Trixie Sher Li Yap and Mohi Narayan, Reuters

SINGAPORE

EnergiesNet.com 09 29 2023

Record volumes of refined products were shipped from Singapore to Mexico in the third quarter on lower U.S. exports to the Latin American country caused by peak summer demand and slow shipping through the Panama Canal, industry sources and analysts say.

The trend could continue into the fourth quarter, especially for gasoline, drawing down Singapore stockpiles and providing a floor for Asian refiners’ margins, the sources added.

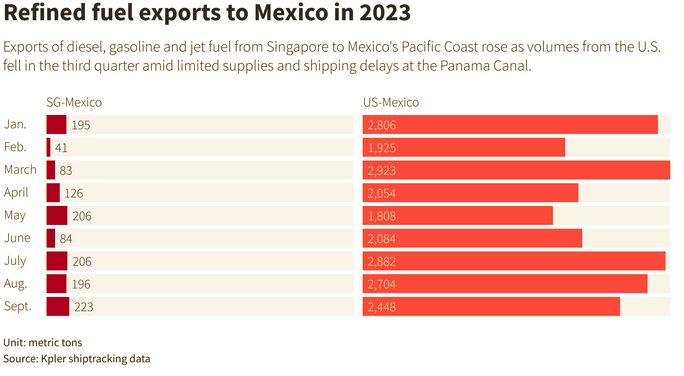

Singapore’s exports of diesel, gasoline and jet fuel to Mexico were at 178,000-208,000 metric tons on average per month between July and September, shiptracking data from Kpler and LSEG showed, a level unseen over the past four years.

Around 80% of the exports were gasoline headed for Mexico’s Pacific coast with state energy firm Pemex (PEMX.UL) as the main receiver, the data showed.

In contrast, Mexico’s refined products imports from the U.S. fell from 2.2 million tons in July to 1.75 million tons in September, Kpler data showed.

“There is a combination of U.S. Gulf Coast (gasoline) supply tightness as well as a comparatively soft Asian market causing this,” said Sparta Commodities analyst Philip Jones-Lux.

U.S. summer driving demand was robust while its output was affected by refinery outages, he added.

Gasoline from Singapore has been $40-50 a ton cheaper than supply from U.S. Gulf Coast in the past two months, Jones-Lux said.

Pemex’s refineries are operating at barely half their capacity in August with gasoline at the lowest monthly level this year.

Tankers travelling from Singapore reached Mexico’s Pacific coast faster than those from U.S. Gulf Coast in the past two months due to delays at the Panama Canal caused by a historic drought, two sources added.

“Continued declines in freight rates of medium-range carriers travelling from east to west also supported these clean products flows,” said an India-based shipping charterer who declined to be named due to its company’s media policy.

Sparta’s Jones-Lux said: “We would expect the USGC gasoline balance to lengthen significantly into Q4 and this should open up opportunities to place barrels into West (of) Mexico again.”

However, “current forward pricing is pointing very strongly to Singapore as the cheapest source of supply for Mexico through the whole of fourth quarter,” he said.

Reporting by Trixie Yap in Singapore and Mohi Narayan in New Delhi; additional reporting by Marianna Parraga in Houston; Editing by Florence Tan and Michael Perry

reuters.com 09 28 2023