Week #52 of 2023, Report on ideas for positive cash flow.

Market Report

Update of material financial information.

December 30, 2023

1 Macroeconomic Environment:

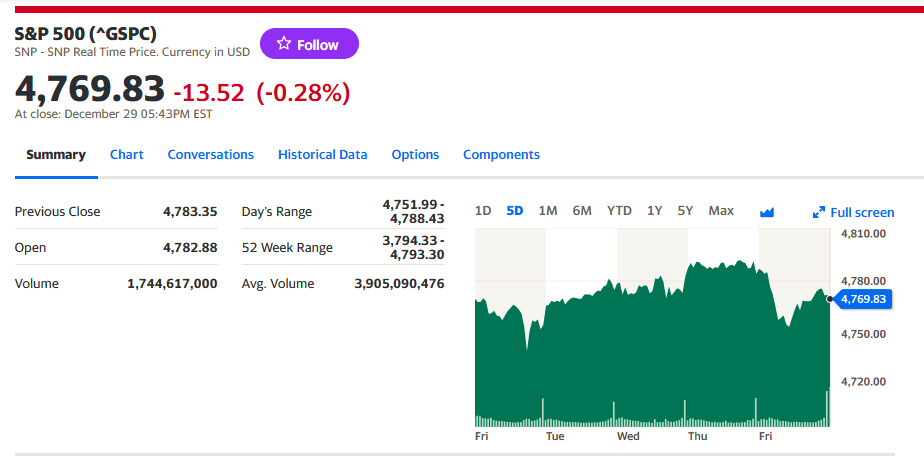

Year 2023 ended. By way of summary we can comment that stocks closed at almost their highest price level ever.

The SP500 ended 24% higher compared to the close of 2022.

This growth was driven by 2023 earnings plus projections for 2024, amid falling inflation at levels acceptable to monetary supervisors, who are almost in consensus ready to see several interest rate cuts throughout the year ahead.

However, a group of Wall Street’s 20 most recognized analysts have released their forecasts of price changes for this year and Bloomberg showed them, but they do not look so bright.

In general the consensus is a growth of less than 2% , a 4850 for the whole year on average , with the forecasts being the following:

Ranges :

Oppenheimer and Fundstrat 5200.

Citi, Goldman Sachs, BMI and Deutsche Bank 5100

Bank of America 5000

Barclays 4800

Wells Fargo 4625

UBS 4600

Morgan Stanley 4500

JP Morgan 4200

Fewer analysts are aligned towards a possible recession of the economy.

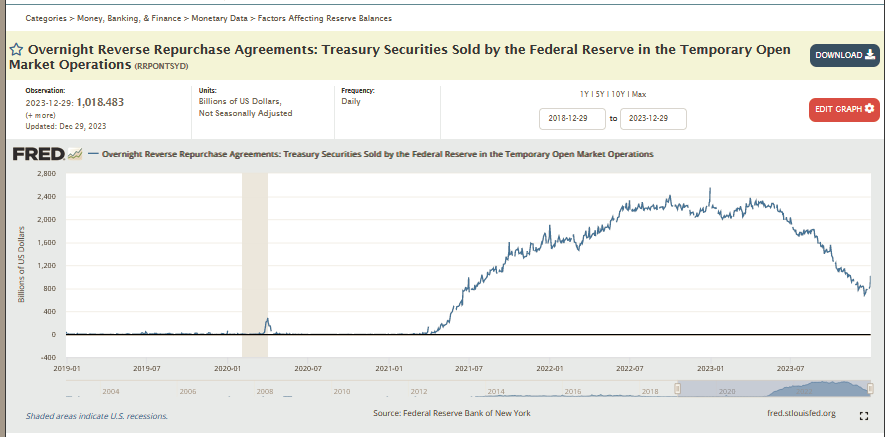

Reverse Repos, with which the Fed injects liquidity into the system, rose to over $1,000,000 trillion in the last auctions of the year. 2024 enters with a high level of liquidity in the markets.

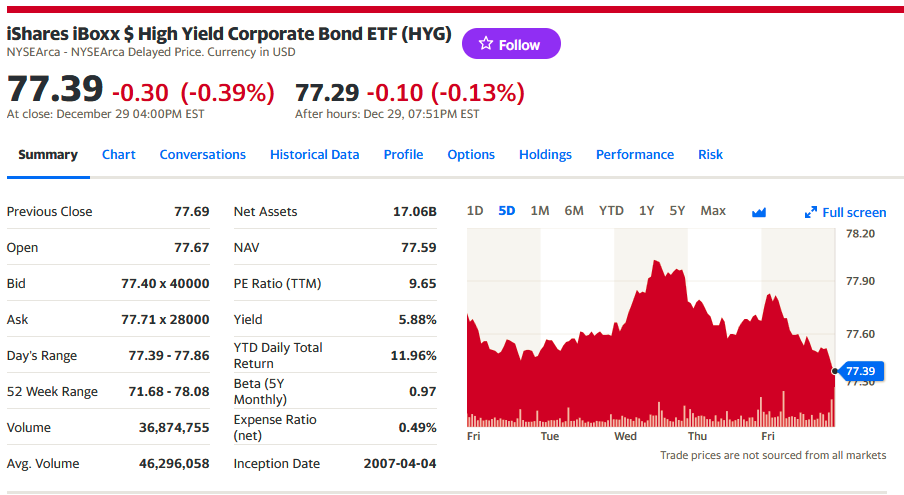

The ETF grouping HYG Corporate Bonds fell in price as seen in the chart of the week:

Market liquidity was generally lower for the last week, due to the Christmas and New Year holidays.

