Market Report

Week #4 of 2024, Report on ideas for positive cash flow.

Update on relevant financial information.

January 22-26, 2024

1 Macroeconomic Environment

Week ending:

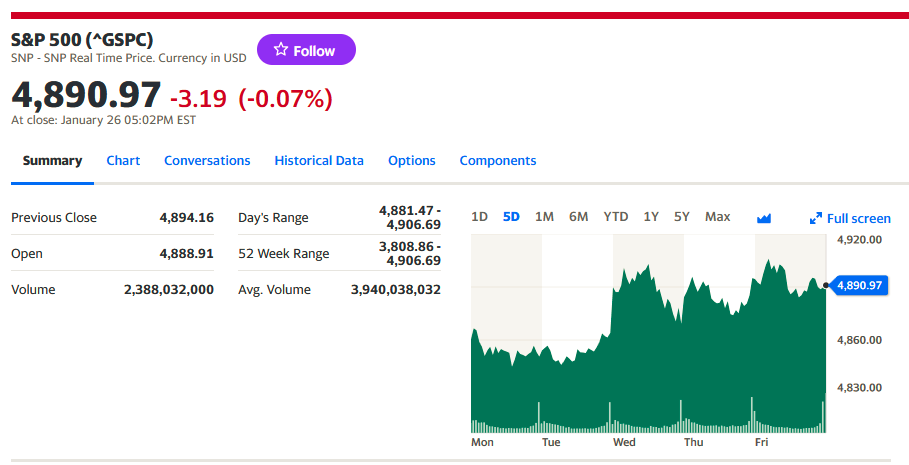

The market is sustained at higher levels than the previous week.

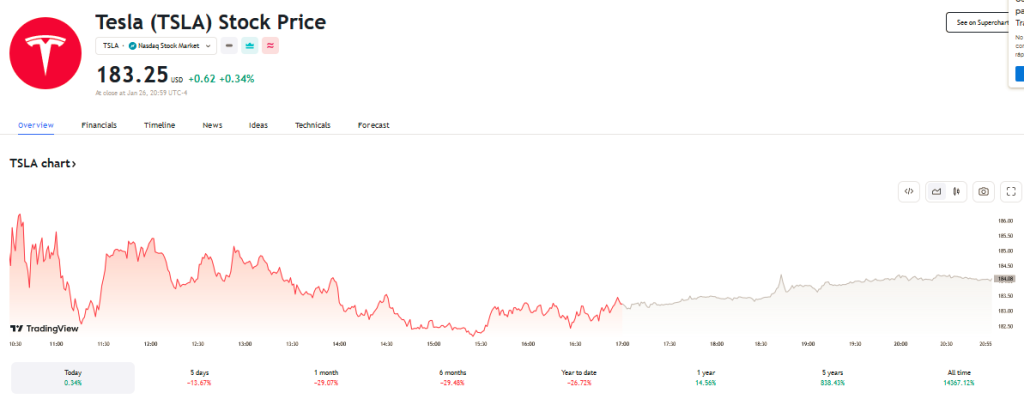

Earnings from companies like NETFLIX very good and TESLA very bad continue.

U.S. stocks ended mixed, another day of consolidation after hitting new all-time highs earlier this week, pending potentially huge catalysts to emerge. The S&P 500 Index (SPX) once again broke above the 4,900 intraday level, but failed to hold or move significantly higher. The S&P 500 and Nasdaq saw their 6-day winning streak snapped. Still, the S&P has advanced three consecutive weeks after its 9-week winning streak was snapped in the first week of 2024 (for a total of 12 of the last 13 weeks closing higher), in a remarkable streak since late October. Markets remain optimistic going into next week’s FOMC policy meeting, where investors/markets expect recent “more moderate” inflation data to prompt “dovish” comments and lead to rate cuts starting at the March meeting.

Next week will be a big event for Wall Street with the FOMC meeting on Wednesday (no rate changes expected), as well as five of the “Mag 7” companies expected to report (GOOGL, MSFT on 1/30, AAPL, AMZN and META all on 2/1) and also some other big names (AMD, BA, GM, MA, UPS, XOM, among others), in what could be an interesting week! The week could mark a new catalyst for new market highs or provide the correction that the bearish were waiting for after a relentless 3-month rally.

So how long does the bullish market optimism/rate cut last? A Vanguard survey today noted that in December investors expected stocks to return 5.7% over the next 12 months, up 1.3 percentage points from October…a level that was more than double their 2.7% expectation for 2023. Markets certainly priced in perfectly For the moment, there is a lot of “AI” related hype embedded in growth stocks, such as chips/players in the space (NVDA, MSFT, GOOGL, AVGO, others).

Reverse Repos are rising week by week, as shown in the chart, the system continues to receive liquidity

Corporate bonds continue to rise, a sign of lower rates at large bond issuers.

