Week #52 of 2023, Report on ideas for positive cash flow.

Market Report

Update on relevant financial information.

December 24, 2023

1 Macroeconomic Environment:

Week ending:

Santa Claus rally almost concluding.

After the rally gains are already being taken and the market is preparing for a 2024 expectations.

2023 Economic Calendar

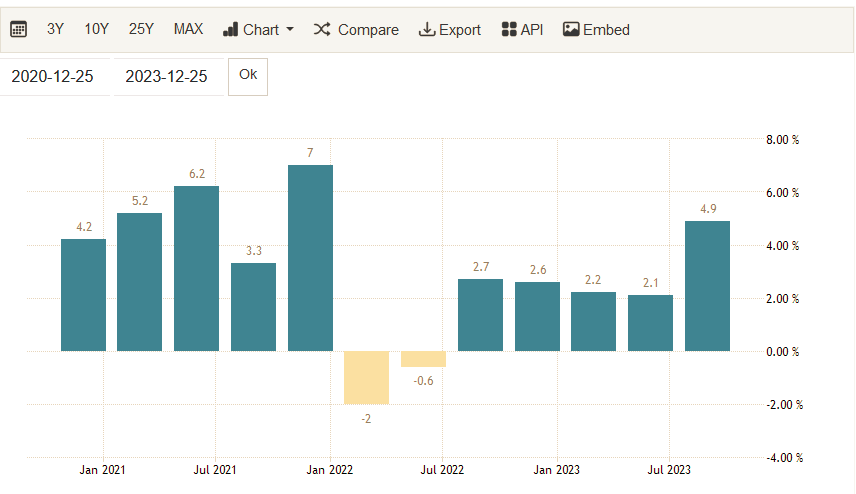

The housing market looks soft, with better tendency due to the lull in interest rates.Gross Domestic Product declined slightly to 4.9 in November from 5.2 in October.

United States GDP Growth Rate

Other indicators were in line with analysts’ forecasts.

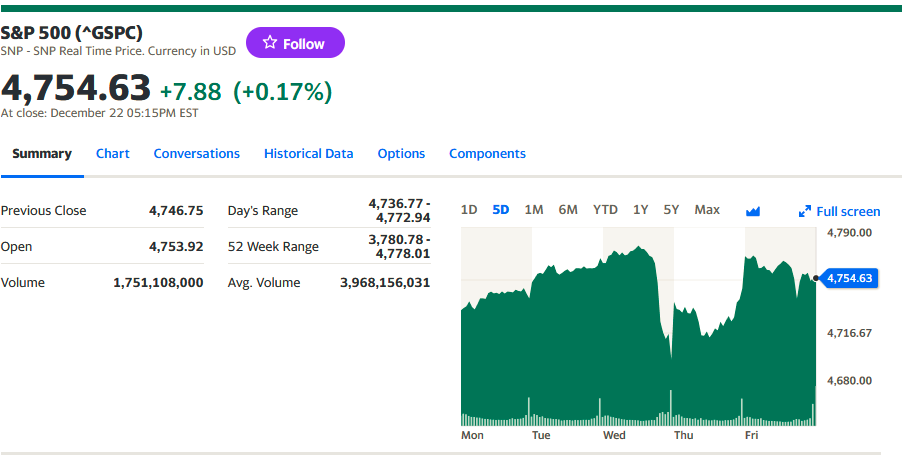

Stock market last week.

Reverse Repos, with which the FED injects liquidity into the system, remain at optimal levels, resulting in volumes better than the average traded in recent months.

