Mayra P. Saefond and William Watts, MarketWatch

SAN FRANCISCO/NEW YORK

EnergiesNet.com 02 17 2024

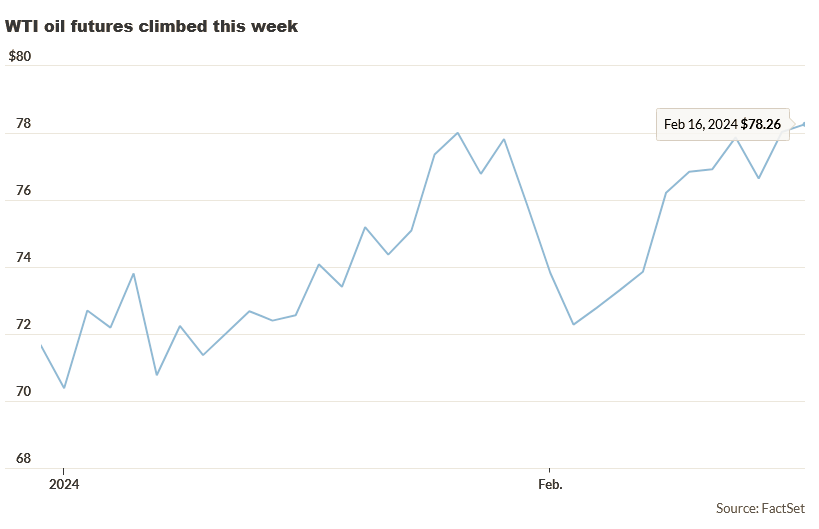

Oil futures climbed for the week, with the U.S. benchmark settling at its highest since early November as investors weighed the outlook for interest-rate cuts by the Federal Reserve, tensions in the Middle East and uncertainty about the outlook for crude demand.

Price action

- West Texas Intermediate crude CL00, +0.84% for March delivery CL.1, +1.53% CLH24, +1.53% rose $1.16, or 1.5%, to settle at $79.19 a barrel on the New York Mercantile Exchange, the highest finish since Nov. 6, according to Dow Jones Market Data. Prices based on the front-month contract logged a weekly gain of 3.1%.

- April Brent crude BRN00, +0.13% BRNJ24, +0.13%, the global benchmark, climbed 61 cents, or 0.7%, at $83.47 a barrel on ICE Futures Europe. Prices ended1.6% higher for the week and logged the highest finish since Jan. 26.

- March gasoline RBH24, +0.32% shed 0.8% to $2.24 a gallon, settling nearly 0.2% lower for the week.

- March heating oil HOH24, -0.52% lost 0.6% to $2.81 a gallon, for a weekly loss of 5.3%.

- Natural gas for March delivery NGH24, +1.39% settled at $1.61 per million British thermal units, up 1.8%, after ending Thursday at the lowest level since June 2020. It settled 12.9% lower for the week.

Market drivers

“Oil prices likely benefited this week from a ratcheting-up of tensions in Middle East,” said Stewart Glickman, energy equity analyst at CFRA Research. “The closer one gets to pairing up Iran and Israel in a battle, the more upward pressure on oil — and Israeli strikes against Lebanon are a move in that direction.”

Both WTI and Brent crude tallied a second straight weekly gain.

Oil prices, however, saw “choppy” trading this week, partly because of the U.S. dollar’s strength holding them back, Fawad Razaqzada, market analyst at City Index and Forex.com, told MarketWatch.

The strength of the dollar has been “offsetting supportive measures such as the Middle East situation, OPEC’s ongoing intervention, and hopes economic conditions in China will improve in the coming quarters,” he said. “All told, I think risks are skewed to the upside for oil, as there are not many negative influences to impact prices.”

WTI on Friday settled above what Razaqzada sees as “key resistance around $78,” where the 200-day average has proven a “tough nut to break.” This could lead to a “sharp continuation toward $80 next,” he said.

Expectations for a Federal Reserve rate cut as early as March took a hit earlier this week after a hotter-than-expected January consumer-price index reading, which also sent the stock market skidding and Treasury yields higher.

Equities subsequently recovered most of their losses and yields stabilized, however, helped by a soft January retail-sales report on Thursday that soothed worries that economic growth would lead to a resurgence in inflation.

The larger-than-expected drop in U.S. retail sales prompted “hopes that the [Fed] will consider cutting rates sooner, despite the latest CPI reading creating a hawkish sentiment” within the Fed, StoneX’s Kansas City energy team, led by Alex Hodes, said in a Friday note .

Economists are cautioning against reading too much into the sharp drop, noting that the extreme cold snap the U.S. experienced in January slowed everyone down. “While the data is great news for the [Fed rate-cut plans], it needs to be taken with a grain of salt because of the weather,” Hodes said.

On Friday, however, data provided a sign that inflation may not slow toward the Fed’s 2% target as fast as hoped, as wholesale costs in January rose by a greater-than-expected 0.3%.

“The past few months have been a struggle to get a good handle on oil markets, with too much geopolitical noise and one U.S. supply disruption after another creating short-term price overshoots,” Stephen Innes, managing partner at SPI Asset Management, told MarketWatch.

He believes the oil market will “get politically testy” if prices move much higher.

marketwatch.com 02 16 2024