Market Report

Building Income:

Week #8 of 2024, Report on ideas for positive cash flow.

Update on relevant financial information.

February 19-23, 2024

1 Macroeconomic Environment:

Week ending:

This week’s Fed meeting minutes revealed no more than what some officials have been stating, that there is no rush to lower interest rates, that they do not see indicators showing an economy poised for cuts in the near term.

Markets attentive to changes in the downward direction of inflation, there were no contrary signals.

However, the market was very active since Wednesday when the leading Artificial Intelligence company NVDIA Corporation became the third company on Wall Street worth more than 3 trillion dollars.

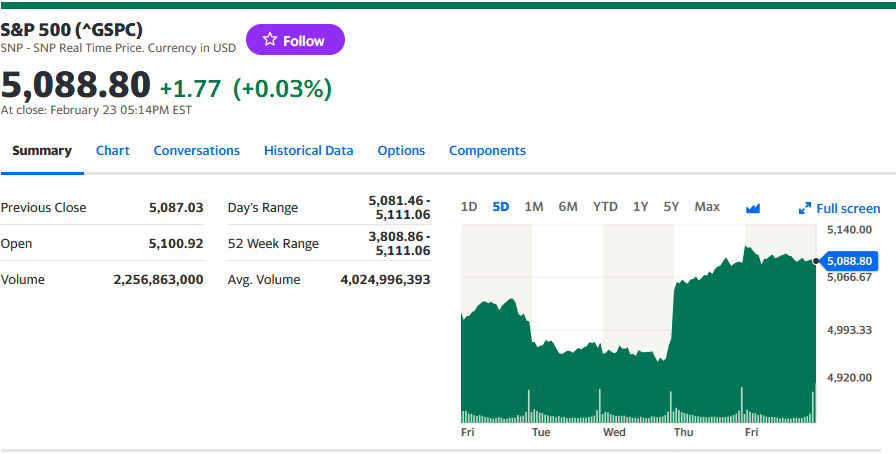

All indices aligned with the IA leader’s results and the SP 500 closes higher on the day.

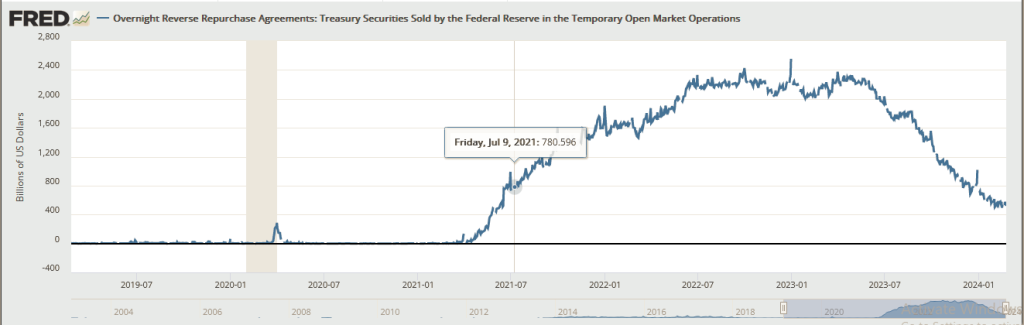

Less liquidity collected by the Fed through Reverse Repos.

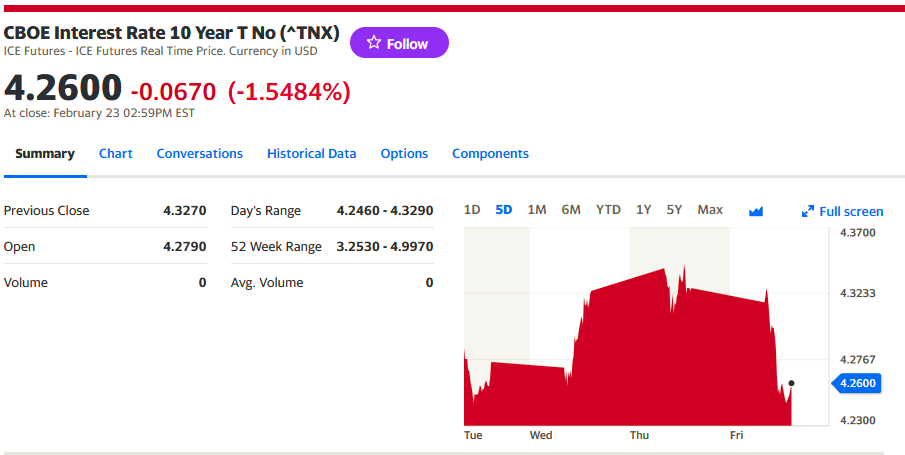

The 10-year bond is little changed.

