Elizabeth Low, Bloomberg News

SINGAPORE

EnergiesNet.com 05 19 2022

The worsening gasoline crunch looks set to buoy Asian refiners — particularly those in India — as sky-high US prices encourage more exports.

US pump prices have now risen above $4 a gallon in all states for the first time ever as the summer driving season approaches. JPMorgan Chase & Co. forecast this week that American gasoline could surge to as high as $6.20 a gallon by August, which would be more than double the price a year ago.

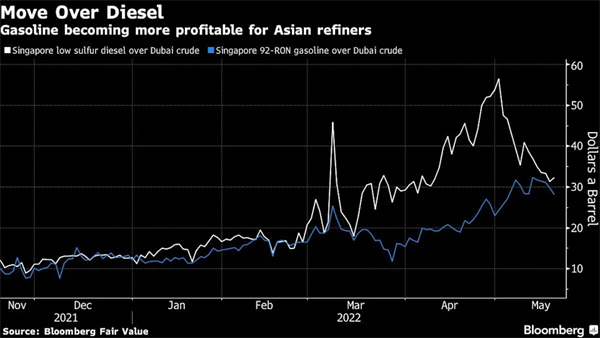

Motor fuel is taking over from diesel as the major focus of oil-product supply fears, with the tightening market stretching a global refining system that was hit by closures over the last couple of years due to Covid-19. In Asia, gasoline margins jumped to almost $35 a barrel this week, and are now near those for diesel, which have eased from a peak in early May.

“The tightness in the Atlantic Basin, especially in the US, should continue to see Asian gasoline barrels pulled West,” said Dylan Sim, an analyst at FGE. “This will mainly come from India, with several major refineries in the country postponing their planned maintenance to August-September.”

Asia’s gasoline deficit will narrow from an estimated 260,000 barrels a day in June to 110,000 barrels a day in the three months through September as plants return from maintenance and the PRefChem facility in Malaysia ramps up, the industry consultant said in a note. That should provide more scope for the region’s processors to increase exports.

The Indian shipments are likely to come from private refiners like Reliance Industries Ltd. and Nayara Energy Ltd., as the state-run processors have an obligation to meet domestic demand. The nation’s gasoline exports jumped to a five-year high of 1.6 million tons in March, the latest available data show, and domestic prices that have remained unchanged since early April are incentivizing refiners to send as much fuel abroad as they can.

Factors that could limit the amount of gasoline Asia can send to the US would be a comeback in Chinese demand, or an acceleration in consumption in the rest of the region. Crude processing in Asia’s largest economy tumbled to the lowest in more than two years last month, but it could recover quickly if China can put the worst of its current wave of virus outbreaks behind it.

Gasoline and jet fuel demand is set to pick up strongly this summer in Asia, said Kang Wu, head of global demand and Asia analytics at S&P Global Commodity Insights. Diesel consumption will probably remain stable until the fourth quarter, when seasonal use by the agriculture and infrastructure sectors picks up, he said.

bloomberg.com 05 18 2022

Let’s celebrate the strength, courage and incredible contributions of women around the world. https://www.EnergiesNet.com Portal of Latin America and the Caribbean with news and information on Energy, Oil, Gas, Renewables, Engineering, Technology and Environment

Let’s celebrate the strength, courage and incredible contributions of women around the world. https://www.EnergiesNet.com Portal of Latin America and the Caribbean with news and information on Energy, Oil, Gas, Renewables, Engineering, Technology and Environment