Myra P. Saefong, MarketWatch

SAN FRANCISCO

EnergiesNet.com 01 27 2023

The European Union will ban imports of Russian oil products early next month, in a move to further punish Russia for its invasion of Ukraine, but one that could lead to tighter global supplies and higher prices for products such as diesel.

The ban on Russian oil products is likely to have a bigger impact than the EU ban on Russian seaborne crude oil and the Group of Seven price cap on Russian oil, says Tom Kloza, global head of energy analysis at the Oil Price Information Service, or OPIS, a Dow Jones company.

The EU banned imports of Russian seaborne crude oil from Dec. 5, and plans to ban imports of certain Russian petroleum products from Feb. 5.

Crude oil and refined products prices bottomed after the oil ban, since it “didn’t really impede the flow of oil,” Kloza says. Europe fared well despite the ban, he adds, because the winter season has been among the warmest on record for Europe, driving down winter heating fuel demand.

Even so, “it’s probably too soon to write the obituary for the 2023 winter in the Northern Hemisphere,” says Kloza.

The Feb. 5 ban on Russian oil products comes at a time when “ice and brutal weather can impede Baltic exports, and it is quite likely that Russian diesel is impacted.”

The EU, along with the G-7, also set a price cap on Russian oil at $60 a barrel in December, while a price cap on Russian oil products is set to take effect on Feb. 5.

“Through self-sanctioning since the end of last winter, European refiners had been divorcing Russia crude for a while, allowing for the reshuffle and appetite East of Suez to develop for Russian crude,” says Hédi Grati, executive director, refining & marketing at S&P Global Commodity Insights.

However, “product markets are more fragmented, the parcel sizes are smaller, and the shipping side of things is likely to be a greater bottleneck than it is for crude oil,” says Grati.

Russia is also a large diesel exporter, and replacement options for Europe are “less widespread” than for crude.

Tanker-tracking data show that Europe sourced more than a quarter of its diesel imports from Russia weeks ahead of the EU’s Russian oil products ban, says S&P Global Commodity Insights.

There has been a “strong uptake in diesel flows from outside Russia in recent weeks,” says Grati.

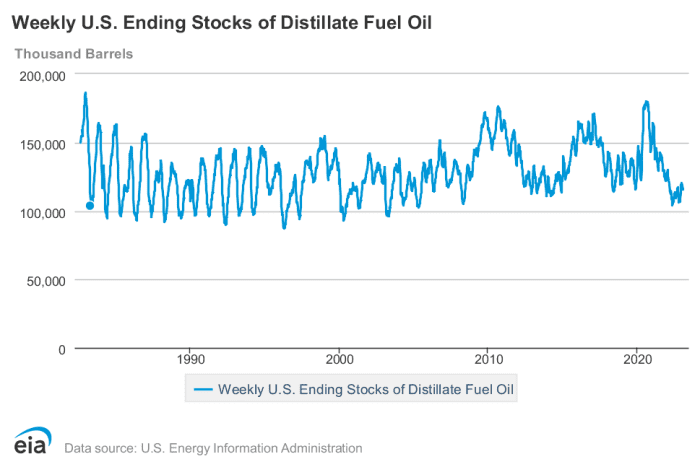

Globally, the market has been dealing with tight diesel supplies. In the U.S., distillate inventories, which include diesel, stand 20% below the five-year average.

OPIS’ Kloza says diesel prices may remain firm on both sides of the Atlantic, and perhaps fetch $50 to $60 a barrel above crude costs.

Futures prices for New York Harbor ultra-low sulfur diesel traded on the New York Mercantile Exchange HOG23, -3.86% HO00, -3.29%, which is also known as the heating-oil contract, settled at $3.3613 a gallon on Jan. 25. At 42 gallons per barrel, that would be about $141 a barrel. West Texas Intermediate crude futures trades above $80 a barrel.

“These are beaucoup margins for refiners,” says Kloza, adding that they will probably come down to more normal levels at some point in 2023. But for now, “they will remain and reward refiners.”

The EU embargo is “great news” to North American refiners, and European refiners are much better off than they were before because natural-gas prices are about a fifth of what they were in late August, he says.

“It will be very difficult for diesel, jet fuel, and gasoline prices to drop” in the next two weeks, as the first week of February brings “a kind of triple witching hour to markets.”— Tom Kloza, OPIS

Kloza believes that “it will be very difficult for diesel, jet fuel, and gasoline prices to drop” in the next two weeks, as the first week of February brings a “kind of triple witching hour to markets.”

There’s the beginning of a key turnaround for the Phillips 66 Bayway Refinery on Feb. 2, and the EU embargo on Feb. 5—and both dates overlap with what appears to be a return to colder-than-normal temperatures across most of the U.S., he says.

Simply put, the perception may be that ‘it is not safe to sell,’ ” Kloza says.

marketwatch.co 01 27 2023