Corporate bonds are up almost 1% in harmony with stocks and the rest of the market.

Next Week

Some technical retracement or pullback is expected after this week’s record highs.

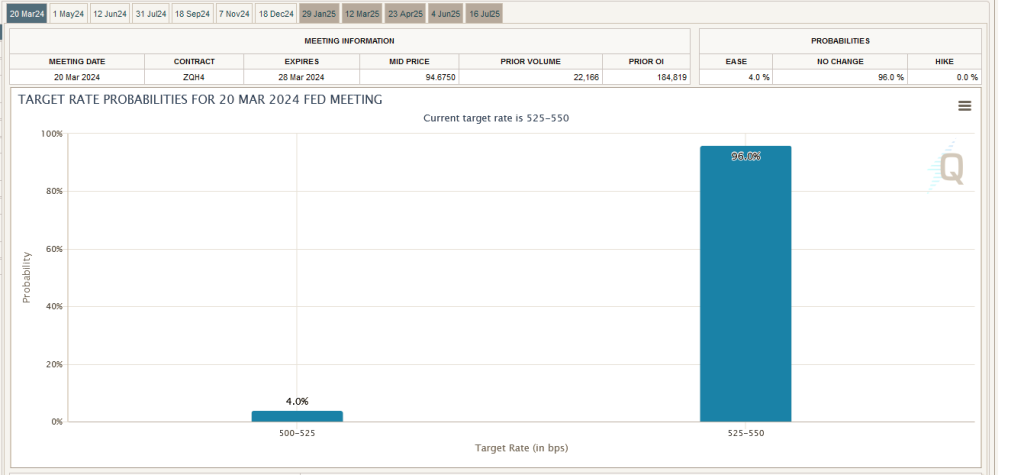

Expectations of rate hikes are becoming more and more distant in light of the probability chart consulting analysts.

CME FedWatch Tool

2 Micro

The SP500 will move in ranges from 5,120 high to 5,050 low, and may approach 5,000.

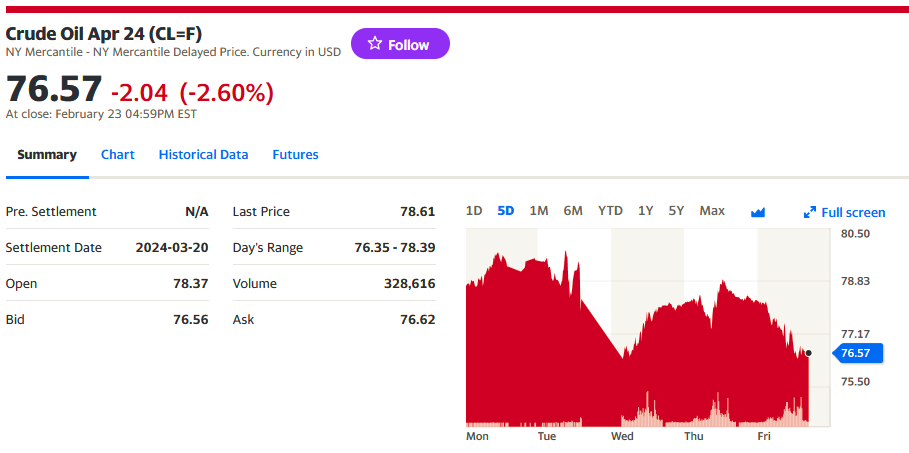

Oil barrels fell in price

Crude oil prices post first weekly decline in three weeks

Market drivers

Fed Gov. Chris Waller late Thursday said there was “no rush” to cut interest rates following stronger-than-expected inflation and economic data since the beginning of the year. Waller and other Fed officials have made a concerted effort in the past few weeks to brush back Wall Street’s previous forecasts for rate cuts as early as March.

Strong data “provides the Fed with greater leeway to sustain its restrictive monetary policy for an extended period. This dynamic constrains economic growth and suggests reduced future oil demand, contributing to the price decline,” said Ricardo Evangelista, senior analyst at ActivTrades, in a note.

“Nonetheless, the downside for the barrel’s price remains limited by supply-side concerns stemming from ongoing geopolitical turbulence in the Middle East,” he said.

In the U.S., however, a rise in the number of active rigs drilling for oil pointed to the potential for further gains in already record-high domestic production.

Baker Hughes Co. BKR, +2.36% reported Friday that the number of U.S. oil rigs climbed by six this week to 503, following a decline of two oil rigs the week before.

