Market Report

Building Income:

Week #10 of 2024, infome on ideas for cash flow positive Week.

Relevant Financial Information Update: March 4-8, 2024

1 Macroeconomic Environment:

Week ending:

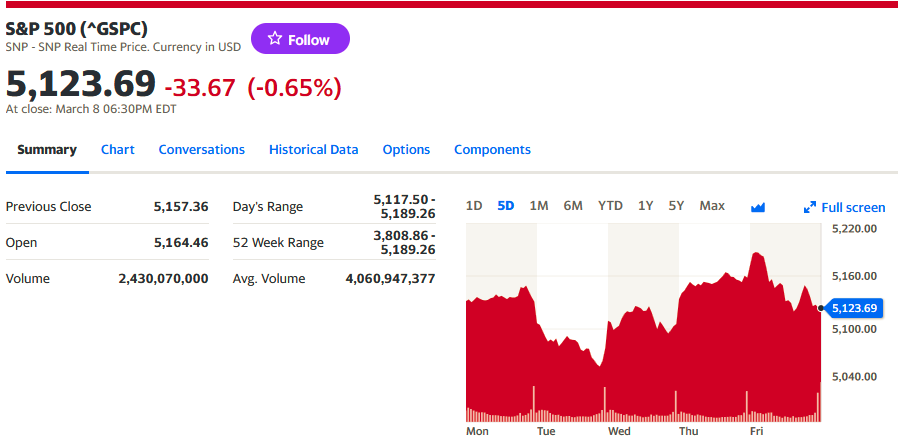

Markets after rallies to record levels entered a phase of price coupling to new realities.

“We’ve seen, within the U.S. market, a broadening of prosperity,” David Donabedian, chief investment officer of CIBC Private Wealth US, told Barron’s , really let’s say this is an enduring bull market, it can’t just be the Magnificent Seven; prosperity has to broaden. And that has happened.”

Stocks were rallying on the latest comments from Powell, who said the Fed “can and will begin” rate cuts this year. Of course, that will ultimately depend on inflation data.

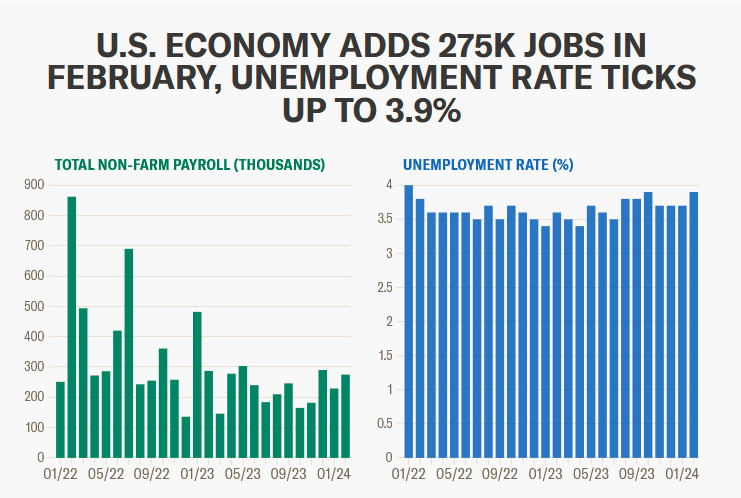

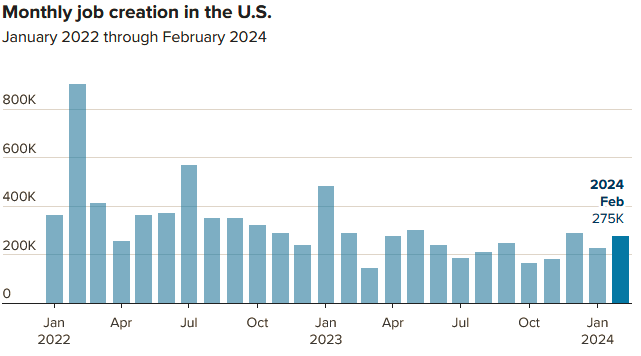

The U.S. economy added 275,000 non-farm jobs in February, a number significantly higher than the 200,000 expected by economists. Meanwhile, the unemployment rate rose to 3.9% from 3.7% in January.

