Peter Millard, Bloomberg News

RIO

EnmergiesNet.com 09 23 2024

TotalEnergies SE is assembling a fleet of deepwater rigs, support vessels and drilling crews off the coast of Suriname in the clearest sign yet that it’ll move forward with a historic oil development.

Although the French supermajor hasn’t formally greenlit the $9 billion development of crude discoveries in the Latin American nation, it’s already seeking to lock in two rig leases for future drilling in the area, according to people familiar with the tenders who asked not to be named discussing non-public information.

That comes less than four months after TotalEnergies directed contractors to reserve construction capacity in a Chinese shipyard for fabrication of a floating oil-production vessel for the project.

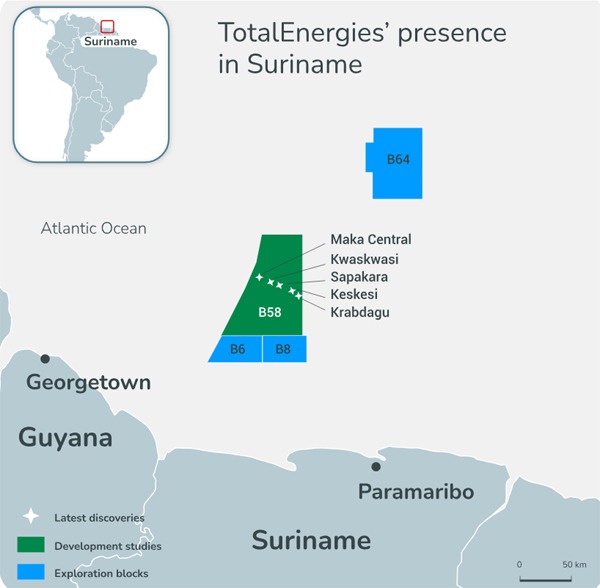

For Suriname, a former Dutch colony on the northeast tip of South America, the moves presage an end to years of delay and disappointment in harvesting billions of barrels of crude trapped under the seafloor. TotalEnergies and partner APA Corp. are expected as soon as early October to make a so-called final investment decision to develop oil discoveries dating back as far as 2020.

Suriname is years behind neighbor Guyana in enticing foreign explorers and reaping the vast riches of massive offshore oil troves. But when production — now slated for 2028 — actually commences, the windfall is expected to transform the economy of one of the world’s most-sparsely populated nations.

The investment also is part of a broader revival of high-seas oil exploration up and down the Atlantic Basin. From the US Gulf of Mexico and Brazil to Namibia on Africa’s southwest coast, some of the world’s most-sophisticated explorers are racing to find and tap the next oil frontier.

Deepwater drilling in many regions was largely sidelined by the shale revolution little more than a decade ago that drew companies back to less-risky, land-based exploration. That impact was compounded by the global pandemic that gutted energy demand and prices — and any residual appetite for risky endeavors among explorers.

But as the shale sector matures and many of its best prospects near their peaks, drillers are once again going down to the sea in search of untapped finds.

“Exploration is back,” said Ross Lubetkin, chief executive officer at consultancy Welligence Energy Analytics.

TotalEnergies declined to comment for this story. An APA spokesperson directed a reporter’s inquiry to TotalEnergies as operator of the project.

The French giant’s decision to order a hull for a 200,000 barrel-a-day production vessel for the Suriname discoveries is one of the clearest signals that the project is a go, said Annand Jagesar, the managing director of Suriname’s state oil company, Staatsolie.

“They have reserved this hull,” he said in an interview. “You’re not going to pay a lot of money for that to have it sitting around.”

In Suriname, a country the size of Wisconsin inhabited by just 612,000 people, Malaysia’s Petronas is considering a high-tech, floating facility to process natural gas that would cost billions of dollars. Separately, Chevron Corp. is expected to start an exploration campaign in 2025 in shallow waters, according to Staatsolie, which also serves as Suriname’s oil regulator. Chevron declined to comment on its timeline for Suriname.

So far, Suriname’s potential is much less than in neighboring Guyana, but even one major project could transform the economy and improve social services in a country where about 40% of the population lives in poverty. Anticipation of an oil windfall is making Suriname’s debt a top performer in emerging markets this year.

The scale of the investments shows how the supermajors are less concerned about a sudden transition to renewable fuels than they were a few years ago. Oil companies are now vying for a limited number of drilling rigs and production vessels to pursue expensive offshore developments.

“There’s generally more of a consensus around the importance of upstream, especially among the majors,” said Julie Wilson, the director for global exploration research at Wood Mackenzie Ltd. “People are beginning to think that perhaps the energy transition is going to be more challenging.”

–With assistance from David Wethe, Zijia Song, Francois de Beaupuy and Mitchell Ferman.

bloomberg.com 09 20 2024