Market Report

Week #2 of 2024, Report on ideas for positive cash flow.

Update on relevant financial information.

January 8-12, 2024

1 Macroeconomic Environment:

Week ending:

Positive data , unsettled markets.

The annual CPI declined to 3.9, indicating a continued price deceleration. Although it rose 0.3 in December, the trend line remains downward.

PPI was also in line with expectations.

So what’s going on?

Here we elaborate.

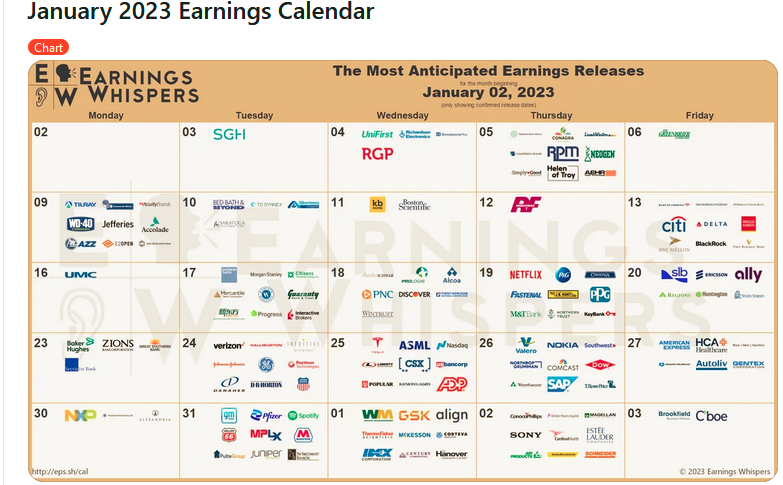

Banks like JP Morgan, Bank of America, Wells Fargo, Citibank started with quarterly earnings data. On average with negative averages especially in the forecasts for the next quarters.

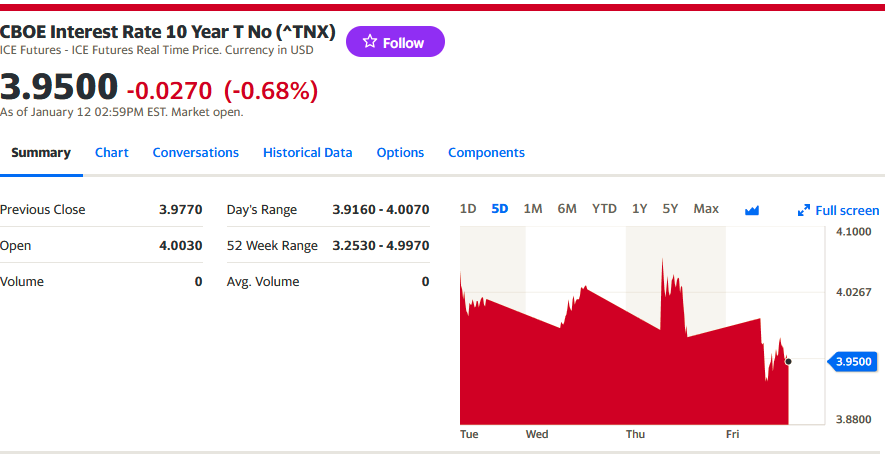

This fact confirms the thesis of the lowering of interest rates for this year 2024, since at lower rates, bank profits tend to be reduced and the opposite when they rise.

