It’s always tricky to trade on potential war scenarios. Assessing any prospective fallout — as well as its magnitude — is never simple. But the flipside is also true. If the Ukraine situation were to de-escalate, there isn’t going to be a neat reversal of recent market swings. Things will remain complicated if Russia takes the off-ramp.

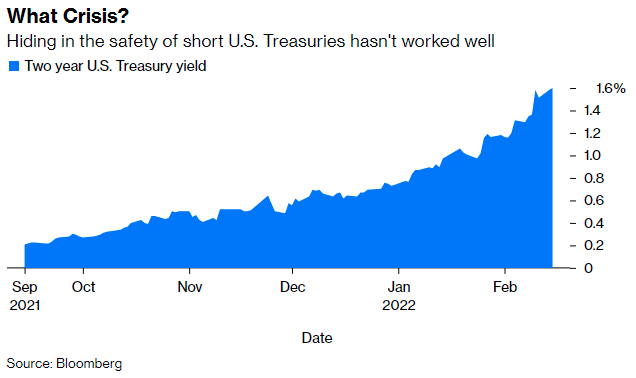

What makes it particularly messy is that the obvious havens — such as the U.S. dollar and in particular short-dated U.S. Treasuries — have not necessarily been a friend to investors during the crisis. The dollar, yen and Swiss franc have all chopped sideways. Gold has done well but not spectacularly, especially compared to industrial-use metals overall. German 10-year yields — the European safe space — are at the highest since late 2018, having resolutely

punched positive. There has been no protection from diving into top-quality fixed income.

The short-term key to market direction is energy — even if the rising cost of housing, food and other commodities make central bankers fret. Crude oil has been threatening to push through the $100 barrier for some time — and may continue to do so even if the prospect of war on the European continent fades. That’s because there is still strong global post-pandemic economic growth and multifold logistical bottlenecks to keep prices surging. At least, in theory.

Still, central bankers would be relieved if peace breaks out and leads to a sharp downturn in gas and oil prices. That would help break the back of persistently — and embarrassingly — higher inflation numbers that have led to sharp pivots on rate guidance from the major central banks. A dose of realism on how far and fast official rates can be yanked up is overdue. But that may be too much to hope for.

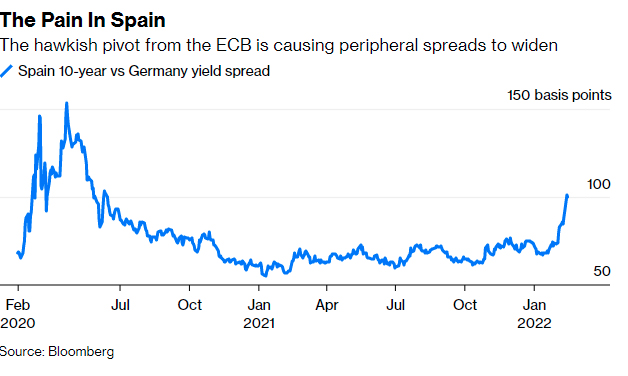

Bond markets have their own underlying crisis over inflation to work through. With parts of the U.S. Treasury yield curve already on the verge of inverting, there are a lot of conflicting signals as to how high rates can go before the recovery is affected. Short-end yields cannot continue to rise faster than longer maturities forever. But there are other problems, including more visible signs of stress in the eurozone. Spanish 10-year yields have risen to a 100 basis points premium over those in Germany, the highest since the summer of 2020; meanwhile, the Italian 10-year yields are nearing 2%. Not a crisis but uncomfortable. The French presidential election in April is going to add more tension to the mix.

Credit spreads — the premium that corporations have to offer above government debt — have felt the strain recently despite broadly strong underlying economies. Along with the Ukraine situation, rising government yields have been weighing heavily on all bonds. New issue activity has dried to a trickle with just the higher quality issuers feeling confident in testing investor demand. On Tuesday, Belgium successfully syndicateda 30-year deal, with order books in excess of 36 billion euros ($40.9 billion).Opinion. Data. More Data.Get the most important Bloomberg Opinion pieces in one email.EmailSign UpBloomberg may send me offers and promotions.By submitting my information, I agree to the Privacy Policy and Terms of Service.

But already there are promising signs that the supply of corporate bonds will rebound swiftly. Prologis Inc. has raised 500 million pounds ($677 million) in a two-tranche green deal and BMW Finance AG placed a benchmark euro deal. Issuers will be keen to raise funding ahead of higher rates. If the upward yield surge calms down, they’ll happily meet demand from investors. There is plenty of cash to be put to work if war is no longer on the agenda.

Meanwhile, equities could, and probably should, take a much-needed respite after a troublesome 2022 so far. It’s questionable how much of the recent correction has been down to nerves over Eastern Europe. The unwinding of once-darling tech and meme stock plays has contributed substantially, too. There will be further to go if interest rates head firmly higher.Sponsored ContentWallStreetBets: Yesterday’s Meme or Here to Stay?Capital.com

This year has had a rocky start, one that would be magnified considerably if the worst-case scenario plays out in Ukraine. But a resolution that doesn’t involve bloodshed would just re-order the list of underlying pressures. The disjointed recovery with its inflationary blowoff is going to continue the bumpiness. So, heads down, keep it tidy. Don’t expect much of a peace dividend.

Marcus Ashworth is a Bloomberg Opinion columnist covering European markets. He spent three decades in the banking industry, most recently as chief markets strategist at Haitong Securities in London.@marcusashworth. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg Opinion, on February 16, 2022. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

energiesnet.com 02 16 2022