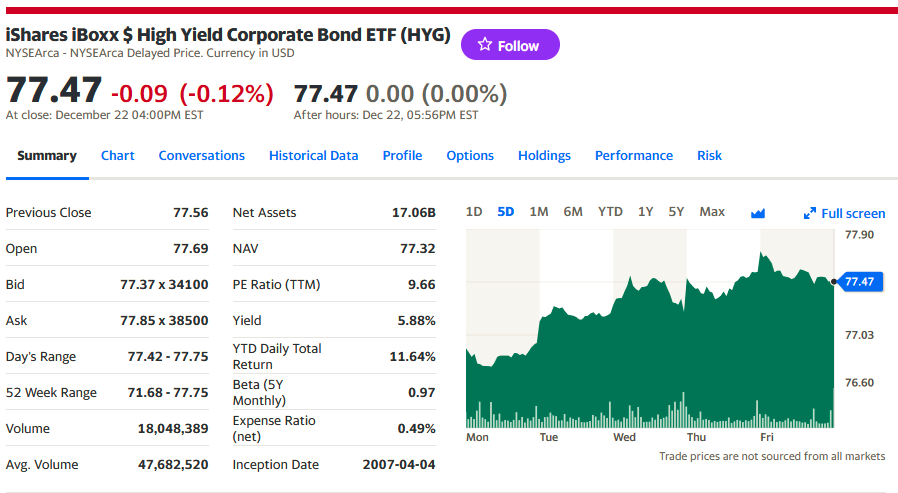

The Corporate Bond ETFs are rising in price, for the second week, lowering yields as seen in the chart of the week:

The Apple Watch was at the center of a legal controversy over patents, which forced the company to redesign and delay the release of the latest model of the watch. The stock lost only 0.47% , watch lovers supported prices in the week.

Stocks in the SP500 index are up 0.42%:

It remains above the 4,700 support.

Next Week

Housing data will be released by the Federal Housing Finance Agency, the home price index, pending home sales, wholesale and retail inventories, natural gas, and the PMI which measures the movement of production in the important Chicago area.

Commercial bank assets and liabilities and the Group of 20 report.

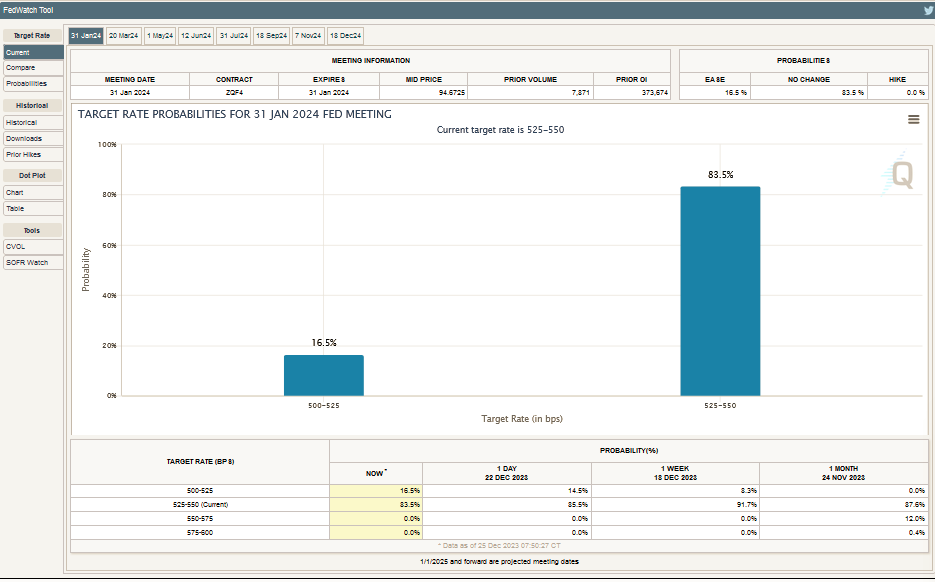

The next Fed meeting on monetary issues will be in 38 days, on January 23, 2024. 85.5% that they will not rise and 14.5% that they will, expectations today.

CME FedWatch Tool

2 Micro

Market price volatility rose 4.54% , a natural after a drop of almost 80% since the beginning of November. Monitoring this VIX index, which touched the supports of 12 and is a bounce signal, remembering that when this VIX bounces the markets go down in price.

Cboe

The VIX® Index

Oil prices rose 2.16% on the week.