They remain above 4,740 support with resistance at 4800.

Next Week

Detailed employment cost data will be shown, plus changes in payrolls , plus we will see the minutes of the last Fed meeting for Wednesday….

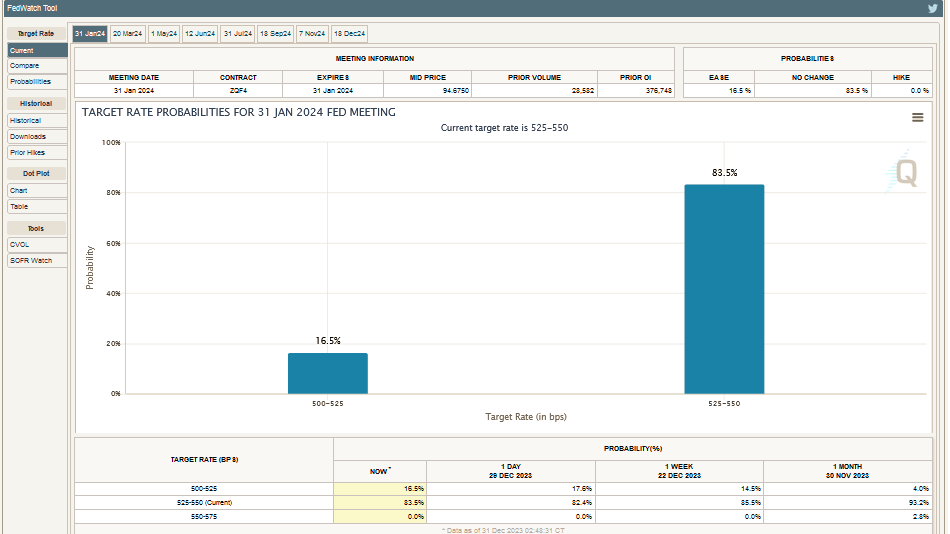

The Fed’s next monetary policy meeting is less than 30 days away, on January 31, 2024.

83.5% that they will not go up and 16.5% that they will, expectations today

CME FedWatch Tool

2 Micro

Market price volatility fell to 12.40 , the VIX is approaching dangerous levels of 12 , which anticipates price changes.

Crude oil prices were down -3.35% on the week.

Crude oil futures ended slightly lower on Friday on the last trading day of 2023, making it crude’s first losing year since 2020, losing more than 10% in 2023 in a tumultuous year marked by geopolitical turmoil and production levels from major global producers, concerns about the demand outlook outweighed potential supply disruptions and efforts by OPEC and its allies to limit output.

Bitcoin finished shining in 2023 with +160% upside .

JP Morgan will be the custodian and liquidator of the Fund to be approved in January, containing Bitcoin.

3 Building a long-term portfolio

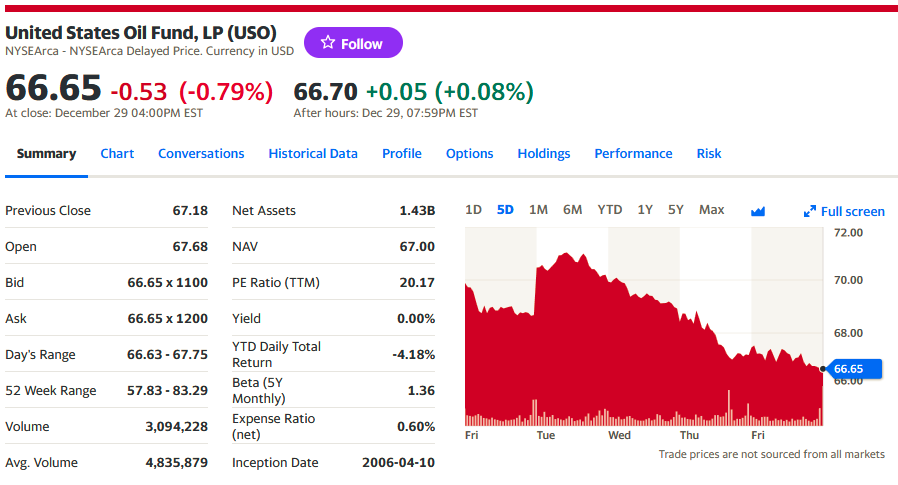

The two energy-focused funds that we track every week followed the trend of the underlying asset, oil.

This week the energy ETF markets moved like this:

The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO which works with short crude oil futures contracts, is up +1.49% for the week, on less volume.