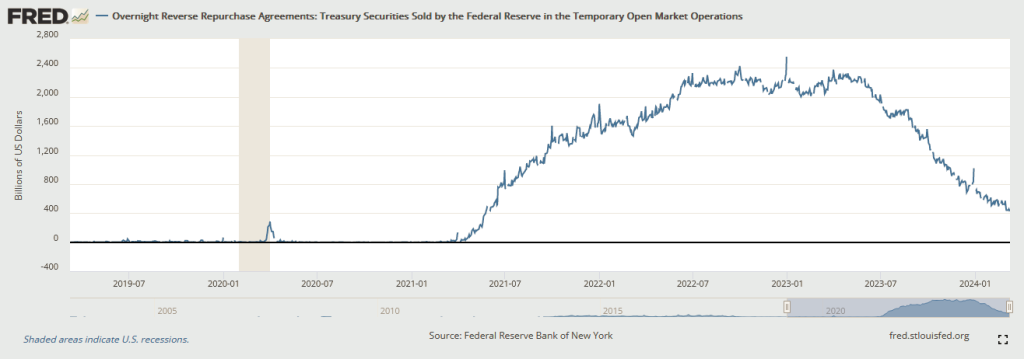

Data as of March 8, 2024 – https://shorturl.at/apG12

Market liquidity remains at healthy levels.

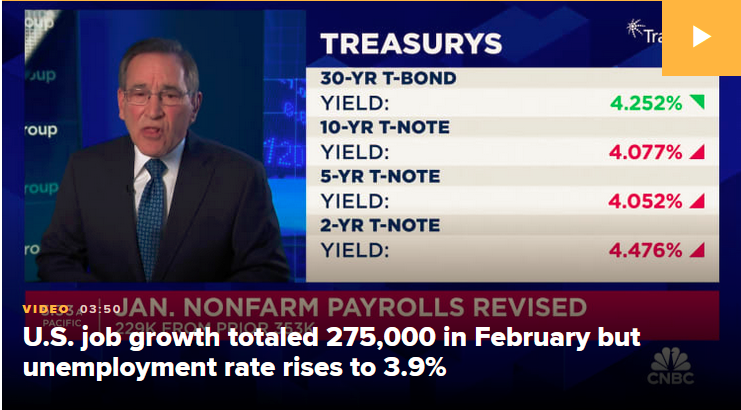

The 10-year bond yield falls and rises in price, in a bullish signal.

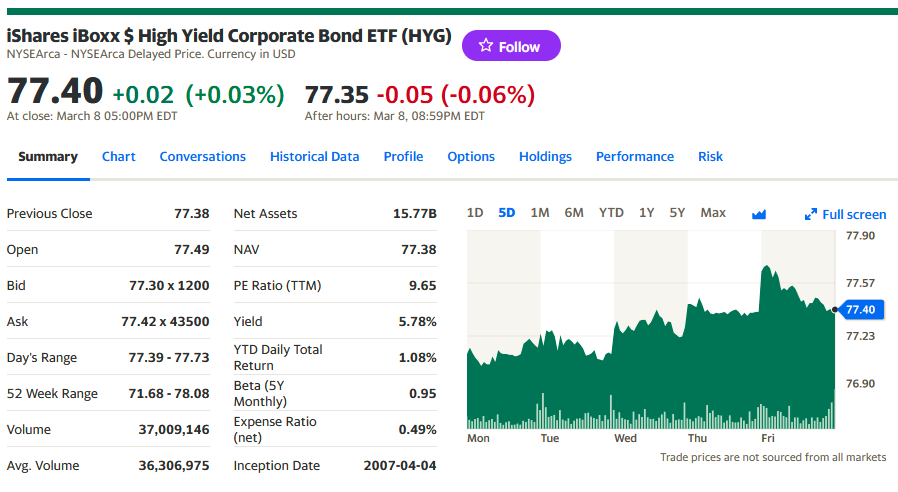

Corporate bonds in sideways mode, with slight price declines.

Next Week

The monthly hard data from the U.S. Department of the Treasury is coming.