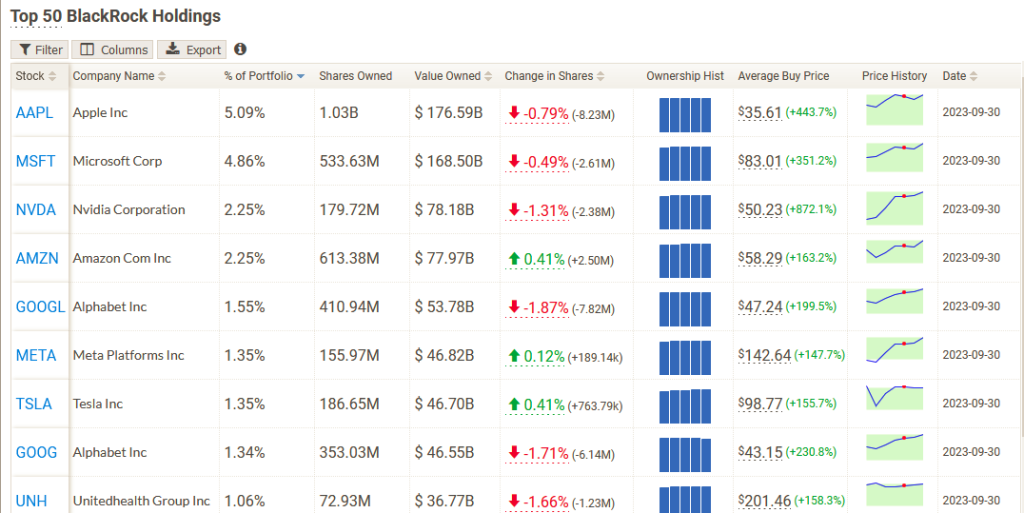

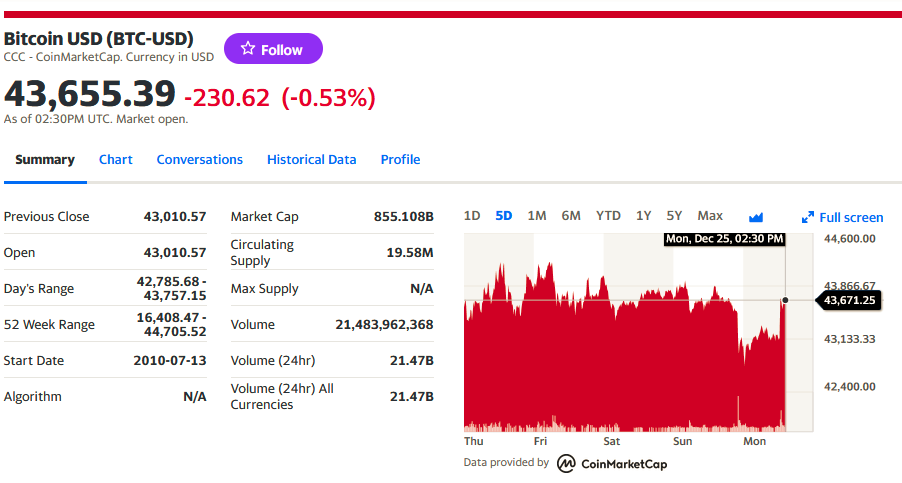

It is worth noting in this report that the price of Bitcoin, the most popular crypto asset rose 160% in 2023, driven by expectations of approval of the first fund or ETF by the US securities authorities in early January 2024. It is relevant to say that behind this approval are none other than Black Rock, the fund that controls more than 10 trillion dollars in large assets.

In addition there are more than 9 managers of the most important US funds such as the brothers Tyler and Cameron Winklevoss (the twin co-founders of Facebook).

On October 23, prices jumped when the ETF marked IBTC containing Bitcoin was listed on the Depository Trust and Clearing Corporation, the step prior to any SEC approval to begin trading on the stock exchanges.

