By

The planned restart of Three Mile Island is a step forward for nuclear power, but the U.S. needs to deploy new plants to keep up with rising electricity demand, one of the nation’s top nuclear officials said this week.

The U.S. needs to at least triple its nuclear fleet to keep pace with demand, slash carbon dioxide emissions and ensure the nation’s energy security, said Mike Goff, acting assistant secretary for the Office of Nuclear Energy at the Department of Energy.

The U.S. currently maintains the largest nuclear fleet in the world with 94 operational reactors totaling about 100 gigawatts of power. The fleet supplied more than 18% of the nation’s electricity consumption in 2023.

The U.S. needs to add 200 gigawatts of nuclear power, Goff told CNBC in an interview. This is roughly equivalent to building 200 new plants, based on the current average reactor size in the U.S. fleet of about a gigawatt.

“It’s a huge undertaking,” Goff said. The U.S. led a global coalition in December that formally pledged to meet this goal by 2050. Financial institutions including Goldman Sachs and Bank of America endorsed the target at a climate conference in New York City this week.

Constellation Energy’s plan to restart Three Mile Island by 2028 is a step in the right direction, Goff said. The plant operated safely and efficiently, only shutting down in 2019 for economic reasons, he said.

The reactor that Constellation plans to reopen, Unit 1, is not the one the partially melted down in 1979.

Microsoft will purchase electricity from the plant to help power its data centers. Goff said the advent of large data centers that consume up to a gigawatt of electricity only reinforces the need for new reactors.

“A lot of the data centers are coming in and saying they do need firm, 24/7, baseload clean electricity,” Goff said. “Nuclear is obviously a perfect match for that,” he said.

But restarting reactors in the U.S. will provide only a small fraction of the nuclear power that is needed, he said. There are only a handful of shuttered plants that are potential candidates for restarts, according to Goff.

“It’s not a huge number,” Goff said of potential restarts. “We need to really be moving forward also on deploying plants,” he said.

From coal to nuclear

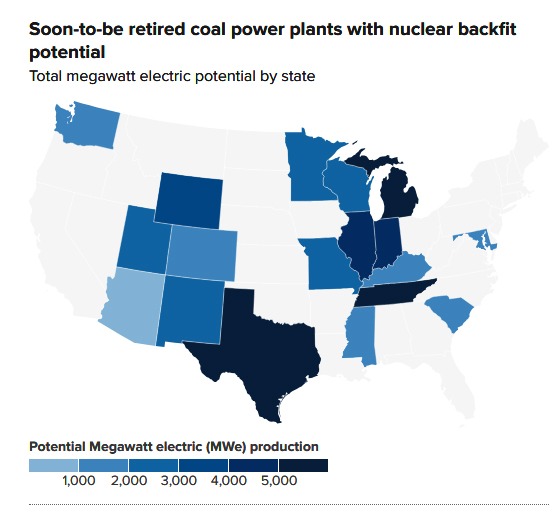

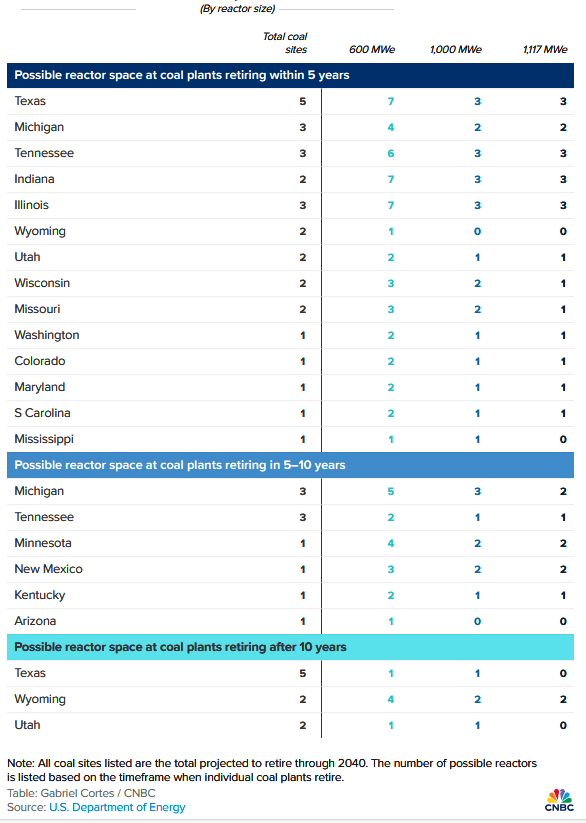

Coal communities across the U.S. could provide a runway to build out a large number of new nuclear plants. Utilities in many parts of the U.S. are phasing out coal as part of the clean energy transition, creating a supply gap in some regions because new generation is not being built fast enough.

