OPEC+ faces a complicated ‘decision tree’, says analyst

Myra P. Saefong, MarketWatch

SAN FRANCISCO

EnergiesNet.com 11 29 2022

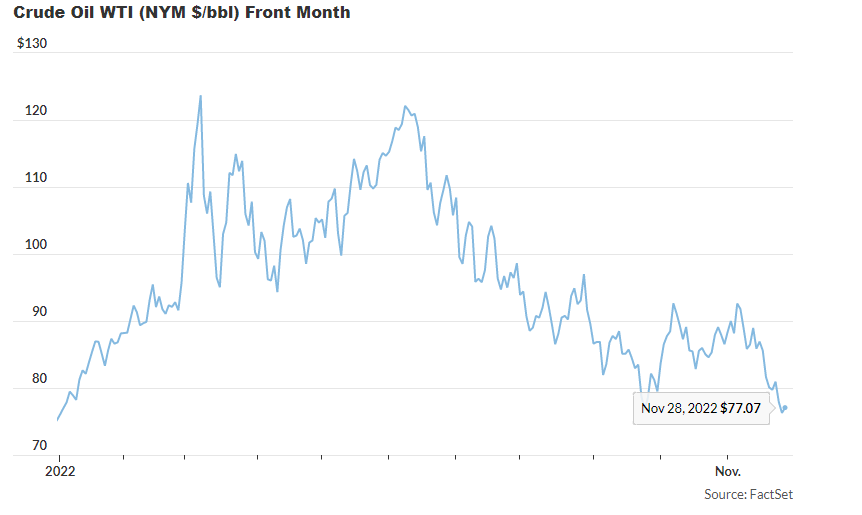

U.S. benchmark oil futures touched their lowest price of 2022 on Monday, briefly erasing what had been a sizeable year-to-date gain, as China’s zero-COVID policy has wreaked havoc on expectations for energy demand.

The price move has come less than a week before a Dec. 4 decision by the Organization of the Petroleum Exporting Countries and their allies, led by Russia, on production levels.

“China is the growth engine for commodities and clearly the biggest driver of recent price action in crude,” Rebecca Babin, senior energy trader at CIBC Private Wealth U.S., told MarketWatch. OPEC+ is going to be “focused on Chinese demand.”

Protests against President Xi Jinpin’s strict COVID-19 curbs were seen in Beijing, Shanghai and other major Chinese cities over the weekend.

Oil prices were already under pressure before the markets saw “rampant protests flare across China, adding fuel to the simmering fire on oil prices,” Manish Raj, chief financial officer at Velandera Energy Partners, told MarketWatch.

“The question is: will the Chinese communist government double down to show its authority, or listen-in to protester’s legitimate concerns about the zero-tolerance policy?” he said.

U.S. benchmark West Texas Intermediate crude for January delivery CLF23, 0.93% CL.1, 0.93% traded as low as $73.60 a barrel on the New York Mercantile Exchange Monday, the lowest intraday price for a front-month contract since Dec. 27, 2021, according to Dow Jones Market Data.

That drop prompted prices to trade as much as 2.1% lower year-to-date, given that front-month prices settled at below the $75.21 on Dec. 31 of last year. WTI finished higher on Monday, however, to settle at $77.24. Global benchmark January Brent crude BRNF23, 1.17% traded as low as $80.61, the lowest since January, and settled at $83.19

Recent lockdowns are estimated to have cut Chinese oil demand by 900,000 barrels per day, bringing the market for supplies “from tight to balanced,” she said. The drop in Chinese demand has “nearly mirrored” the amount of supply that OPEC+ removed from the market at their last meeting, said Babin.

At a meeting in October, OPEC+ agreed to reduce their collective crude production levels by 2 million barrels a day starting in November, citing “uncertainty that surrounds the global economic and oil market outlooks.”

Among the issues OPEC+ will most likely review at its meeting Sunday include economic weakness stemming from the continued restrictive COVID-19 policies in China, said Greg Sharenow, managing director and portfolio manager at PIMCO.

