Mayra P. Saefong, William Watts, MarketWatch

SAN FRANCISCO/NEW YORK

EnergiesNet.com 07 18 2022

U.S. oil prices settled back above $100 a barrel on Monday for the first time in a week as investors took advantage of last week’s steep losses to scoop up the commodity on the view that President Joe Biden’s visit to Saudi Arabia wouldn’t yield a quick supply fix.

Meanwhile, natural-gas futures rallied on worries surrounding supplies in Europe and as the International Energy Agency’s executive director warned that the global energy crisis is “especially perilous” in Europe.

Price action

- West Texas Intermediate crude for August delivery CL.1, -0.62% CLQ22, -0.62% rose $5.01, or 5.1%, to settle at $102.60 a barrel on the New York Mercantile Exchange. The contract rose 1.9% on Friday but slumped 6.9% on the week. Front-month contract prices marked their first settlement above $100, as well as their highest finish, since July 11, FactSet data show.

- September Brent crude BRN00, -0.55% BRNU22, -0.55%, the global benchmark, gained $5.11, or nearly 5.1%, to $106.27 a barrel on ICE Futures Europe. The contract gained 2.1% to $101.16 on Friday, but fell 5.5% for the week.

- Back on Nymex, August gasoline RBQ22, +0.62% rose 5 cents, or 1.6% to $3.2643 a gallon.

- August heating oil HOQ22, -0.69% fell 4 cents, or 1.2%, to $3.6555 a gallon.

- August natural gas NGQ22, -0.98% rose 6.6% to $7.479 per million British thermal units—the highest settlement since June 13. Prices gained 16.3% last week.

Market drivers

Crude prices have been trending lower since mid-June, amid rising concerns over a potential recession that would cut demand. The sharp retreat has seen both WTI and Brent sink below the $100-a-barrel threshold, with the U.S. benchmark at one point last week temporarily erasing gains stemming from Russia’s Feb. 24 invasion of Ukraine.

A four-day Middle East tour that included meetings with Saudi Crown Prince Mohammed bin Salman and King Salman bin Abdulaziz failed to yield any promises on increasing oil production. Reuters reported that Washington was hanging hopes on an Aug. 3 meeting of OPEC+ — the Organization of the Petroleum Exporting Countries and their allies.

“Traders got one clear message from Biden’s recent visit to Saudi Arabia, during which President Biden spoke to a number of Arab leaders. The message is that it is OPEC+ that makes the oil supply decision, and the cartel isn’t remotely interested in what Biden is trying to achieve,” said Naeem Aslam, chief market analyst at AvaTrade, in a note to clients.

“OPEC+ will continue to control oil supply, and one country alone cannot determine the oil supply — at least that is the message that traders have taken from Biden’s visit to Saudi Arabia,” Aslam added. “Brent oil prices crossed above the $100 price mark earlier today, and if the price continues to trade above this price mark, then it is highly likely that the path of the least resistance will be skewed to the upside.”

Meanwhile, a top White House energy adviser, Amos Hochstein, said Sunday that U.S. gasoline prices should continue to fall in the coming weeks to around $4 a gallon, on average, after peaking at above a record $5 a gallon in June. He added that the Biden administration’s measures amid “extraordinary circumstances” are working.

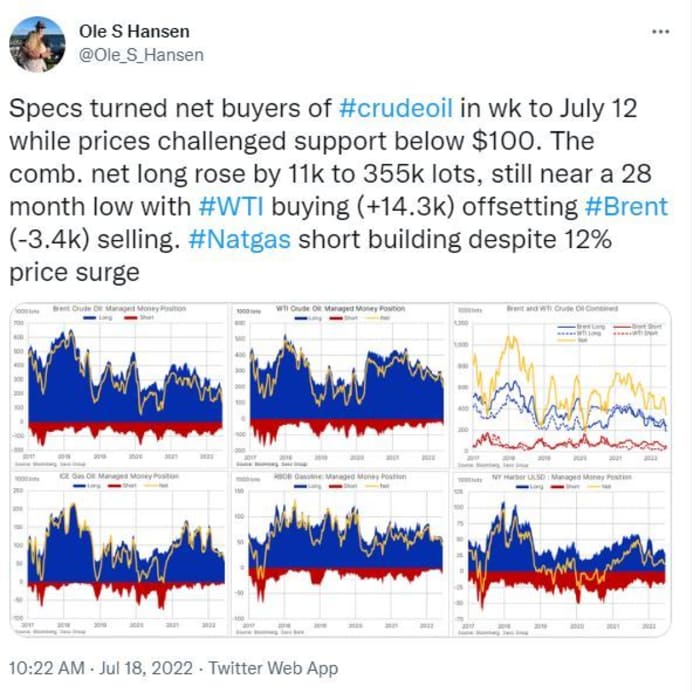

Speculator and hedge fund selling slowed in the week to July 12 according to the latest Commitment of Traders update from the U.S. Commodity Futures Trading Commission, noted Saxo Bank. “Speculators turned net buyers of crude oil, copper and sugar with selling concentrated in natural gas, soybeans, corn, wheat and coffee,” Saxo told clients in a note.

In the energy complex, natural-gas futures saw the biggest percentage gains on Monday.

Russia’s Gazprom declared force majeure on natural-gas supplies to Europe to at least one major customer, Reuters reported Monday, citing a letter from Gazprom. The declaration means the company cannot meet its delivery obligations due to an extraordinary circumstance.

The IEA’s Executive Director Fatih Birol, meanwhile, said Monday in published commentary that the world is “experiencing the first truly global energy crisis in history” and that the IEA has been warning for “many months, the situation is especially perilous in Europe.”

Europe “needs to do be doing everything it can to reduce the risk of major gas shortages and rationing, especially during the coming winter,” he said.

marketwatch.com 07 18 2022