Devika Krishna Kumar, Bloomberg News

LONDON

EnergiesNet.com 04 20 2022

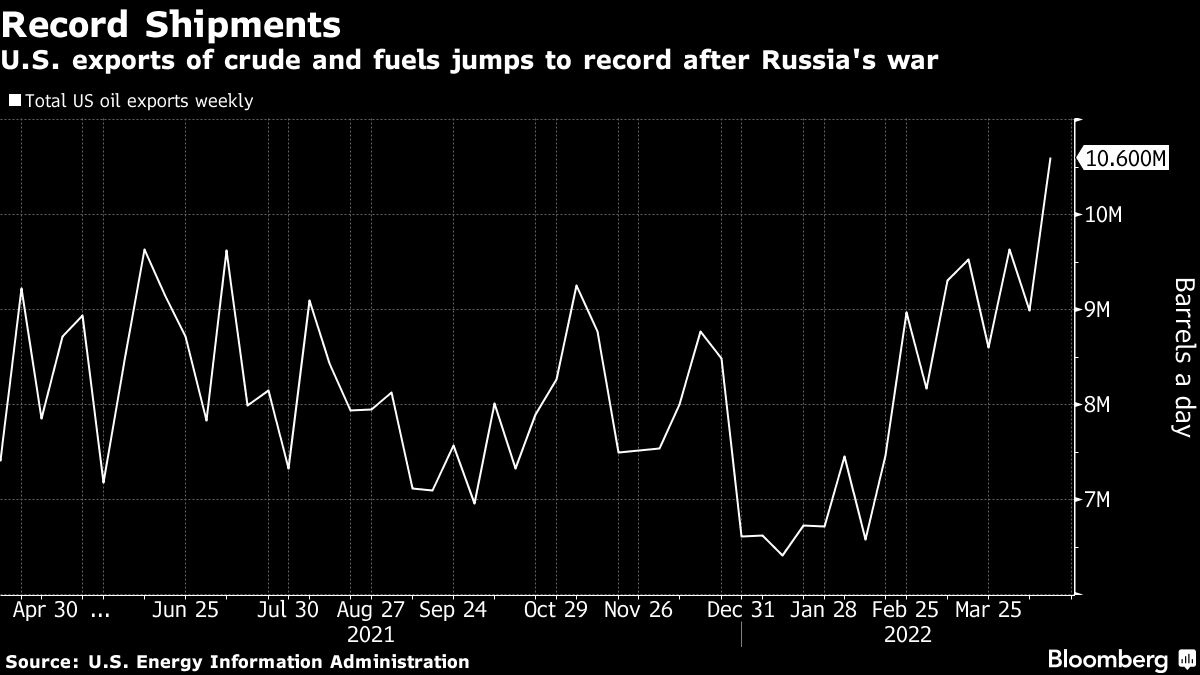

The U.S. exported the most oil and petroleum products in history last week as countries across the world work to replace Russian supplies in the wake of the war in Ukraine.

Exports of U.S. crude and petroleum products surged to a weekly record of 10.6 million barrels a day during the week ending April 15, according to data from the U.S. Energy Information Administration. The country’s exports also outweighed its imports by the most ever in government data going back to 1990.

The U.S. is becoming the energy supplier of last resort after Russia’s invasion of Ukraine drove buyers to turn to it for everything from crude to motor fuel and liquefied natural gas. Western companies pulled investments from Russia and cut ties with its energy and trading firms and multiple governments including the U.S., U.K., and Canada imposed sanctions on oil imports.

“Strong exports have been driven by a pull to Europe and we should expect strength in the weeks ahead,” Matt Smith, oil analyst at market intelligence firm Kpler.

Appetite for U.S. diesel has remained elevated from countries in Latin America as well as Europe. The jump in exports across the board is also helping to drain inventories in the U.S. and elevating prices. U.S. crude stocks last week plunged by more than 8 million barrels, the most since January of 2021.

Weekly U.S. government data tends to fluctuate, some traders said but noted demand for U.S. oil remains robust, pointing to strong exports heading into the summer. Relatively weak prices for U.S. crude could also entice more buyers, they said.

bloomberg.com 04 20 2022