- Brent oil futures mark fresh finish at highest since November

Myra Saefong and Williams Watts, MarketWatch

SAN FRANCISCO/NEW YORK

EnergiesNety.com 09 14 2023

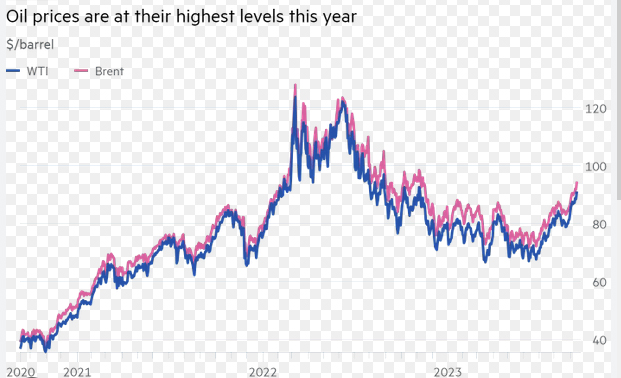

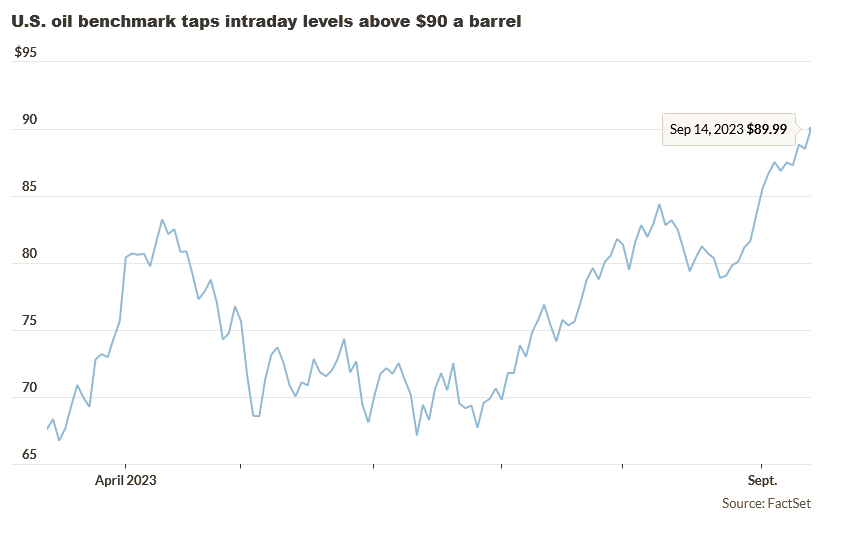

The U.S. crude-oil benchmark settled above $90 a barrel on Thursday for the first time since November, lifted by ongoing concerns over the outlook for tight global supplies.

Price action

- West Texas Intermediate crude CL00, 0.54% for October delivery CL.1, 0.57% CLV23, 0.57% rose $1.64, or nearly 1.9%, to settle at $90.16 a barrel on the New York Mercantile Exchange. That was the highest finish for a front-month contract since Nov. 7, according to Dow Jones Market Data.

- November Brent crude BRN00, 0.49% BRNX23, 0.49%, the global benchmark, climbed $1.82, or 2%, at $93.70 a barrel on ICE Futures Europe, the highest finish since Nov. 15.

- October gasoline RBV23, 0.55% settled at $2.74 a gallon, up 0.2%.

- October heating oil HOV23, 0.10% added 1.3% to $3.48 a gallon.

- October natural gas NGV23, -0.07% ended at $2.71 per million British thermal units, up 1%.

Market drivers

Crude oil “appears to be responding more to supply issues once again amid signs that demand could hold up or even potentially increase in future,” Colin Cieszynski, chief market strategist at SIA Wealth management, told MarketWatch. “Undersupply is only an issue during times of healthy or strong demand, just as oversupply becomes a problem when demand is soft.”

Crude on Wednesday pulled back from 2023 highs after the Energy Information Administration reported a larger-than-expected rise in U.S. crude inventories last week.

Oil had gained ground ahead of the supply data, after the Paris-based International Energy Agency’s monthly report reiterated a forecast for a fourth-quarter deficit in global supply as Saudi Arabia and Russia extend supply cuts through the end of the year.

“OPEC+ is currently demonstrating a remarkable display of pricing power, skillfully increasing prices without causing a significant dent in demand,” said Stephen Innes, managing partner at SPI Asset Management, in a note.

“This formidable pricing prowess can be attributed to OPEC+’s substantial market share, bolstered by its alliance with Russia, and the relatively inelastic nature of non-OPEC supply, primarily influenced by the financial discipline observed in the U.S. shale industry,” he wrote.

As long as OPEC+ keeps curbs on production and exports, oil prices will remain firm until high prices force a round of demand destruction at the gasoline pump, Innes said.

Meanwhile, economic news Thursday is “bullish for the world economy,” said Cieszynski, implying upbeat prospects for energy demand, with the European Central Bank hinting that it’s “close to done, if not done” with raising interest rates, and with U.S. retail sales beating expectations.

WTI crude has broken out above the $90 “round number,” and the market may start to hear “more chatter about the big $100 barrier, and political pressure to do something about rising energy costs may start to ramp up again,” he said.

On Nymex Thursday, natural-gas futures settled higher after the EIA reported that U.S. supplies of the commodity in storage rose by 57 billion cubic feet for the week ended Sept. 8.

On average, analysts surveyed by S&P Global Commodity Insights forecast an increase of 49 billion cubic feet.

marketwatch.com 09 14 2023