By Einstein Millan Garcia

New hydrocarbon discoveries offshore Guyana, were announced last week totaling 31 so far. Exxon-Guyana claim resources around 11,000 MMBbls (million barrels), although as previously said [ Guyana is Far from its Dream of Becoming a Rich Economy | Energy Analytics Institute (EAI) (energy-analytics-institute.org) ], net crude oil recoverable reserves will ultimately be not far from the 4,800 to 3,100 MMBbl range, even with these new discoveries.

Venezuela for example, out of its 303,000 MMBbls of total, proven oil reserves, still has over 22,000 MMBbls of condensate-light-medium crude oil “P1 reserves” located onshore; some 7 to 5 times the total Guyana proven oil reserves and over 2 times the claim resources.

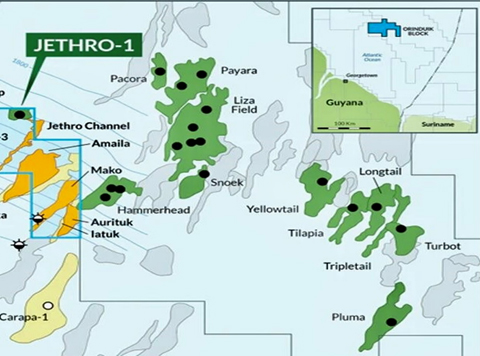

This net proven Guyana total oil reserves are spread around 31 different assets located offshore, at an average of 140 to 100 MMBbls per asset. This distribution unveils the fact that, the tail-end of these so-called discoveries will never be actually developed because of the high ratio of development-cost-to-revenue involved. Most of these assets are located far from each other even within the same block, as for the case of Stabroek, the most promising and prolific among all of them.

Liza Asset already in trouble

As per available information, CAPEX exposure for Liza phase I was revised from $4.4B to $3.7B, whereas for Liza phase II has been assessed as $6.4B. Liza phase I development considered a total of 17 well, with 8 producers, 6 water injectors and 3 gas injectors. The initial specifications for Destiny FPSO [ Guyana’s First FPSO Named Liza Destiny (worldenergyreports.com) ] included up to 120,000 BPD, and 170 million cubic feet per day (MMCFD) of gas, equivalent to an expected production gas oil ratio (GOR) of nearly 1,400 SCF/STB. This was later [ Liza Destiny total liquids capacity is over 150,000 bpd (gogecgy.com) ] changed without any known basis to 150,000 BPD, and 190 MMCFD of gas, rendering a production GOR of approximately 1,260 SCT/STB.

For Liza phase II, the $6.4B CAPEX has been initially committed to produce 220,000 BPD, and 400 MMCFD of gas [ Liza Unity under construction – Department of Public Information (dpi.gov.gy) ], to an expected GOR of around 1,820 SCF/STB. A total of 30 well were considered, with 15 producers, 9 water injectors, and 6 gas injectors.

The Unity FPSO arrived in Guyana during October’2021, bringing the total production capacity of offshore Guyana to 340,000 BPD; in theory. On the second week of February’2022 Liza phase II delivered its first oil, and recently in late April Guyana lifted its first oil cargo of approximately 1 MMBbls, pocketing around $106 MM [ Guyana expecting US$ 106M from first Liza Unity oil lift – News Room Guyana ].

Interestingly the design specifications between Destiny and Unity reveals what we have always sustained; the volumetric nature of these reservoirs, meaning no additional pressure support other than rock and fluid expansion, which could threaten the sustainability of the production plateau if fluid injection continues to prove unsuccessful.

Design specifications varied considerable between phase I and II from 1,260 to 1,820 SCF/STB respectively. Therefore, Exxon is expecting more free gas to be produced in spite of the increasing fluid injection volumes, supposedly planned to compensate for the sharp decline in the reservoir pressure currently experienced. This confirms our initial concern about the limited nature of the recoverable reserves early mentioned, and the lack of response of the reservoir to fluid injection after more than 2 years.

Liza-I has been unresponsive to fluid injection as producing GOR has been consistently increasing, loosing needed energy to sustain and accelerate production. Very likely the injected fluids are insufficient, or are dynamically dispersing outside the target reservoir. Flared volumes consequently have been considerably increasing since first oil, as facilities and the development plan were not designed to handle the unexpected level of gas produced, forcing Exxon to flare massive volumes of toxic emissions to the atmosphere. We suspect that peak emissions reached over 22 MMCFD of toxic gases between June’2021 and October’2021. No production/injection information has been released precisely after H1’2021.

Now that a second FPSO is on stream and more injection wells are available, it could be possible to handle in the meantime the additional volumes of gas, reducing emissions, while increasing the fluid injection volumes. But as production continues from Liza-I and II, more gas will be liberated as more production comes into stream, and larger pressure gradients are experienced, creating a dual-bottleneck. This situation will worsen when Payara field comes into stream, as initially it could be handling some of its produced fluids, via the Liza phase II Unity FPSO.

Apart from the gas-to-shore project for thermoelectric generation; which has not yet been sanctioned, no other project for gas handling/utilization is expected for the short to mid-term. Therefore, a larger volume of toxic emissions to the atmosphere should be expected within a relatively short period of time.

The next two developments in line are Payara for 2024 with 41 wells, and Yellowtail for 2025 with 50 wells. Payara is expected to cost $9B, and utilize the Prosperity FPSO facility once commissioned. For Yellowtail the plan considers a CAPEX exposure of $10B with an additional FPSO designed to handle up to 250,000 BPD liquids and 450 MMCFD of gas. Guyana has already started production from two FPSO platforms since first oil in December’2019; Destiny for Liza phase I on December’2019, and Unity for Liza phase II on February’2022, with a third FPSO platform; Prosperity, on its way to handle Payara production.

Through all these investments, Exxon plans to grow towards 1,200,000 BPD by 2027. But so far total Guyana output is still in the neighborhood of 127,000 to 129,000 BPD, even though two platforms with 23 (Liza-1:8+Liza-II:15) producers are presumably aligned, and gas injection wells now total 9 available wells (Liza-I:3+Liza-II:6), while gas handling capacity increased to 590 MMCFD (Liza I+Liza II).

These results are very concerning for the 2027 production target, as it confirms that Liza-I production has considerably declined in only 2-½ years. It’s still a good business at current market price for Exxon, but not much for Guyana in the long term, because of the reduced profit ratio (low royalty, high Exxon-cost recovery), and the likelihood for a much shorter plateau. Strategically speaking, the way these developments are phased considering the volumetric nature of these reservoirs, will hardly translate into a long-term-sustained-production-plateau, but instead into a single-peak-profile which could rapidly drop to a much lower production level, as the reservoir will tend to bleed off unresponsive to fluid injection, as it has been the case for Liza Phase-I. If pressure drops consistently, a number of formation-damage-related-phenomena will beguine to unleash, targeting well productivity as the first victim.

_______________________________________________________

Einstein Millan Garcia is a Senior Upstream Oil & Gas Global Adviser and Subject Matter Expert. Managing Director for Energy and Carbon Sequestration at Fractal [Fractal Software- Multiple Industries. Flexible Solutions (fractal-software.com)]. Energiesnet.com does not necessarily share these views.

Editor’s Note: All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

energiesnet.com 05 11 2022