Market Report

Update of material financial information.

December 10, 2023

1 Macroeconomic Environment:

Week ending:

In addition to inflation and economic growth, the other data underpinning the fundamentals of the economy is employment.

Well, in the week ending the Labor Department released November’s unemployment rate which dropped to 3.7% from October’s 3.9%, the highest level in nearly two years.

Additionally, average hourly earnings rose 0.4% after rising 0.2% in October, less productivity.

The markets nevertheless kept rising, showing optimism that there will be no more interest rate hikes and even begin cuts sometime in 2024.

In general there is a lot of encouragement among investors.

Stocks in the SP500 index are up 0.8%:

And, very importantly , broke the 4,600 resistance.

Next Week

Two-day meeting of Federal Reserve governors, Fed. Results come out Wednesday at 2 pm.

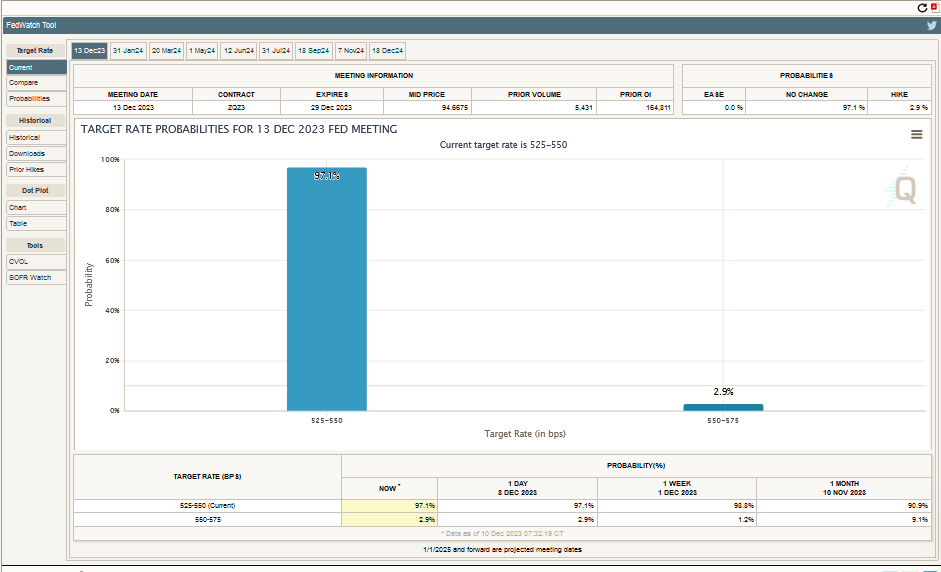

For the Fed’s upcoming meeting on monetary issues, expectations remain high that interest rates will remain unchanged for 3 days from now.

97 what not vs. 3 what ifs, expectations for rate hikes this week.

CME FedWatch Tool

2 Micro

2 Micro

CBOE Volatility Index

VIX:Exchange

Market price volatility continues to decline, i.e. the spring is shrinking.

Futures contracts are at the limits of upward resistance.

S&P 500 Fut (Mar′24)

@SP.1:CME:Index and Options Market

The current market, or cash, broke the 4,600 resistance and maintains support at 4,540.

Oil prices fell -2.54%.

3 Construir un portafolio a largo plazo

Los dos Fondos concentrados en energía que seguimos todas las semanas, siguieron la tendencia del activo subyacente , Crude Oil.

Esta semana los mercados de ETFs de energía se movieron así:

The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO, which works with short crude oil futures contracts, is up +5.24% in a week, with a lot of volatility.

Meanwhile, the United States Oil Fund USO, which contains not only crude oil futures, but also natural gas, diesel and gasoline futures, with less volatility, loses -2.94%.

Considerable arbitrage between the prices of both funds. A +2.3% weekly difference.

4 Execution of an algorithm or method to generate cash flow on a long-term portfolio or with money in the account.

We look at volumes, volatility, technical analysis on short and long term support and resistance charts.

Our favorite strategy.

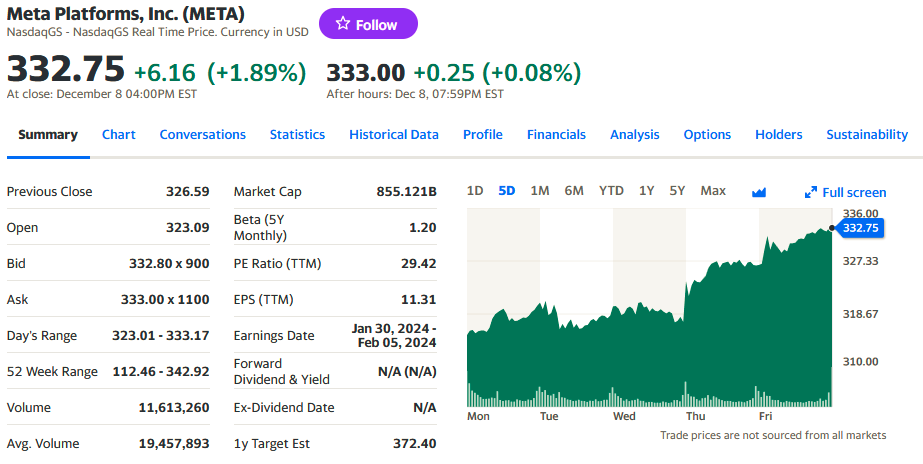

The Magnificent 7, AAPL, TSLA, MSFT, GOOGL, AMZN and META, almost unanimously up +1.45% . META, formerly Facebook, after dropping -3.96% the previous week, this week rises +2.44%, which is usually the case in these high Beta stocks.