Meanwhile, the United States Oil Fund USO, which contains, in addition to crude oil futures, futures in natural gas, diesel and gasoline, with less volatility, remained stable as the underlying asset fell by 4.41%.

The arbitrage between the prices of the two funds was +2.92% weekly difference.

4 Execution of an algorithm or method to generate cash flow on a long term portfolio or with money in the account.

We look as we usually do at volumes, volatility, technical analysis on short and long term support and resistance charts.

This is our favorite strategy.

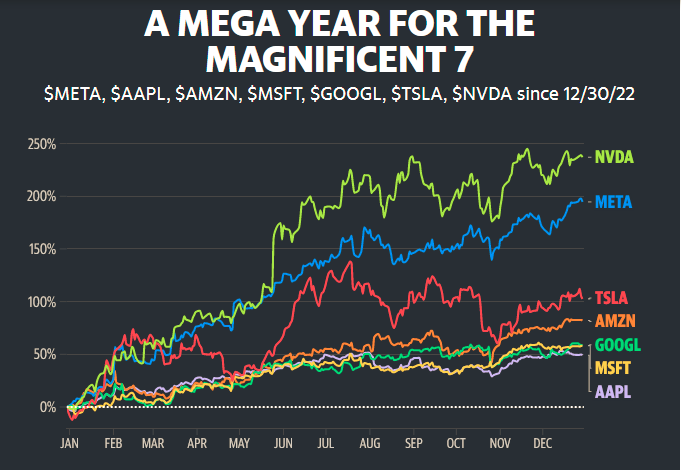

The Magnificent 7, carried 70% of the weight of the indexes’ rise in 2023.

https://shorturl.at/yBKMV

5 Analysis of results from the previous week’s forecast

Positive so far.

The SP500 breaking the 4760 resistance, held a range up to 4790.

Volatility rose as we already indicated.

The 10-year bond yield is down -0.17% and as a consequence its price is down to 3.86.

Oro –0,22%

OIL -3,35%

10 Year Bond -0,17%

SPY Flat

6 Forecast for the week ahead:

We will compare and hypothesize on the yields of oil , Gold, SPY, crude oil and the 10 Year Bond.

Liquidity continues to enter the market.

We will use our method for stocks in ranges of 4,700 support and 4800 resistance in the SP500 for entries in and exits. Watch for.

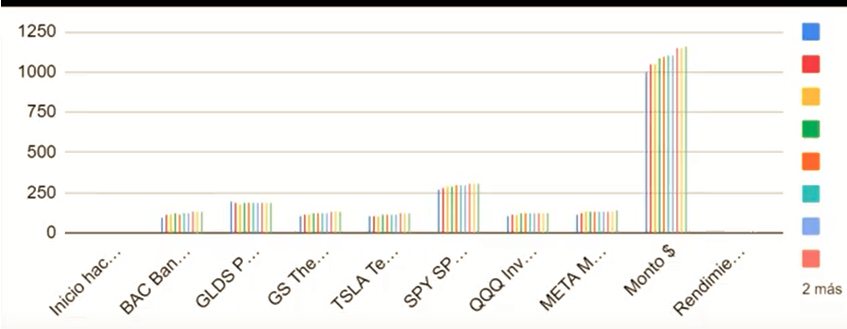

Weekly performance of the US $ 1,000 investment challenge, in 15 weeks:

BAC Bank of America Corporation 100,188

GLDS PDR Gold Shares 198.55

GS The Goldman Sachs Group, Inc. 104.96

TSLA Tesla, Inc. 100.8

SPY SPDR S&P 500 ETF Trust 269.4

QQQ Invesco QQQ Trust 108.46

META Meta Platforms, Inc. 117.6

Amount $ 999,958

Yield 100.00%.

The portfolio is yielding 16%, still rising. Equivalent to 58% annualized. This does not mean that it will continue to rise in the future, it is just today’s snapshot. Soon, at the beginning of 2024, we will change the portfolio by adding assets that point downwards, which is predictable in the markets and will happen at some point.

Gráfico Desempeño

Chart of our portfolio since its inception 15 weeks ago.

Venezuelan market

Price of the dollar vs Bs

BCV : Bs 35,93 +0,15

Unofficial : Bs 39.13 +1.01

Another modest slide in the official exchange rate. The parallel exchange rate also rises. The year ends with a differential of 3 dollars, not seen for 8 weeks. We insist that December inflation to be published in January should give a big surprise, we see it much lower than November.

Caracas Stock Exchange

Equities:

OPERATIONS NOMINAL AMOUNT (BS.S) CASH AMOUNT (BS.)

108 163,500 179,00010 Up

3 Down

9 Equal

Fixed income:

TRADES TRADED SECURITIES CASH AMOUNT (BS.)

15 1 7 MMBs Bs Bs 17 MM of Bs

Follow Us in : You tube Instagram

Translated by Elio Ohep, Editor EnergiesNet.com

______________________________________________

Raúl Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and posted on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

EnergiesNet.com 30 12 2023