CPI or inflation will be announced on Tuesday

PPI or producer inflation on Thursday

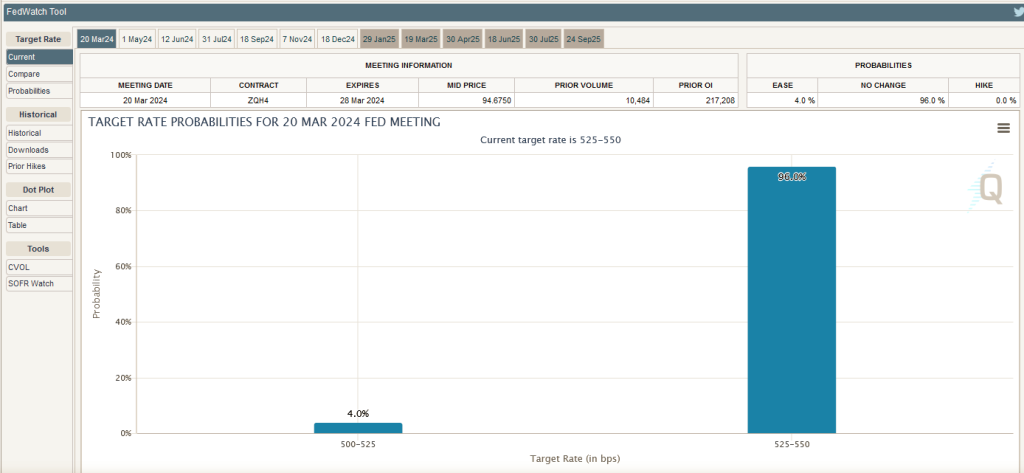

The odds of interest rate hikes are only 4%, versus 96% that they will be maintained or lowered for the March 20 meeting.

CME FedWatch Tool

2 Micro

Crude oil prices down 2.5% to 77.85 , volatility in energy prices.

Market Drives

Oil futures posted weekly losses, with U.S. benchmark prices ending at their lowest since Feb. 26.

Prices extended early Friday losses after U.S. data revealed a bigger-than-expected 275,000 new jobs in February, but also downwardly revised the number of jobs created in January and December. Employment growth in the two months was 167,000 lower than previously reported.

The jobs report had some good news in the nonfarm payrolls report for February, but “hidden in the data” were revisions to the numbers reported for January and December, and an increase in the unemployment rate to 3.9%, said Gary Cunningham, director of market research at Tradition Energy.

“That indicates to many that job certainty is down and that can manifest in less likelihood to take vacations and travel, which in turn indicates lower petroleum demands in the U.S.,” he said.

Overall, oil has been “caught between support from the prolonged output cuts by OPEC+ and some questions on global demands, driven both by the Chinese setting their growth at 5% and fears of the U.S. still not being able to control inflation,” Cunningham told MarketWatch.

U.S. crude production is “strong, which is giving traders pause on just how bullish things can get despite the OPEC+ cuts and the potential for both Iranian and Venezuelan barrels to flow in the near future,” he said.

OPEC+, which comprises members of the Organization of the Petroleum Exporting Countries and their allies, including Russia, produced 41.21 million barrels of oil per day in February, according to latest Platts survey by S&P Global Commodity Insights. February was the second month of the group’s latest voluntary production cuts which were supposed to take approximately 700,000 barrels per day off the market in the first quarter of 2024, the report on the survey said.

However, “the group has yet to deliver on this pledge,” the report said. “The survey showed that OPEC+ countries implementing cuts produced 175,000 [barrels per day] above their combined quotas in February — a compliance rate of 97.8%.”

Over in the U.S., the number of rigs actively drilling for oil fell for the first time in three weeks, down 2 to 504, according to Baker Hughes BKR, -0.75% data. That implies a potential future decline in U.S. output.

Meanwhile, gains in electric vehicles sales in China “caught some eyes, but it isn’t likely to be enough to stem the dragon’s appetite for fuel,” said Cunningham. China’s sales of battery-powered EVs rose 18.2% in January-February, compared with 20.8% for all of 2023, Reuters reported, citing data from the China Passenger Car Association.

Next week in the oil market, “we expect more focus to be on petroleum demand outlooks for the coming summer holiday driving season, but especially here in the U.S. where consumers stayed a bit closer to home last year and we didn’t have gasoline demands as high as expected,” Cunningham said.

Source: MarketWatch.

Price moves

- West Texas Intermediate crude CL00, +0.15% for April delivery CL.1, +0.15% CLJ24, +0.15% fell 92 cents, or 1.2%, to settle at $78.01 a barrel on the New York Mercantile Exchange. Prices for the front-month contract ended nearly 2.5% lower for the week, according to Dow Jones Market Data.