Overall this week, analysts have been “chasing price action rather than forecasting it,” because of “fluctuating price action without clear direction,” Stephen Innes, managing partner at SPI Asset Management, told MarketWatch.

‘Factors influencing oil markets include the macroeconomic landscape in the U.S., China’s recent Loan Prime Rate (LPR) cut, tight market dynamics versus OPEC spare-capacity concerns, rising U.S. oil production versus OPEC compliance, and ongoing geopolitical tensions in the Middle East.’ — Stephen Innes, SPI Asset Management

“The intricate web of factors influencing oil markets includes the complex … macroeconomic landscape in the United States, China’s recent Loan Prime Rate (LPR) cut, tight market dynamics versus OPEC spare-capacity concerns, rising U.S. oil production versus OPEC compliance, and ongoing geopolitical tensions in the Middle East,” he said. “So, the resulting headline noise from these shifting narratives creates far too many moving pictures to have a salient short-term view of the market.”

Last week, concerns over rising inventories, elevated inflation and disappointing U.S. economic indicators capped oil prices and overall risk sentiment, Innes said.

This week, however, some optimism in the market is partly attributable to robust economic data and a “broader risk-on sentiment.” So aside from unforeseen supply shocks or an escalation in the Middle East that throttles production, “perhaps we can stay rangebound” into the second half of the year, he said.

Price action Friday, February 23, 2024

West Texas Intermediate crude for April delivery CL00, -2.60% CL.1, -2.60% CLJ24, -2.60% fell $2.12, or 2.7%, to settle at $76.49 a barrel on the New York Mercantile Exchange. Front-month contract prices saw a 2.5% weekly fall and settled at their lowest level since Feb. 8, according to Dow Jones Market Data.

- April Brent crude BRN00, -0.06% BRNJ24, -0.05%, the global benchmark, lost $2.05, or nearly 2.5%, at $81.62 a barrel on ICE Futures Europe. Brent was down 2.2% for the week, ending at its lowest level since Feb. 14.

- March gasoline RBH24, -2.61% shed 2.5% to $2.28 a gallon, ending 2.5% lower for the week.

- March heating oil HOH24, -2.14% declined by 2.3% to $2.69 a gallon, losing 4.2% for the week.

- Natural gas for March delivery NGH24, -8.60% settled at $1.60 per million British thermal units, down nearly 7.5% Friday to post a weekly loss of 0.4%.

Fuente: MarketWatch

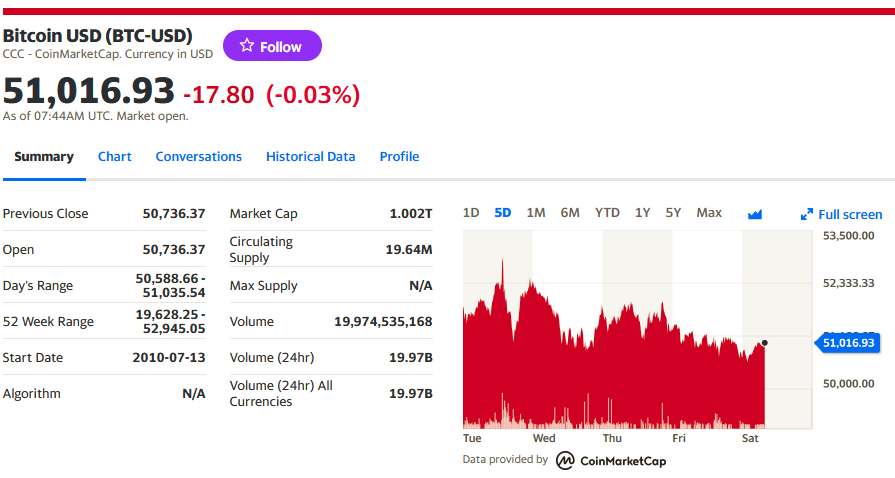

Bitcoin fell 1.9% in the week.