3 Building a long-term portfolio

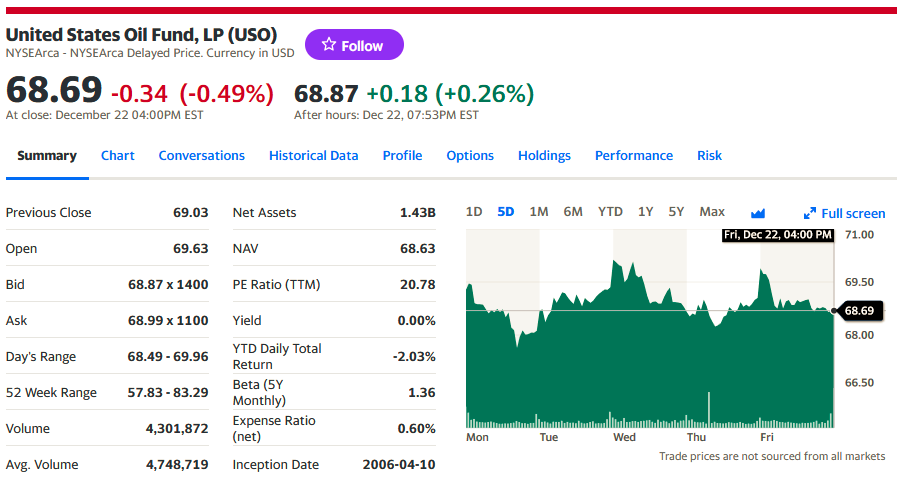

The two energy-focused funds that we follow every week followed the trend of the underlying asset, oil.

This week the energy ETF markets moved like this:

The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO which works with short crude oil futures contracts, is up +3.60% in one week, with volatility.

Meanwhile, the United States Oil Fund USO, which contains, in addition to crude oil futures, futures in natural gas, diesel and gasoline, with less volatility, remained stable as the underlying asset declined by 0.85%.

The arbitrage between the prices of the two funds was +2.75% weekly difference.

4 Running an algorithm or method to generate cash flow on a long-term portfolio or with money in the account.

We look as we usually do at volumes, volatility, technical analysis on short and long term support and resistance charts.

This is our favorite strategy.

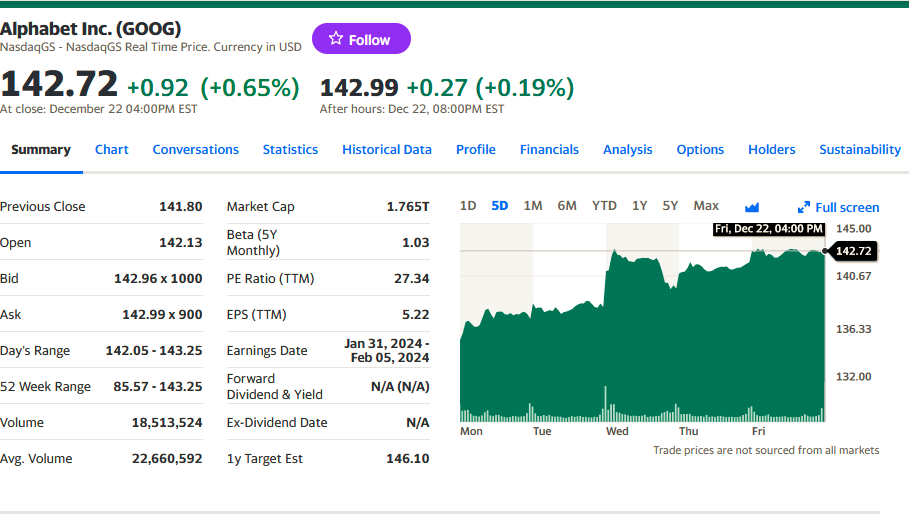

The Magnificent 7, AAPL, TSLA, MSFT, GOOGL, AMZN and META, are up +4.03%. All 7 improved in price, with GOOGLE adding 7.30% over the week to its

5 Analysis of results from the previous week’s forecast

Positive so far.

The SP500 breaking the 4700 resistance, held a range up to 4760.

Volatility rose as already indicated.