- May Brent crude BRN00, +0.30% BRNK24, +0.30%, the global benchmark, lost 88 cents, or 1.1%, to settle at $82.08 a barrel on ICE Futures Europe, down 1.8% for the week.}

- April gasoline RBJ24, +2.13% lost 1.1% to $2.53 a gallon, down 3.3% for the week.

- April heating oil HOJ24, +0.39% declined by 2% to $2.64 a gallon, for a weekly loss of 2.3%.

- Natural gas for April delivery NGJ24, -2.99% settled at $1.81 per million British thermal units, down 0.7% Friday, for a weekly loss of 1.6%.

Source: MarketWatch.

Bitcoin broke its all-time high and reached 70,000 last Thursday, it showed volatility between 61,000 and 70,000, on the week.

3 Building a long-term portfolio

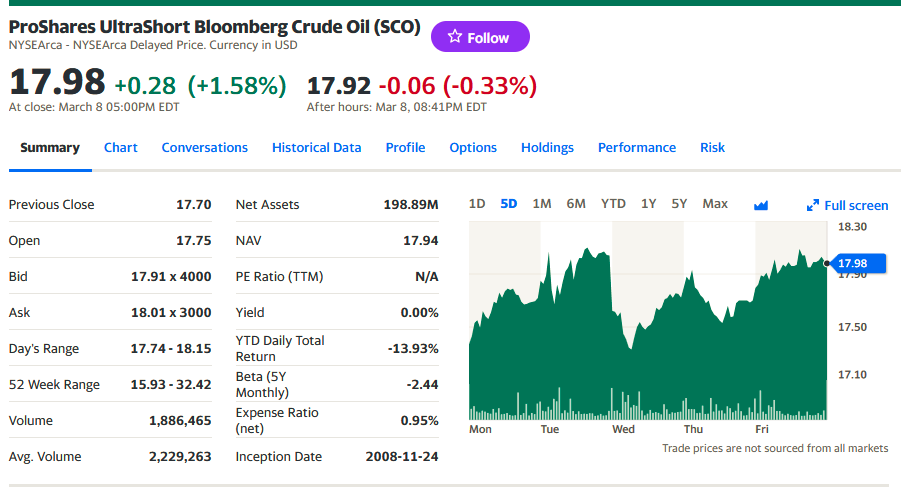

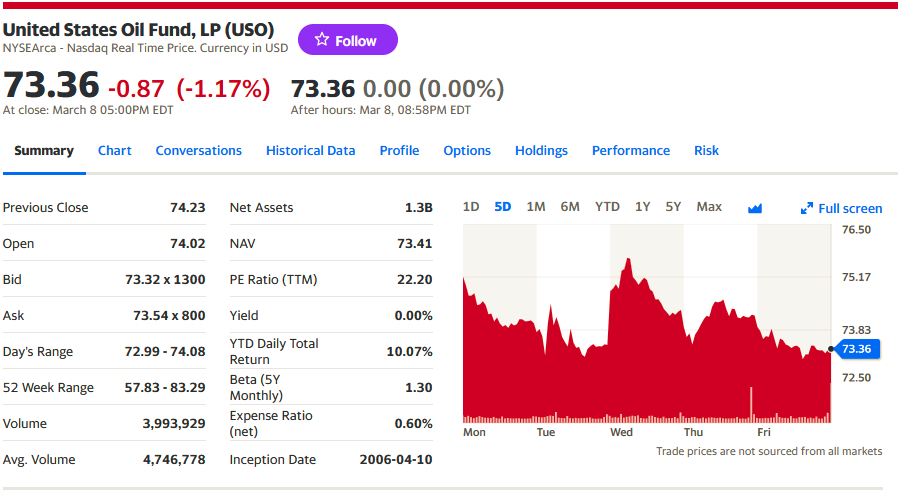

This week the energy ETF markets moved like this:

The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO which works with short crude oil futures contracts, gained 3.5%,

Esta semana los mercados de ETFs de energía se movieron así:

Meanwhile, the United States Oil Fund USO, which contains not only crude oil futures, but also natural gas, diesel and gasoline futures, with less volatility, fell -2.42%.

The arbitrage between the prices of both funds was +1.10% per week.

4 Execution of an algorithm or method to generate cash flow on a long-term portfolio or with money in the account.

Our procedure involves reviewing volumes, volatility, technical analysis on support charts and short and long term resistances.

This is our favorite strategy.