He believes that economic weakness from China’s restrictive COVID policies is “well telegraphed by now.” He also pointed out that commodity markets have “broadly been very strong despite an absence of a supportive Chinese economy.”

If China’s economy does begin to reopen in the second quarter of 2023, or if the Chinese government further stimulates industries, any slowdown in the developed economics from tighter financial conditions, which is being priced in currently, would be quite supportive for oil prices,” Sharenow told MarketWatch.

Complicated ‘decision tree’ for OPEC+

The OPEC+ decision on oil production levels may soon become the bigger focus for oil traders.

The “decision tree” is quite complicated for OPEC+, in part because of uncertainty around the loss of Russian output and the disruptive nature of shipping insurance restrictions, said Sharenow.

The European Union’s ban on seaborne imports of Russian oil, along with the Group of Seven’s plan to cap prices of oil from Russia early next month, are expected to go into effect on Dec. 5, a day after the OPEC+ meeting.

The EU’s eighth package of sanctions against Russia, including a ban on imports of Russian seaborne oil, lays the basis for the legal framework to implement the G-7 price cap. EU sanctions also include a ban on insuring ships that carry Russian oil.

Read: Why the EU ban and G7 price cap on Russian oil won’t guarantee a lasting rally for oil

Russia’s oil production has been “extremely resilient” in the face of sanctions, said Babin. Heading into the Dec. 5 sanctions, some buyers have increased purchases, reducing the supply impact and brining Russian production almost back to pre-invasion levels, she said.

If the EU agrees to a price cap range between $65 and $70, “we do not see additional Russia supply impacted into the end of 2022 because the cap price is essentially equivalent to the price that Russia is currently selling crude in the market without a cap,” said Babin.

The key for Russian supply next year will be how the EU handles the upcoming oil product related sanctions set to go into effect in February, she said. The EU is expected to ban Russia oil product imports from Feb. 5.

See Barron’s: Europe’s price cap on Russian oil is all bark, no bite

“If the EU enforces stricter shipping sanctions on Russian products, this could impact the prices of gasoline and diesel significantly,” Babin said.

For now, however, based on developments in China and “extreme volatility in crude markets over the past several weeks, Babin believes that the odds for additional OPEC+ production cuts have climbed.

Both near-term WTI and Brent crude have flipped from backwardation to contango, giving OPEC+ “further confirmation that demand is weak and more action is needed,” she said. Backwardation refers to a situation in crude contract values where prices for oil for delivery in the near future are higher than those for later deliveries, while in contango, prices for future delivery rise above the spot market.

Given all that, there is potentially a 60% chance that OPEC+ cuts by an additional 500,000 barrels a day at its next week, and a 40% chance they do no change production targets, said Babin.

CME Group’s CME, +0.97% OPEC Watch Tool, however, currently sees a 77.7% December OPEC meeting outcome probability for “no change or [a] small output increase,” and a 12.4% chance for an output decrease.

Oil outlook

Even with U.S. oil and Brent oil holding a more modest gain year to date on Monday than the market has seen for most of the year, PIMCO’s Sharenow sees upside for oil prices.

“Certainty, economic growth slowdown is the primary headwind to oil and commodity prices more broadly,” he said.

However, “greater demonstrated capital discipline among oil and gas companies,” which limit the “forward outlook for oil supplies, a key reason for PIMCO’s bullish outlook on prices, he said.

Oil futures are also approaching the level at which the U.S. would consider buying oil to refill the Strategic Petroleum Reserve, and “buffers in the system to supply shocks are quite limited,” said Sharenow.

CIBC’s Babin said oil prices may recover some of t heir recent losses, with WTI heading back to $80 and Brent to $90, based on the “roll off of SPR releases and demand stabilization in China.”

Next year, crude should trade modestly higher as China reopens, improving the demand profile, and as OPEC+ continues to support the market, with WTI Trading in the $85 to $90 range and Brent in the $95 to $100 range, she said.

“Downside risks to these estimates include a delayed reopening in China, a severe slowdown in the U.S. or OPEC+ changing course on its plan to support markets,” Babin said.

marketwatch.com 11 29 2022