Oil investment is geared toward declining demand, but just the opposite is happening.

By Javier Blas

: Oil’s Unsustainable Path

In life, everything has a price. OPEC Secretary-General Haitham Al-Ghais was adamant about that earlier this week after the cartel cut oil production, lifting Brent crude prices toward $100 a barrel again. “Energy security has a price, as well,” he said.

Al-Ghais, a veteran Kuwaiti oil diplomat and executive, has a point. Largely focused on climate change in recent years, many European and American policymakers had forgotten about energy security.

Over the long term, energy security equals investments in oil production. The industry needs to spend billions of dollars each year to drill new wells, build pipelines and design new refineries.

Currently, oil investment is geared toward a world of stagnant, or even falling, demand — in line with climate-change goals to slash fossil-fuel emissions. The problem is that oil demand not only isn’t declining, but so far this year it’s increasing. The current path is unsustainable.

The result is that the oil market has operated at times this year close to maximum capacity. On an annual average, for example, Saudi Arabia is set to pump the most oil ever in 2022, even after the last OPEC output cut. And a world without spare oil capacity tends to see higher, and more volatile, energy prices.

As the International Energy Agency put it last year in the World Energy Outlook 2021: “High prices are a signal that supply is struggling to meet demand.”

: Oil’s Unsustainable Path

In life, everything has a price. OPEC Secretary-General Haitham Al-Ghais was adamant about that earlier this week after the cartel cut oil production, lifting Brent crude prices toward $100 a barrel again. “Energy security has a price, as well,” he said.

Al-Ghais, a veteran Kuwaiti oil diplomat and executive, has a point. Largely focused on climate change in recent years, many European and American policymakers had forgotten about energy security.

Over the long term, energy security equals investments in oil production. The industry needs to spend billions of dollars each year to drill new wells, build pipelines and design new refineries.

Currently, oil investment is geared toward a world of stagnant, or even falling, demand — in line with climate-change goals to slash fossil-fuel emissions. The problem is that oil demand not only isn’t declining, but so far this year it’s increasing. The current path is unsustainable.

The result is that the oil market has operated at times this year close to maximum capacity. On an annual average, for example, Saudi Arabia is set to pump the most oil ever in 2022, even after the last OPEC output cut. And a world without spare oil capacity tends to see higher, and more volatile, energy prices.

As the International Energy Agency put it last year in the World Energy Outlook 2021: “High prices are a signal that supply is struggling to meet demand.”

Chart of the Day

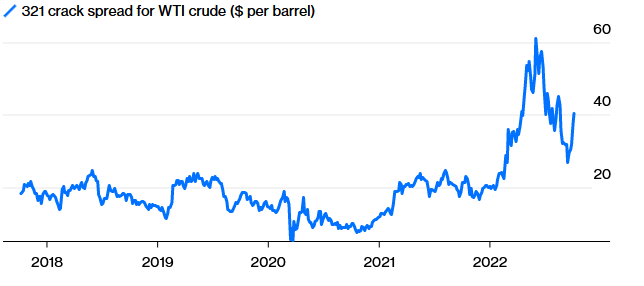

Refining Profits Rise Again

After falling from post-invasion records earlier this year, the profit from refining crude oil into the fuels people use is on the rise again. The so-called 321 crack spread for WTI crude futures — which measures the notional return from turning three barrels of oil into two of gasoline and one of diesel — has moved above $40, suggesting tightness is back in product markets as winter approaches.

___________________________________________________________________

Javier Blas is a Bloomberg Opinion columnist covering energy and commodities. He previously was commodities editor at the Financial Times and is the coauthor of “The World for Sale: Money, Power, and the Traders Who Barter the Earth’s Resources.” @JavierBlas. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg Opinion, on October 07, 2022. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

energiesnet.com 10 07 2022