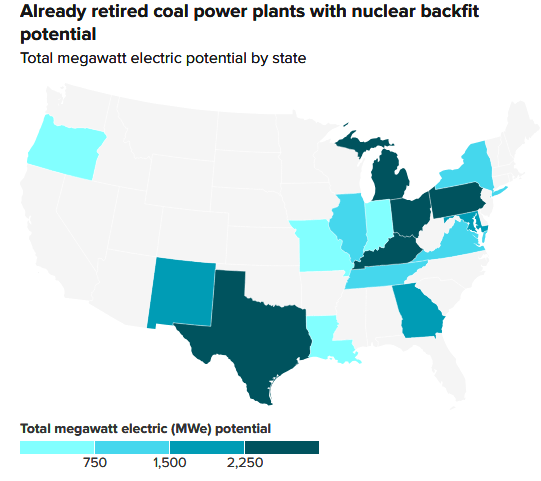

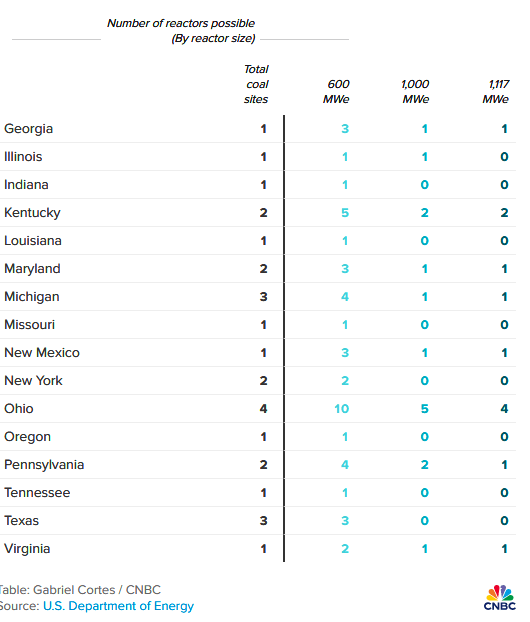

Recently shuttered coal plants, those expected to retire, and currently operating plants with no estimated shutdown date yet could provide space for up to 174 gigawatts of new nuclear power across 36 states, according to a Department of Energy study published earlier this month.

Coal plants already have transmission lines in place, allowing reactors at those sites to avoid the long process of siting new grid connections, Goff said. The plants also have people experienced in the energy industry who could transition to working at a nuclear facility, he said.

“We can actually get a significant cost reduction by building at a coal plant,” Goff said. “We can maybe get a 30% cost reduction compared to just going on a greenfield site.”

Cost overruns and long timelines are major hurdles for building new nuclear plants. The expansion of the Vogtle plant in Georgia with two new reactors, for example, cost more than $30 billion and took around seven years longer than expected.

Expanding operational nuclear plants and building at retired sites in the U.S. could create a pathway for up to 95 gigawatts worth of new reactors, according to the DOE study. Between coal and nuclear sites, the U.S. potentially has space for up to 269 gigawatts of additional nuclear power.

The potential capacity would depend on whether advanced, smaller reactors are built at the sites, or larger reactors with a gigawatt or more of power.

More electricity could potentially be generated if the smaller reactors were rolled out on a large scale because there is space for more of them, according to the DOE study. Some of these smaller advanced designs, however, are still years away from commercialization.

But rising electricity demand from data centers, manufacturing and the electrification of the economy could provide a catalyst to build the larger plants as well, according to Goff. The Three Mile Island restart, for example, would bring back just under a gigawatt of power to meet Microsoft’s needs.

“That increased power demand, that will lead toward an additional push toward those gigawatt-size reactors as well,” he said.

Restarts likely to secure greenlight

While reactor restarts aren’t a silver bullet, shoring up and maintaining the existing fleet is crucial, Goff said. The U.S. went through a decadelong period in which reactors were shutting down because they could not compete with cheap, abundant natural gas.

The economics are changing, however, with tax support from the Inflation Reduction Act and nuclear increasingly valued for its carbon-free attributes, Goff said.

“One of the issues with the economics, especially in the non-regulated utilities, was there was no value necessarily for clean, baseload electricity,” he said. “There is a lot more recognition of the need for that clean, firm, reliable baseload for nuclear.”

Constellation’s decision to restart Three Mile Island follows in the footsteps of the Palisades nuclear plant in Michigan. The private owner, Holtec International, plants to restart Palisades in 2025. The two restarts are subject to review and approval by the Nuclear Regulatory Commission.

“They are an independent agency, but I expect if the safety cases are presented, they’re going to approve it,” Goff said of those potential restarts.

“Constellation obviously operated the Three Mile Island plant for years, and has a very large fleet of reactors that they’ve operated safely and efficiently,” he said. “They will continue to have a great expertise in moving those plants to continue their safe operation.”

But finding additional plants to restart could prove difficult, said Doug True, chief nuclear officer at the Nuclear Energy Institute.

“It gets harder and harder,” True previously told CNBC. “A lot of these plants have already started the deconstruction process that goes with decommissioning and the facility wasn’t as thoroughly laid up in a way that was intended to restart in any way.”

_________________________________________________`

Spencer Kimball reports on energy markets for CNBC.com. He previously reported on health, leading CNBC’s coverage of the Covid-19 pandemic and the pharmaceutical industry. Prior to CNBC, Spencer was a reporter and editor with Deutsche Welle, Germany’s international news broadcaster, and Handelsblatt Today, the English edition of Germany’s leading business daily. He got his start in journalism as a general assignments reporter at The Advocate-Messenger in Danville, KY and The Monitor in McAllen, TX. Gabriel Cortés is CNBC.com’s data visualization journalist. He was previously a reporter and data journalist for Grow, a joint publication between CNBC and Acorns. Before that, he was a data journalist at American Public Media. He has a master’s degree in journalism from the University of Southern California and a bachelor’s degree in comparative literature from Princeton University. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by CNBC, on September 27, 2024. EnergiesNet.com do not reflect either for or against the opinion expressed in the comment as an endorsement of Petroleumworld or EnergiesNet.com

America’s coal communities could help the U.S. triple nuclear power (cnbc.com)

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

EnergiesNet.com 09 30 2024