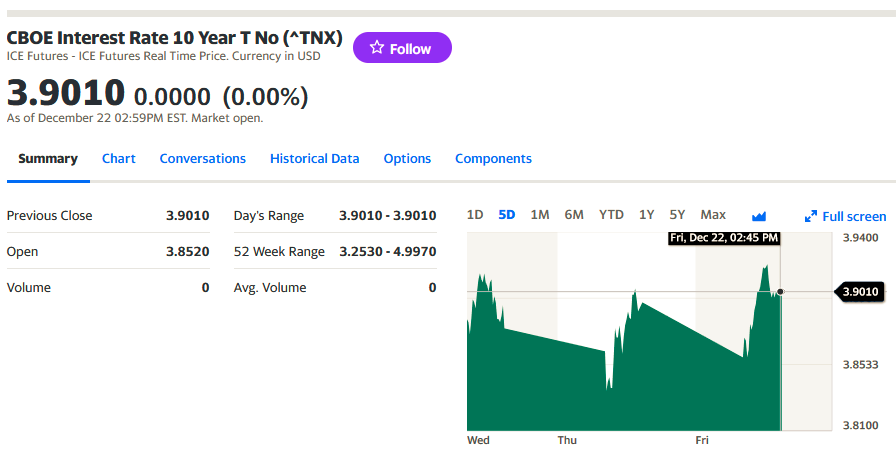

The 10-year bond yield declines by 0.50% and as a consequence its price rises to 3.90.

Gold +1,32%

OIL +2,16%

10 Year Bond +0,50%

SPY +0,43%

Bitcoin , se eleva un 3% en la semana. Sigue su Rally.

6 Forecast for the week ahead:

We will compare and hypothesize on the yields of oil , Gold, the SPY, crude oil and the 10-year Bond.

Liquidity continues to enter the market.

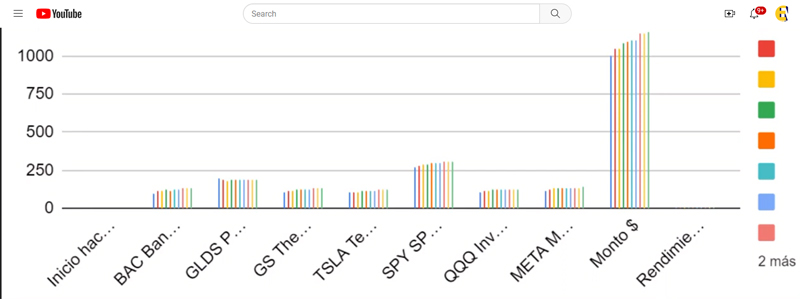

Weekly performance of the US $ 1,000 investment challenge, in 14 weeks:

The portfolio is yielding 15.81%, still rising. Equivalent to 61.14% annualized. This does not mean that it will continue to rise in the future, it is just today’s snapshot. Soon, at the beginning of 2024, we will change the portfolio by adding assets that point downward, which is predictable in the markets and will happen at some point.

As of November 19, 2023

Started 9 weeks ago

Venezuelan market

The license granted to Trinidad for the exploitation of natural gas by Dutch-English Shell, for 30 years, will bring benefits to the country in the medium term.

Price of the dollar vs Bs

BCV : Bs 35,78 +0,14

Unofficial : Bs 38.14 +0.70

Another modest slide in the official exchange rate. The parallel also rises. the year ends, the public remains alert.

We insist that the December inflation to be published in January should give a big surprise, we see it much lower than that of November.

La Bolsa de Caracas

Renta Variable:

NOMINAL OPERATIONS NOMINAL AMOUNT (BS.S) CASH AMOUNT MONTO (BS.)

99 278,600 282,398

Fix Income

TRANSACTIONS SECURITIES TRADED AMOUNT IN CASH (BS.)

5 17,495,000 17,494,372,000

Watch video (Spanish): Reporte Financiero: +Flujo de Caja Positivo (24 de diciembre, 2023) – Raúl Torrealba Ramos (Audio)

_______________________________________________________

For inquiries about our Algo de entradas diarias, please write to : editor@petroleumworld.com

NOTE: We do not recommend investments, we only give our opinions.

For special courses or investment management contact : editor@petroleumworld.com

_______________________________________________________

Raúl Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and posted on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

Translated by Elio Ohep, Editor EnergiesNet

EnergiesNet.com 12 24 2023