New Tariffs Expected to Impact US Refining Sector and Global Oil Markets

Jeff Mower, Platts S&P Global

HOUSTON

EnergiesNet.com 03 04 2025

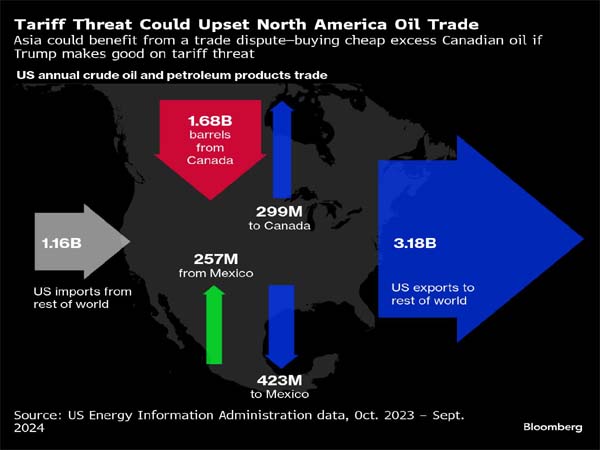

The US will impose a 10% tariff on energy imports from Canada and a 25% tariff on energy imports from Mexico, both major suppliers of crude to US refiners, the White House said on March 3.

The new tariffs take effect March 4, according to advance notices published on the US Federal Register website.

The US will also impose an additional 10% tariff on goods from China, also set to take effect on March 4.

The lower 10% tariff on energy imports from Canada was likely due to US refiners’ reliance on Canadian crude, specifically in the Midwest.

“If the implementation is not delayed again, on the crude front, Western Canadian Select price will increase for Midcontinent buyers even though Canada absorbs much of the cost,” said S&P Global Commodity Insights analysts Zhuwei Wang and Richard Joswick in a report. “WCS exports from the US Gulf Coast and West Coast will likely shift to Asia, primarily China, on the margin although some other Asian refiners are economically reluctant to take such a heavy sour grade.”

The tariff would likely eat into refining margins. The WCS coking margin in the Midwest was at $12.73/b on March 3, according to data from Platts.

However, if the tariffs boost refined products prices in the Midwest that could help compensate for the rise in crude supply costs, easing the impact on refining margins.

Any tariffs will impact the US refining sector directly and are likely to cause ripples through global oil markets as crude flows change, and could spark retaliatory actions by Canada and Mexico, particularly impacting exports of US gasoline and other refined products to Mexico.

Given that crude oil costs just over half of a gallon of gasoline, pump prices will likely reflect the higher crude cost.

US Midwest refiners are dependent on Canadian heavy crude. US imports of Canadian crude averaged 4.23 million b/d in December, with 2.9 million b/d of that going to Midwest refiners, according to the most recent monthly data from the US Energy Information Administration.

Canadian oil producers are expected to shoulder most of the tariff because they have limited ability to export elsewhere and will be competing at the margin with medium-heavy barrels on the Gulf Coast.

Western Canadian Select at Hardisty, Alberta, was assessed at a $12.85/b discount to WTI on March 3, remaining in a well-worn range as traders waited for more details on the tariffs.

Limited options

Coastal markets would have an easier time replacing Canadian crude via waterborne imports. However, Midwest refiners would have a difficult time importing heavy crudes because of a lack of pipeline capacity from the USGC.

Enbridge’s 212,000 b/d North Dakota pipeline carries light sweet crude from the Bakken to Clearbrook, Minnesota, according to the EIA. Energy Transfer Partners’ Dakota Access pipeline, with a capacity of 750,000 b/d, can carry the same Bakken crude to Patoka, Illinois. Energy Transfer Partners also operates the 280,000 b/d Mid-Valley Pipeline from Longview, Texas, to Samaria, Michigan.

Several pipelines originating in Wyoming and Colorado — the Basin Pipeline, the Platte Pipeline, the Pony Express Pipeline and the DJ Basin — also carry crude to the large storage facility in Cushing, Oklahoma, which could route crude to the Midwest.

However, those lines would move US-produced light sweet crude, which is not optimal for Midwest refineries tooled with coking units designed to process Canadian heavies.

Mexican exports decline

Mexico is also a regular supplier of crude to US refiners, primarily in the USGC. The USGC imported 451,000 b/d of crude from Mexico in December, according to the EIA. However, in contrast to Canada, exports to the US have been declining because of lower Mexican output and because Mexico has been shipping more barrels to Europe.

USGC refiners could turn to other waterborne imports to replace Mexican crude.

Imports from Venezuela have increased following limited sanctions waivers given to Chevron to operate in the country. However, Trump is reversing the 2022 license that has allowed Chevron to operate in Venezuela’s oil sector.

USGC refiners could also turn to US offshore crudes, such as Mars, or other Latin American grades.

spglobal.com 03 03 2025