5 Analysis of previous week’s forecast results

As volatility falls, quoted asset prices strengthen…

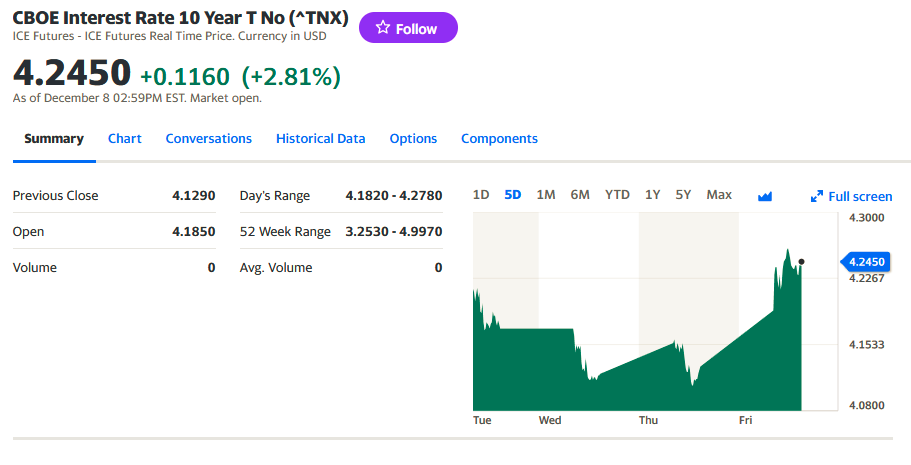

10-year bond, up modestly, there were no alarms in the weekly auctions.

The assumptions we left here last week are fulfilled. Market without firm conviction up or down.

Sideways.

Gold -1.46%.

OIL – 0.5%.

10 Year Bond +0.7% SPY

SPY +0.8%.

And if we look at Bitcoin , it also behaves like this.

6 Forecast for the week ahead:

We will compare and hypothesize on the yields of oil , Gold, the SPY, crude oil and the 10-year Bond.

The week of the FOMC monetary committee meeting has arrived.

Tuesday will be consumer price (inflation) day, Wednesday producer inflation .

Wednesday will form a trend that will mark the close of 2023 and early 2024 for all markets.

The SP500 will have pre-meeting volatility, Already above 4,600, it will now look for the next resistance seen in 2021 of 4,700. As changes in interest rates affect the financing prices of all assets, we will see changes in prices.

Our portfolios, having seen trends in employment, certainty, volumes and volatility, we believe the upside will continue. Only a surprise at Wednesday’s meeting will reverse that trend.

We will use our method in ranges of 4,500 support and 4700 resistance on the SP500 for entries and exits. Watch for.

Weekly performance of the US $1,000 investment challenge, over 12 weeks:

The portfolio is yielding 10.67%, still up but less strongly, given the sideways movements. It is equivalent to 45.90% annualized. We are helped by the upside, the investment is of only purchases in growth instruments. We will soon change the portfolio by adding assets that point downwards, which is predictable in the markets and will happen at some point.

Chart of our portfolio since its inception 12 weeks ago.

Venezuelan market

Price of the dollar vs Bs

BCV : Bs 35.6 +0.09

Unofficial : Bs 37.68 +0.68

Another modest slippage of the two exchange rates.

It seems that the forecasts of the dollar at Bs 62 are not going to happen.

Venezuela registered in November an inflation of 3.2%, the lowest in a month so far this year, and accumulates 182% in 2023, informed this Friday the Central Bank (BCV).

Crucial moment, in order to have an inflation in 2024 lower than 100% or 50%, several political and economic measures must be taken.

Caracas Stock Exchange

Equities:

TRANSACTIONS NOMINAL AMOUNT (BS.S) CASH AMOUNT (BS.)

109 1.303.792 533.911,36

4 Up

15 Down

5 Equal

Fixed Income:

TRANSACTIONS SECURITIES TRADED CASH AMOUNT (BS.)

8 4.785.944 4.784.772,11208

For inquiries about our Algo daily entries, please write to : editor@petroleumworld.com

NOTE: We do not recommend investments, we only give our opinions.

For special courses or investment management contact : editor@petroleumworld.com

Raúl Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and posted on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

EnergiesNet.com 12 10 2023