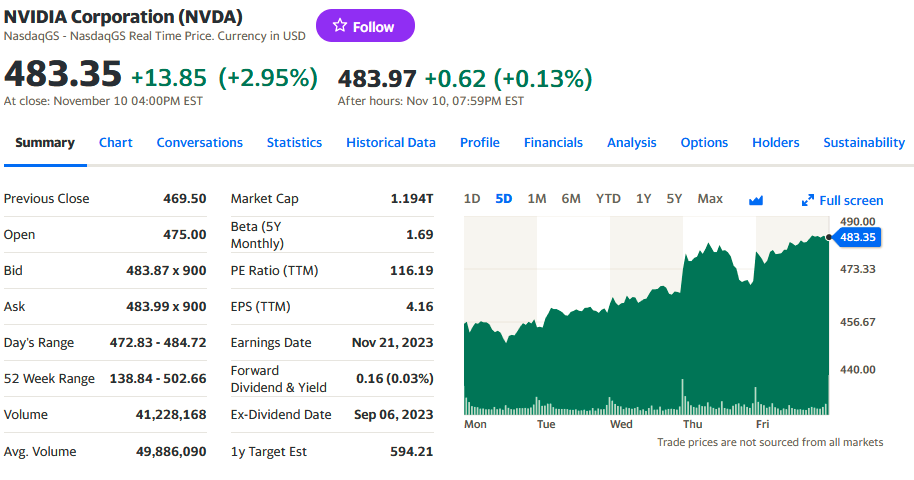

The Magnificent 7, AAPL, TSLA, MSFT, GOOGL, NVDA, AMZN and META, contributed gains to the market , especially NVDA +6%, which reports earnings on November 21 , the exception was TSLA which was down 2.6% due to a price downgrade to $148 by HSBC.

5 Analysis of the results of the previous week’s forecast

- We had made a bullish forecast. The conditions were met. The stocks we compared moved like this:

Gold -1.82%.

OIL -3.86%.

10 Year Bond Unchanged

SPY +1.28%

- The good run for stocks continues. Lower Gold and Oil prices send signals of lower costs to the economy and higher operating yields.

6 Forecast for next week:

- We will again compare the yields of Oil , Gold and the SPY , and the 10 year Bond.

- The SP500 is at a definitional point. If it breaks above 4,415, it breaks the resistance marked on open futures and options trades and will move up towards 4,450.

- Otherwise it may pull back to 4,360.

- Using our method in those ranges we will make entries in those ranges. We think the rally will continue, but with very high volatility due to the economic data we will see this coming week.

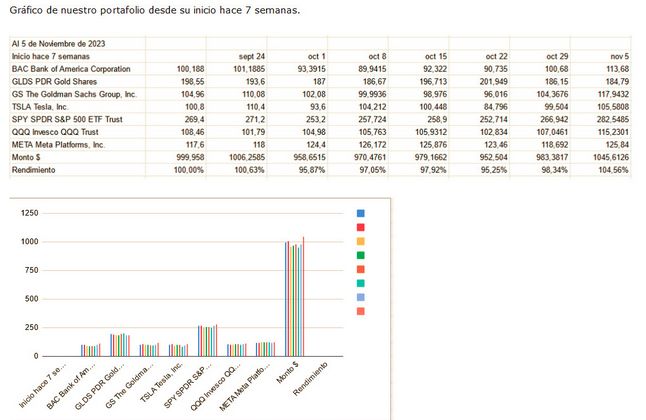

Weekly performance of the US $ 1,000 challenge, 7 weeks:

Venezuelan market

Price of the dollar vs Bs

BCV : Bs 35.33 +0.05%.

Unofficial : Bs 37.17 +0.11%.

The slippage of the two exchange rates in Venezuela was minimal compared to other weeks. There were important interventions in the banking desks by the BCV. If this practice continues, combined with the improved economic expectations due to the return of investments in the oil industry, the exchange rate forecasts at the end of the year will be much lower in reality.

The Caracas Fixed Income Exchange:

OPERATIONS NOMINAL AMOUNT (BS.S) CASH AMOUNT (BS.)

27 9.978.286 9.965.982,39716

Variable Income:

TRANSACTIONS TRADED SECURITIES CASH AMOUNT (BS.)

121 450.540 2.737.564,93

Up: 6

Down: 8

Equals: 11

_______________________________________________________________

For inquiries about our Algo daily entries, please write to : editor@petroleumworld.com

NOTE: We do not recommend investments, we only give our opinions.

For special courses or investment management contact : editor@petroleumworld.com

_________________________________

Raul Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and posted on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

EnergiesNet.com 12 11 2023