3 Building a long-term portfolio

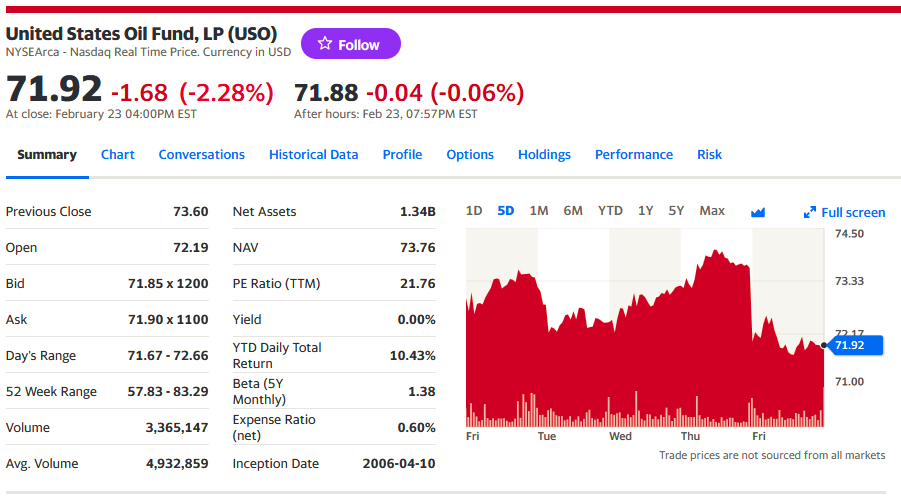

This week the energy ETF markets moved like this:

The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO which works with short crude oil futures contracts, gained -2.2% for the week,

Meanwhile, the United States Oil Fund USO, which contains not only crude oil futures, but also natural gas, diesel and gasoline futures, is up +1.40%, contrary to the underlying assets.

The arbitrage between the prices of the two funds was +1.50% weekly difference.

4 Execution of an algorithm or method to generate cash flow on a long-term portfolio or with money in the account.

Our procedure involves reviewing volumes, volatility, technical analysis on short and long term support and resistance charts.

This is our favorite strategy.

The Magnificent 7, which lead the stock indices with more than 60% due to their traded volumes, were led by NVDIA which ended up 8% on the week . It becomes the leader in Artificial Intelligence and the third company with a capitalization of more than $3 trillion next to Apple and Microsoft.

5 Analysis of previous week’s forecast results.

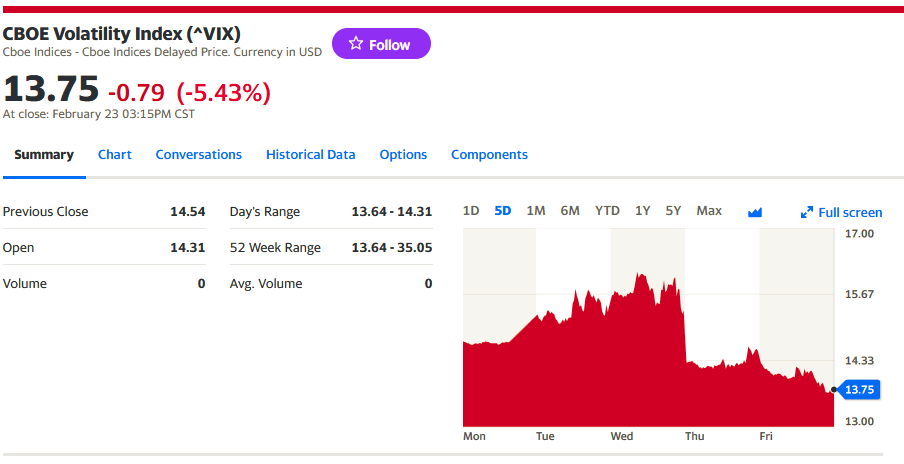

Volatility , VIX with less turbulence, made a high of 16.12 on Wednesday and a low of 13.70 today Friday.

6 Forecast for the week ahead:

We are back to hypothesizing with yields on oil , Gold, SPY, crude oil and the 10-year Bond.

No big load on the economic data, but keep an eye on it.

We will use our method for stocks and options in SP500 ranges of 4,900 support and 5120 resistance .

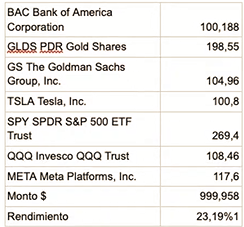

Weekly performance of the US $ 1,000 investment challenge, in 19 weeks.

Yield 23.19%.

The portfolio is yielding 23.19%, with the IA push.

Current amount at $ 1,231.83

Venezuelan Market

VenAmCham Survey: Executives Expect 95.48% Inflation and 3.52% Economic Growth by 2024

Ten banks granted almost 92% of loans by the end of January

Banco de Venezuela (BDV), BBVA Provincial and Banesco maintained their leadership in loan portfolio ranking.

The reserve requirement deficit has been maintained due to the liquidity restriction.

Price of the dollar vs Bs

BCV : Bs 36.29

Unofficial : Bs 38.42

NOTE: We do not recommend investments, we only give our opinions.

For special courses or investment management, please contact us at : Instagram @coachraultorrealba or email : editor@petroleumworld.com

___________________________________________

Raúl Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and posted on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

Energiesnet.com 02 24 2024