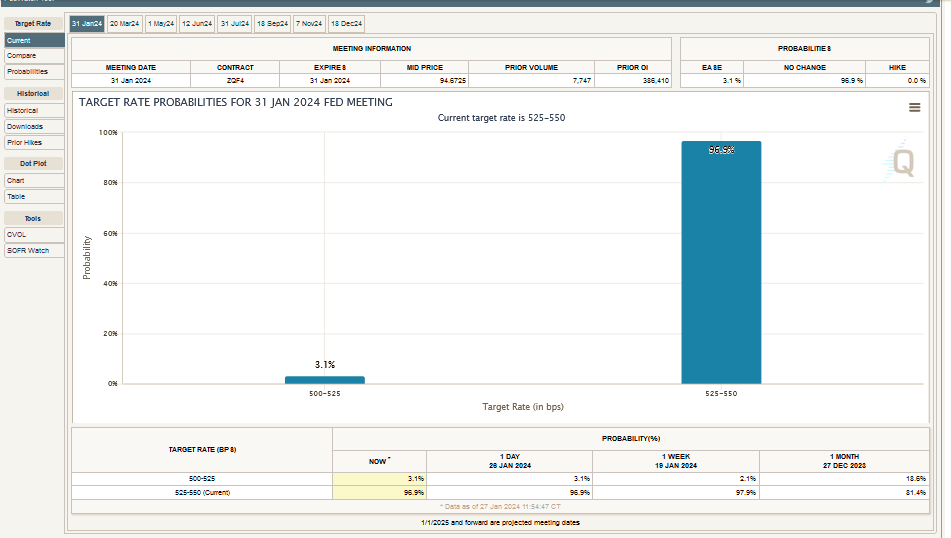

The graph shows that 97% of economic analysts believe that the prices will not go up and 3% that they will…

Next Week

CME FedWatch Tool

2 Micro

Market price volatility is subdued ahead of the Fed meeting next week

This week oil prices are up following news from the Red Sea , about attacks on cargo tankers.

Oil futures are up more than 6% on the week.

The large reduction in U.S. oil supply and production provided support for prices. However, “a lot of the daily trading really seems to be driven by sentiment toward China,” Colin Cieszynski, portfolio manager and chief market strategist at SIA Wealth Management, told MarketWatch.

Reduced supply in the U.S. due to cold weather in North Dakota, Texas and elsewhere has been a major contributor to oil’s rise this week, MarketWatch reports.

According to Jay Hatfield, chief executive officer of Infrastructure Capital Advisors, this week’s rally represents a return to a “somewhat normal winter,” following what has been called the warmest December in 150 years, which reduced heating oil demand and pressured oil prices.

Your firm estimates the WTI oil price range for 2024 between $75 and $95, “based on a global analysis of supply and demand, supported by improving growth in China and India and continued OPEC production restraint.”

In a note, Macquarie strategists said they remain “structurally bearish on crude, but tactically neutral to slightly bullish until tensions in the Middle East balance or subside.”

“Barring an escalation, we expect the price to remain in its current range during 1Q24 as no supply loss is expected.”

Oil analyst experts M. Juan Szabo and Luis A. Pacheco in an article published this week “Contradictions produce turmoil in the oil market ” comment that the current oil market conditions is in turmoil and is in turmoil.

Friday’s Price Evolution: January 26, 2024

West Texas Intermediate crude for March delivery CL00, +0.28% CL.1, +0.28% CLH24, +0.28% CLH24, +0.28% rose 65 cents, or 0.8%, to settle at $78.01 a barrel on the New York Mercantile Exchange, bringing front-month prices up 6.5% on the week, according to Dow Jones Market Data. This is the biggest weekly rise since September 1.

Brent crude for March BRN00, +0.08% BRNH24, +0.17%, the global benchmark, added $1.12 , or 1.4%, to $83.55 a barrel on ICE Futures Europe, up nearly 6.4% on the week, the most since Oct. 13.

Gasoline for February RBG24, +0.07% rose 1.3% to $2.29 a gallon, closing the week up 6.1%.

Heating oil for February HOG24, +0.99% rose 1.7% to $2.84 a gallon, up 6.8% for the week.

Natural gas for February delivery NGG24, +0.26% stood at $2.71 per million British thermal units, up 5.5%, up 7.7% on a weekly basis.