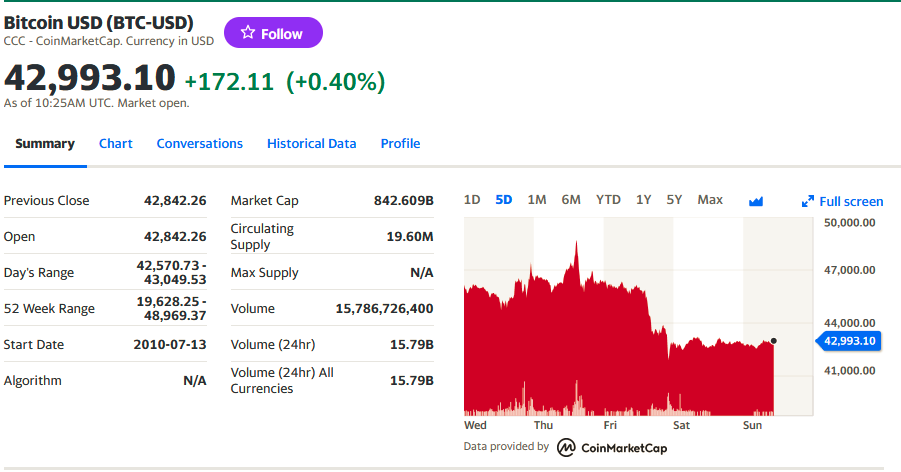

Bitcoin ETFs approved

How many BTC circulate daily?

According to Bitcoin network every day between 3 and 4 million cryptocurrencies are traded in the markets, the asset that supports the 11 approved Funds.

Source: Bloomberg https://www.publish0x.com/cryptobyte/all-btc-etfs-approved-next-week-xqqqnpe

Reverse Repos, with which the FED injects liquidity into the system, dropped to 603,000, in the second week of the year.

Corporate Bonds ETF, HYG rose 1%, in line with the downward trend in interest rates.

Market liquidity continued to decline, authorities control money in circulation to avoid inflation.

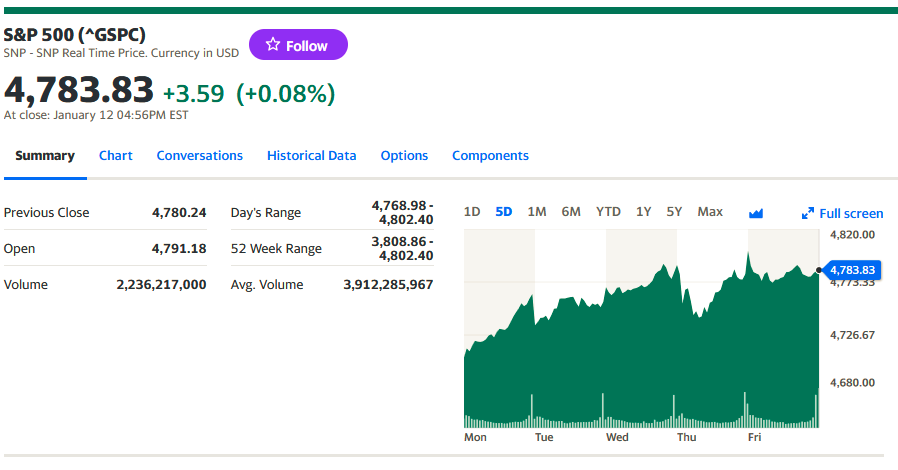

SP500 price range was 4783 high and 4706 low.

Next Week

Retail sales data, the Fed’s beige book , and prices of imported goods among other indicators are shown.

Business Inventories 10:00 AM ET – – – – – -0.1% – –

Capacity Utilization 9:15 AM ET – 78.9% 78.8% 78.8% – 78.8% –

Export Prices 8:30 AM ET – – – – -0.9% – –

Export Prices ex-ag. 8:30 AM ET – – – – -1.0% –

Fed Beige Book 2:00 PM ET – – – – – – – – – – – Import Prices 8:30 AM ET – – – -0.9% – Export Prices ex-ag.

