Stephen Stapczynski and Gerson Freitas Jr., Bloomberg News

SINGAPORE/NEW YORK

EnergiesNEty.com 04 18 2022

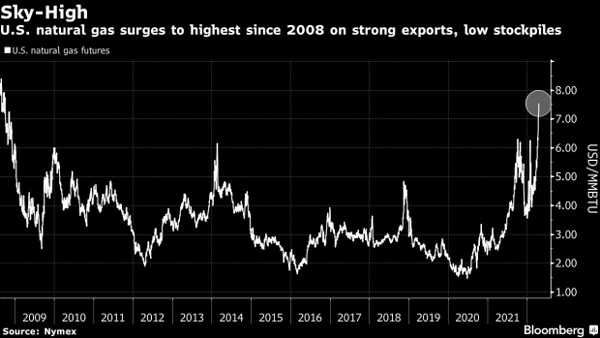

U.S. natural gas prices surged to the highest intraday level in over 13 years as robust demand tests U.S. drillers’ ability to expand supplies.

Futures rose to $7.555 per million British thermal units in early Asian trading, topping January’s short squeeze-fueled rally and roughly double since the start of the year.

A global fuel crunch is rippling across markets as suppliers struggle to meet a post-pandemic surge in consumption, further exacerbated by the war in Ukraine. While U.S. natural gas prices have remained well below rates in Europe and Asia thanks to a bounty of shale fields for the last year, that discount has been shrinking.

Backup U.S. inventories held in underground caverns and aquifers are below normal for this time of year and production is holding flat. Meanwhile, the U.S. is exporting every molecule of liquefied natural gas possible to help Europe reduce its reliance on Russian energy supplies.

Below-normal temperatures are forecast across parts of the northern U.S. from April 25 to May 1, according to the National Oceanic and Atmospheric Administration. That could increase demand for the heating and power-plant fuel, diverting supply that normally goes to storage during this time of year.

A shortage of coal in the U.S. has also helped fuel the gas rally, limiting power generators’ ability to switch fuels when demand, and prices, rise.

Inventories held in salt caverns and depleted aquifers grew 15 billion cubic feet in the week ended April 8, less then half the average gain for the period over the past five years, the Energy Information Administration said last week. Stockpiles remain almost 18% below usual levels.

bloomberg. com 17 2022