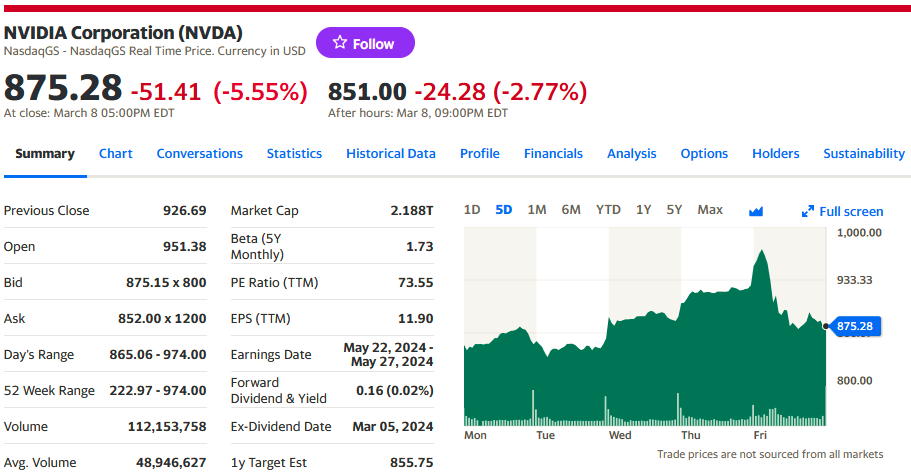

Among the 7 magnificent, NVIDIA stood out with a low of 836 and a high of $972, 130 spread or 15% volatility.

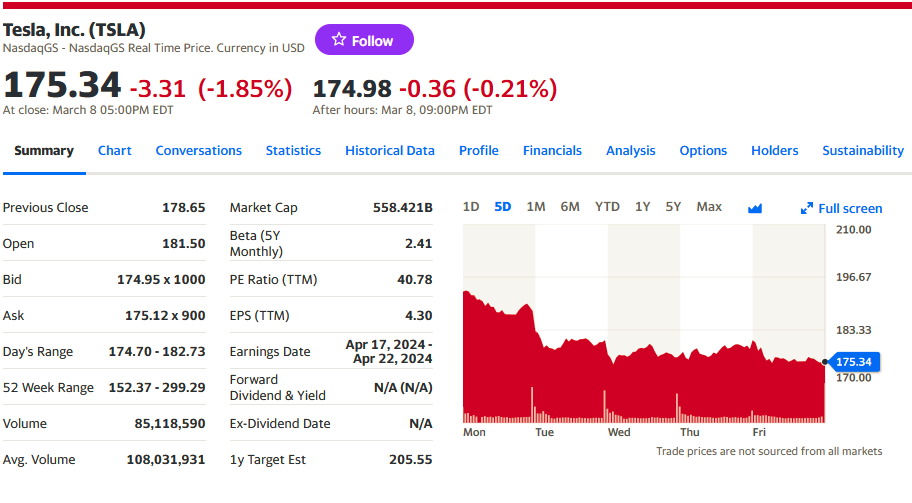

TESLA falls -9.3% on the week victim of multiple reports of electric vehicle price wars and failures in production or shipments from multiple production plants in China, Europe and the Americas.

5 Analysis of previous week’s forecast results.

We will compare and hypothesize with the yields of Oil, Gold, SPY, Crude Oil and the 10 Year Bond.

With inflation data on Tuesday and Wholesale Production on Thursday, comes volatility and an eventual adjustment from historical high prices.

We will use our method for stocks and options in SP500 ranges between 5,000 support and 5180 resistance. Subject to macroeconomic data.

Weekly performance of the US $ 1,000 investment challenge, over 20 weeks:

BAC Bank of America Corporation

100,188

GLDS PDR Gold Shares

198,55

GS The Goldman Sachs Group, Inc.

104,96

TSLA Tesla, Inc.

100,8

SPY SPDR S&P 500 ETF Trust

269,4

QQQ Invesco QQQ Trust

108,46

META Meta Platforms, Inc.

117,6

Amount $ 999,958

Yield 23.87%.

The portfolio is yielding 23.87%. Slightly down.

Venezuelan market

Price of the dollar vs Bs

BCV : Bs 36.19

Unofficial : Bs 38,12

NOTE: We do not recommend investments, we only give our opinions.

For special courses or investment management contact us at : Instagram @coachraultorrealba or email : editor@petroleumworld.com

_

Raúl Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and posted on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

Energiesnet.com 03 09 2024

_____________________________________________