Archie Hunter, Bloomberg News

LONDON

EnergiesNet.com 06 13 2022

Trafigura Group posted record first-half profit, even after Russia’s invasion of Ukraine forced the commodities giant to pare back its activities as trading risk soared.

Wild swings in prices and arbitrage opportunities helped to deliver net profit of $2.7 billion in the six months through March, Trafigura said in a report on Friday. At the same time, the war sharply increased risks as it upended markets, compelling the company to curb trading volumes and inventories.

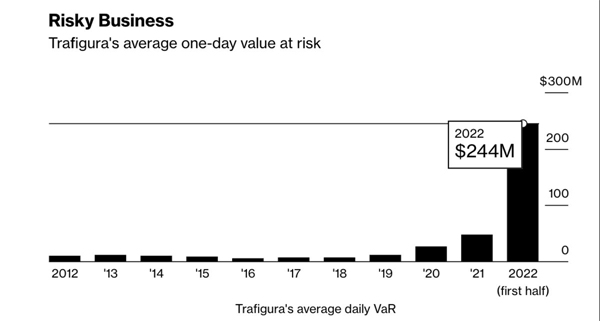

As commodity prices soared in late February, Trafigura’s value at risk — a measure of how much the company could lose on a normal trading day — also shot higher. Over the six-month period, the VaR averaged $244 million, more than five times the previous year’s average.

Trafigura’s first-half report provides an insight into how trading houses grappled with roller-coaster markets as the war in Ukraine and sanctions threatened to curb supplies of energy, grains and metals from Russia. That involved taking action to limit exposure to out-sized price moves and margin calls from brokers, while maintaining the flow of the world’s key natural resources.

“Actions were swiftly taken to bring back the VaR within acceptable risk limits, including but not limited to reducing stocks and traded volumes as well as entering into back‑to‑back trades,” Trafigura said in its results.

In the immediate aftermath of the invasion on Feb. 24, risk surged even higher with the VaR rising beyond Trafigura’s target of keeping it below 1% of group equity. While the company didn’t provide a breakdown for the post-invasion period, the figures imply risk rose to levels uncomfortable for even the biggest of trading houses.

Before the invasion, Trafigura’s VaR had averaged just $86 million. By May, the trader said it had brought down that measure of risk to $139 million, back within what it says were acceptable limits.

Subsequently, policymakers from the Dallas Fed to the International Monetary Fund have called for greater oversight of commodity markets, while lobbying groups are campaigning for regulation to make it easier to post margin against exchange positions.

“Extreme volatility, in particular after the outbreak of war in Ukraine, brought elevated margin calls and tighter position limits that made hedging activity more expensive and in some cases constrained access to commodities futures markets,” Trafigura Chief Executive Officer Jeremy Weir said in results.

Over the half-year, Trafigura’s oil and petroleum product volumes rose 14% to 7.3 million barrels per day, while nonferrous metals volumes climbed 16%. To finance the additional tonnages at higher prices, the company tapped banks for an extra $7 billion over the six months, bringing total credit lines to $73 billion. It also made approaches to private equity funds to explore other funding options.

A bigger equity base — grown to $12.7 billion at the end of March — means the company should be able to leverage even more in the future, while the additional credit already raised could provide a cushion to manage trades if prices run even higher.

Volatile Markets

The war in Ukraine is providing an awkward but highly profitable moment for commodities traders. While price volatility is surging and physical market arbitrages open up, it’s also shining a spotlight on the predominantly private companies that transport oil, gas, copper and wheat and their links to Russia.

“Volatile commodity markets put a premium on our ability to move commodities to where they are in highest demand as efficiently as possible, producing higher margins,” Chief Financial Officer Christophe Salmon said in the report.

Trafigura, which previously announced it was cutting oil volumes from Russia in line with international sanctions, said it intends to divest its stake in the Vostok Oil project, run by Russian state producer Rosneft PJSC. Having sunk 1.5 billion euros ($1.6 billion) in the project, Trafigura said the net value of the investment was a negative $610.1 million as of March 31. Offtake agreements have been ended.

In the second half of its financial year, Trafigura expects profitability to remain “robust,” although geopolitical turbulence and the economic outlook will pose challenges in key markets.

“The lack of depth available in the commodities futures markets looks set to continue to be a challenge for the industry, as reduced access to derivatives for all participants in turn puts pressure on the ability to move physical commodities,” the trading house said.

bloomberg.com 06 10 2022