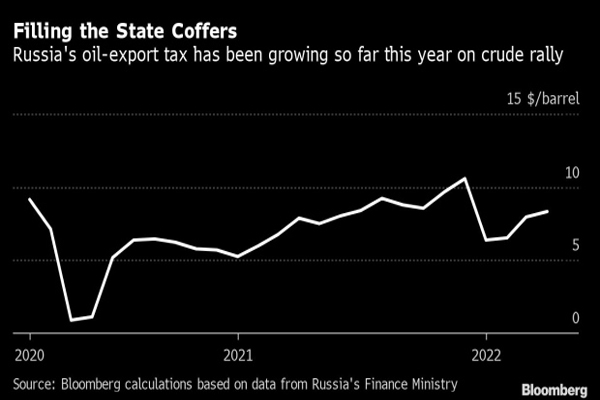

- April export duty for nation’s crude is highest so far in 2022

- Tax could drop in May if Urals discount grows, oil price dips

Bloomberg News

NEW YORK

EnergiesNews.com 03 15 2022

Russia may profit next month from the recent rally in crude prices as its oil-export tax jumps to the highest this year, even amid international sanctions and historic discounts for the country’s key Urals grade.

A barrel of Russian crude or fuel oil exported in April will earn more than $8.30 for state coffers, according to Bloomberg calculations based on data from the Finance Ministry. The monthly duty has grown steadily this year together with oil prices, which earlier in March jumped above $100 amid the worst energy crunch in decades, aggravated by concerns over disruption to Russian flows.

Tapping hydrocarbon revenues in hard currency is important for the Russian economy, which has been partially cut off from the outside world after its invasion of Ukraine. The consequent sanctions imposed on Moscow included limiting access to much of Russia’s foreign reserves of more than $640 billion.

Last year, Russia relied on oil and gas for some 35% of its budget revenues. While the nation has aimed to reduce dependence on hydrocarbons since an earlier wave of sanctions that started eight years ago following its annexation of Crimea, oil and gas combined are still the largest source of flows into the budget.

As Russia does not publish aggregated data on oil exports, its monthly revenues from selling crude abroad are hard to assess. In recent years, the nation exported about half of its crude output, which averaged 11.04 million barrels per day in January-February. As of March 9, seaborne exports, which represent the bulk of Russian oil flows, “continued comfortably,” at about 4.9 million barrels per day, according to data and analytics firm Kpler.

Europe and China, the main purchasers of Russian crude and oil-products, have not imposed any formal restrictions on buying the fuel amid the invasion. Still, international energy firms and traders have shunned the barrels amid a lack of clarity on how the purchases may be treated, while the U.S. and U.K. have said they will ban imports of Russian oil. Kpler expects the volumes of Russian crude on the water to keep growing amid the uncertainty.

“Essentially, cargoes are loading either unsold or heading toward longer haul destinations in Asia,” Kpler said in a note. “As cargoes continue to be shunned by large parts of the market, this volume is set to rise further.”

Global oil buyers have been cautious about taking the cargoes even as Russia’s most popular export blend, Urals, has traded at unprecedented discounts to global benchmark Brent since earlier this month.

The Russian oil-export duty for April is based on the average Urals price recorded between mid-February and mid-March. Should the grade’s discount to Brent, which so far is at about $30 a barrel, hold or deepen, and the oil price growth lose steam, this may result in a lower export-duty rate from May. Coupled with a potential decline in oil exports, this could deliver a blow to Russian budget revenues just when the nation needs the money most.

bloomberg.com 03 15 2022