Import Prices 8:30 AM ET – – – – – -0.4% – –

Import Prices ex-oil 8:30 AM ET – – – – – 0.2% –

Industrial Production 9:15 AM ET – 0.1% -0.1% 0.2% – – – 0.2% –

MBA Mortgage Applications Index 7:00 AM ET – – – – – – – – 0.2% –

NAHB Housing Market Index 10:00 AM ET – 40 38 37

Retail Sales 8:30 AM ET – 0.5% 0.4% 0.3% 0.3% – – – NAHB Housing Market Index

Retail Sales ex-auto 8:30 AM ET – – – – – 0.2% – –

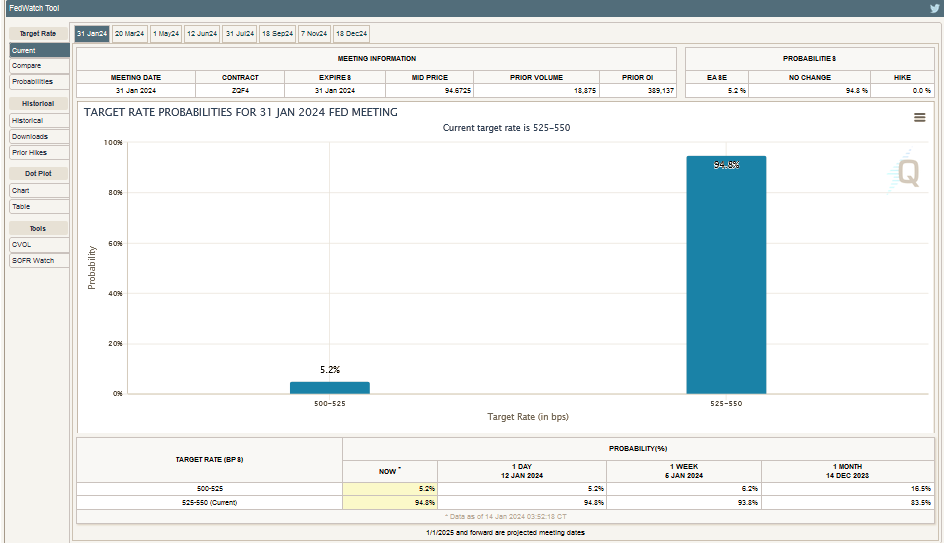

The Fed’s next monetary policy meeting is less than 18 days away on January 31, 2024.

94% what won’t go up and 6% what will, expectations today.

CME FedWatch Tool

2 Micro

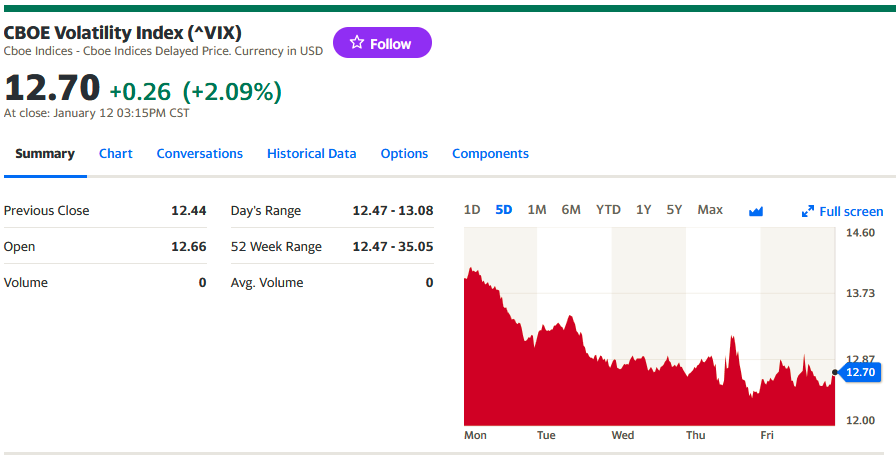

Market price volatility fell to 12.70, making Waves between 12.2 and 13.5.

