Kaieteur News

GEORGETOWN

EnergiesNet.com 03 01 2022

Despite not formally being a part of the International Energy Conference and Expo 2022, the Government of the Republic of Trinidad and Tobago, particularly it’s Ministry of Energy and Energy Industries, was sure to be present at the event’s side attraction—the International Expo—which gave the country an opportunity to market its oil blocks.

Trinidad and Tobago has been in the oil business for more than a century now and has vast experience and knowledge when it comes to the oil sector.

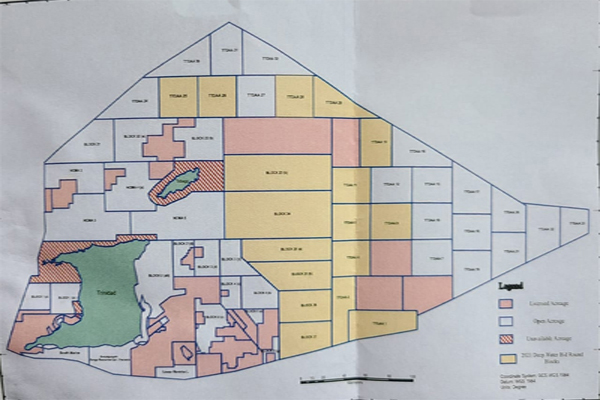

To this end, the country participated in the event to market over a dozen of its oil blocks through a competitive bidding process.

Kaieteur News spoke with a Geologist attached to the Ministry in Trinidad, Raihaan Ali, who explained that not only will the oil blocks be auctioned off to the best bidder, but all prospective bidders must pay a pre-bid fee of US$40,000 to receive the data package.

Additionally, all bidders are required to pay a fee of US$50,000 per block they are interested in. Proposals to the Ministry of Energy and Energy Industries in Trinidad and Tobago must include the share of profit petroleum, minimum work programme and minimum expenditure obligation.

The bidding round will close on June 2022 and successful bidders will be notified by September 2022, Ali explained.

The Geologist told Kaieteur News, “…we are here to really connect with some of the operators that will be in Guyana. We are here to promote our deepwater acreage that is up for licensing. So we have our deep water bid rounds that are presently open and in the next month or so we are going to have our onshore bid round launched.”

He added, “subsequent to that, we have approximately 10 blocks or so that are going to be put out on show as well. Based on the interactions that we have had so far, what we have noticed is that we have a lot of service companies and other subcontractors as well that are out here looking for business as well.

But what we have done as well is really to help us stay connected to Guyana…we just want to form partnerships and we know that there is going to be a lot of investments in Guyana.”

Guyana’s “give away”

For several years, this newspaper has been at the forefront of calls for there to be a thorough, independent investigation into the award of two blocks – Kaieteur and Canje – since several industry stakeholders who examined the matter, concluded that they were awarded under suspicious circumstances.

With respect to the Kaieteur Block, this publication previously reported that it was awarded by President Donald Ramotar on April 28, 2015, just two weeks before the 2015 general and regional elections on the advice of former Minister of Natural Resources, Robert Persaud.

Two companies received the block with 50-50 stakes; Ratio Energy Limited (now Cataleya Energy Limited) and Ratio Guyana Limited.

Ratio Energy was incorporated in Gibraltar on April 15, 2013, and registered in Guyana on October 23 later that year.

kaieteurnewsonlines.com 02 26 2022