Source: MarketWatch

Bitcoin with volatility of up to 4 % , but recovered some value by Friday

3 Building a long-term portfolio

This week the energy ETF markets moved like this:

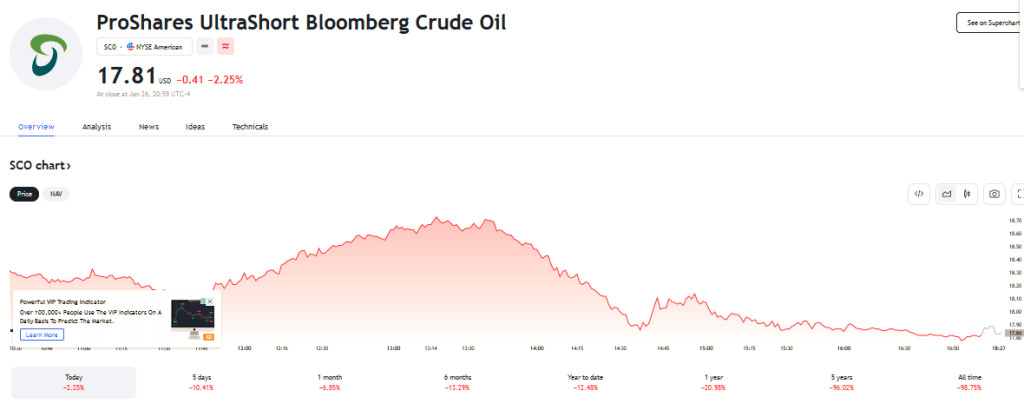

The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO which works with short crude oil futures contracts, loses -10% in one week.

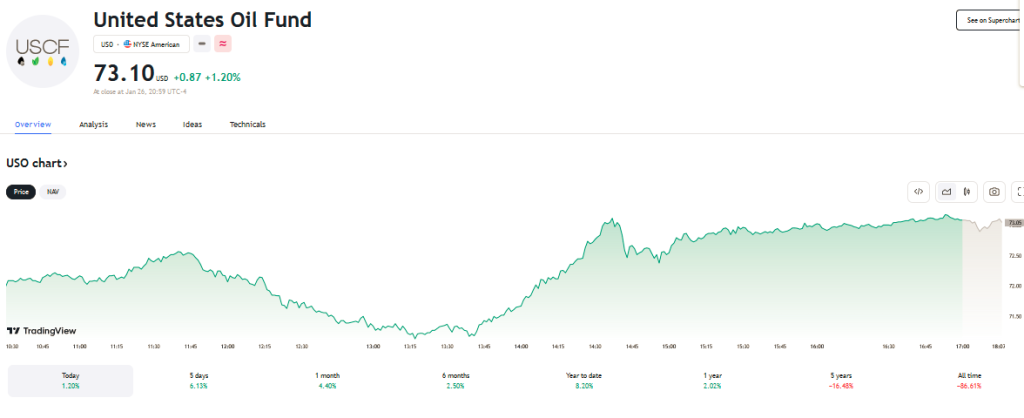

Meanwhile, the United States Oil Fund USO, which contains, in addition to crude oil futures, futures in natural gas, diesel and gasoline, with less volatility, rose 6%, as did the underlying assets.

The arbitrage between the prices of both funds was a +4% weekly difference.

4 Execution of an algorithm or method to generate cash flow on a long term portfolio or with money in the account.

Our procedure involves reviewing volumes, volatility, technical analysis on short and long term support and resistance charts.

This is our favorite strategy.

The Magnificent 7, which drive the price indexes due to their traded volumes, were stable pending gains from most of them this coming week….

5 Analysis of results from the previous week’s forecast

Volatility rose

The 10-year bond raised its yield from 4.08 to 4.16 , in contrast to the rise in stocks.

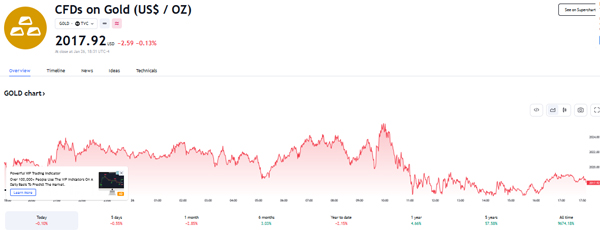

Gold down little to 2018 an ounce

6 Forecast for the week ahead:

We will compare and hypothesize with oil , Gold, SPY, crude and 10-year Bond yields.

Incoming liquidity rises. signal of appetite for equities.

We will use our method for stocks in ranges of 4,850 support and 4900 resistance in the SP500 for entries in and exits.

Weekly performance of the US $1,000 investment challenge, over 18 weeks:

The portfolio is yielding 15.06%, due to the declines in Tesla and Goldman Sachs

Venezuelan market

.

Price of the dollar vs Bs

BCV : Bs 36.11

Unofficial : Bs 38.40

The price of the dollar drops.

__________________________________________

Translated by Elio Ohep, Editor EnergiesNet.

Follow this report on social networks: Instagram You tube linkedin Faceboook

Raúl Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and posted on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.EnergiesNet.com 01 14 2024

Energiesnet.com 01 28 2024