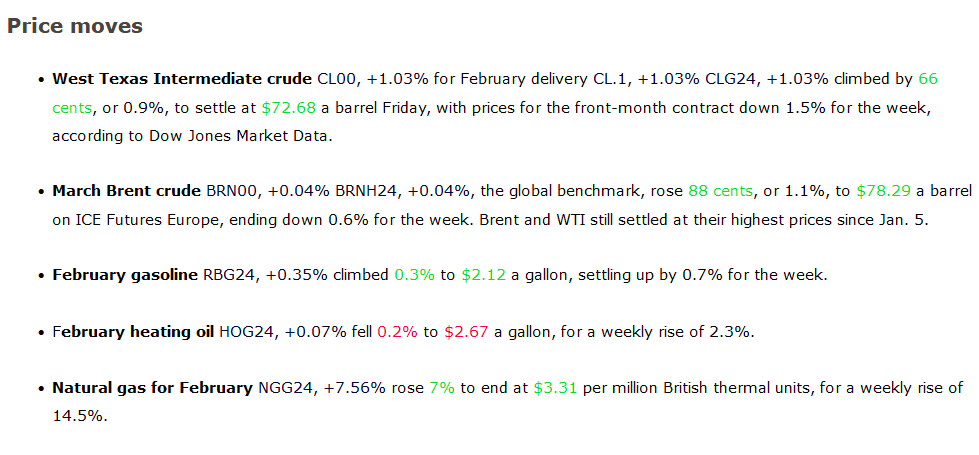

Oil prices in sideways mode on week at 72.76

This week oil prices settled Friday at their highest level in a week after the U.S. and U.K. carried out airstrikes against Houthi rebel targets in Yemen.

Current prices “do not reflect a geopolitical risk premium, so prices could rise to above $80 a barrel should tensions in the Middle East continue to escalate,” Rob Thummel, senior portfolio manager and managing director at Tortoise, said in a comment to MarketWatch.

U.S. benchmark prices (WTI bench mark) remain below that key level, but global benchmark crude hit highs above $80 during Friday’s session.

Natural gas futures rose nearly 15% on the week as forecasts for winter storms continue to boost the demand outlook for the commodity.

Oil Prices Close, Friday, January 12, 2024

Bitcoin lost 7.67% on the week, knocking down multiple thoughts that with the approval of ETFs the price was going to explode higher.

We think it is best to wait until the picture is clear with Bitcoin ETFs.

3 Build a long-term portfolio

The two energy concentrated Funds that we follow every week followed the trend of the underlying asset , oil.

This week the energy ETF markets moved like this:

The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO which works with short crude oil futures contracts, lost -5.5% in one week, on less volume.

Meanwhile, the United States Oil Fund USO, which contains, in addition to crude oil futures, futures on natural gas, diesel and gasoline, with less volatility, rose as did the underlying assets, up +3.43%.

The arbitrage between the prices of both funds was +2.07% weekly difference.

4 Execution of an algorithm or method to generate cash flow on a long-term portfolio or with money in the account.

Our procedure involves reviewing volumes, volatility, technical analysis on short and long term support and resistance charts.

This is our favorite strategy.

The Magnificent 7, which drive the price indexes due to their traded volumes, were all down, traders expect trend reversal this week.

We look at the Fund containing them Listed Funds Trust – Roundhill Magnificent Seven ETF (MAGS) listed on the Exchange since March 2023.

5 Performance analysis of the previous week’s forecast.

Positive outlook.

SP500 in the 4700 and 4800 ranges.

Volatility is up.

The 10-year bond lowers its yield by 1% to 3.95% and as a result lowers its price.

Gold +0.58 %.

OIL FLAT

10 Year Bond + 1

SPY -1.67 %.

6 Forecast for the week ahead:

We will compare and hypothesize on the yields of oil , Gold, SPY, crude oil and the 10 Year Bond.

Incoming liquidity is down again.

We will use our method for stocks in ranges of 4,700 support and 4800 resistance in the SP500 for entries in and exits. Watch for.

We see the market sideways to the upside awaiting further quarterly earnings news.

Weekly performance of the US $1,000 investment challenge, in 16 weeks:

The portfolio is yielding 14.83%, still rising, down from the close of 2023. We will be rotating the portfolio soon.

Venezuelan market

Price of the dollar vs Bs

BCV : Bs 35.96 -0.06

Unofficial : Bs 38.38 -0.13

BCV was intervening in the exchange tables

Translated by Elio Ohep, Editor EnergiesNet.

Energiesnet.com 14 01 2024